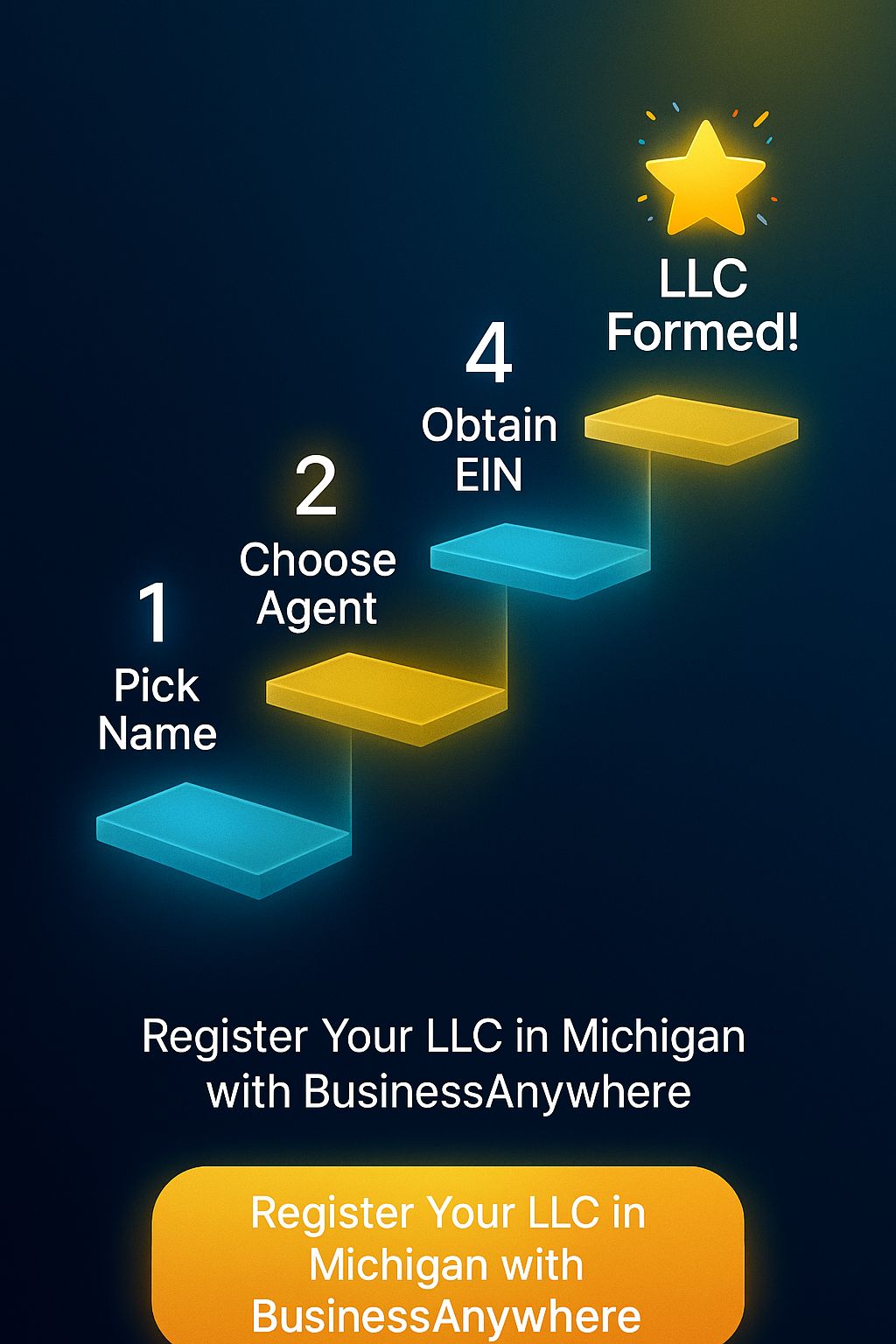

- Pick a Unique Name: Your LLC name must include "LLC" or similar and be distinguishable from others in Michigan. Use the LARA database to check availability.

- Choose a Registered Agent: This person or service must have a physical Michigan address and be available during business hours to handle legal documents.

- File Articles of Organization: Submit this form with Michigan’s LARA online or by mail. The filing fee is $50, with expedited options available.

- Create an Operating Agreement: While optional, this document outlines your LLC’s internal rules, ownership, and management.

- Get an EIN: Apply for a free Employer Identification Number from the IRS to open a business bank account and handle taxes.

- Stay Compliant: File an annual statement by February 15 ($25 fee) and obtain any necessary licenses or permits for your industry.

Quick Tip: Keep your LLC in good standing by maintaining records, meeting deadlines, and staying on top of state requirements. Ready to dive in? Let’s break it down step by step.

Before You Start

Before you officially register your Michigan LLC, there are two important steps to handle first. These steps will lay the groundwork for your business. Here’s what you need to know.

Pick Your LLC Name

Your LLC name must comply with Michigan’s rules and be available for use. Here’s what to keep in mind:

- It must end with "Limited Liability Company", "LLC", "L.L.C.", or "Ltd. Liability Co."

- The name must be unique and distinguishable from other registered businesses in Michigan.

- It can’t include words that might make your LLC sound like a government agency.

- Certain words, like "Bank", "Insurance", or "Corporation", require special approval to use.

To check if your desired name is available, use the Michigan Department of Licensing and Regulatory Affairs (LARA) database. If your name is already taken or too similar to another business, LARA will reject your filing.

| Naming Requirement | Description | Example |

|---|---|---|

| Required Suffix | Must include an LLC designation | "Michigan Builders LLC" |

| Uniqueness | Must differ from existing names | Not "Pure Michigan LLC" if "Pure Michigan Tours LLC" exists |

| Restricted Words | Needs approval for certain terms | "First National Bank LLC" requires banking authority approval |

Once your name is confirmed, move on to securing a registered agent.

Select a Registered Agent

A registered agent is your LLC’s official contact for legal paperwork and state communications. In Michigan, your registered agent must meet these requirements:

- Have a physical street address in Michigan (no P.O. boxes).

- Be available during standard business hours (Monday through Friday, 9 AM to 5 PM).

- Be one of the following:

- A Michigan resident

- A business entity authorized to operate in Michigan

- A member of your LLC who lives in Michigan

Since the registered agent’s address is public, many business owners opt for a professional service. These services can help protect your privacy and ensure documents are handled properly.

Not maintaining a registered agent can lead to penalties and could jeopardize your LLC’s good standing. Once you’ve chosen your registered agent, you’re ready to move forward with registering your LLC.

Legal Registration Steps

Now it’s time to officially set up your Michigan LLC.

Submit Articles of Organization

Filing your Articles of Organization with LARA is the step that legally establishes your LLC. Here’s what to include:

- Company Information: Your LLC’s name and main business address

- Registered Agent Details: Name and physical address in Michigan

- Management Structure: Whether the LLC will be member-managed or manager-managed

- Organizer Information: Name and signature of the person submitting the filing

- Effective Date: Either immediate or up to 90 days in the future

You can file these documents online using LARA’s Corporations Online Filing System (COFS) or send them by mail. The standard filing fee is $50.

| Filing Method | Processing Time | Fee |

|---|---|---|

| Online (COFS) | 2-3 days | $50 |

| 7-10 days | $50 | |

| Expedited Service | 24 hours | $50 + $100 |

| Same-Day Service | Same day | $50 + $200 |

Create an Operating Agreement

While not legally required, an Operating Agreement is a smart way to protect your LLC’s internal structure. This document should cover:

- Your LLC’s management setup (member-managed or manager-managed)

- Roles and responsibilities of members or managers

- Profit, loss, and distribution rules, including initial contributions and tax allocation

- Procedures for membership changes, such as adding or removing members and transferring ownership

- Terms for dissolving the LLC, including voting rules and asset distribution

Keep your Operating Agreement on file and review it annually to ensure it stays relevant. Once your Articles of Organization and Operating Agreement are ready, you’re closer to completing your LLC formation.

After Formation Tasks

Get Your EIN

Apply for an EIN (Employer Identification Number) through the IRS. You’ll need this number to open business bank accounts, file taxes, hire employees, and apply for licenses. The process is quick – about 15 minutes – and requires your formation documents and Social Security number.

Note: Single-member LLCs without employees technically don’t need an EIN. However, most banks will ask for one to set up a business account.

Once your EIN is sorted, focus on meeting Michigan’s state requirements.

Complete State Requirements

Annual Statement Filing

Submit your annual statement by February 15 each year. The filing fee is $25, and you can complete this through LARA’s Corporations Online Filing System. Use this opportunity to update your business address or registered agent details if needed.

Business Licenses and Permits

Depending on your industry or location, you might need additional licenses or permits. This could include sales tax permits or specific professional licenses.

State Tax Registration

If your business is subject to state taxes, register with Michigan’s Department of Treasury. You’ll need your EIN and formation documents to complete the process.

Insurance Requirements

For businesses with employees, ensure you have the required insurance policies, such as workers’ compensation, unemployment insurance, or disability coverage. These are essential to comply with state laws.

sbb-itb-ba0a4be

Quick Setup Checklist

Here’s a streamlined checklist covering all the key steps mentioned earlier.

Pre-Formation Tasks

- Research and Planning

- Finalize your business plan.

- Calculate startup costs and funding needs.

- Choose your business structure.

- Estimate your operating expenses.

- Name Selection

- Search Michigan’s business name database.

- Confirm domain name availability.

- Check trademark databases.

- Reserve your LLC name if necessary.

- Registered Agent Preparation

- Decide whether to act as your own agent or hire a professional service.

- Provide a valid Michigan street address for your registered agent.

- Ensure business hours allow for reliable service.

- List an alternate contact for backup.

Once you’ve completed these steps, you’re ready to file your formation documents.

Formation Process

- Articles of Organization

- Fill out all required fields on the form.

- Pay the applicable filing fee.

- Submit your Articles of Organization online.

- Operating Agreement

- Define ownership percentages.

- Set up your management structure.

- Outline profit distribution.

- Include procedures for dissolution.

Post-Formation Requirements

- Federal Requirements

- Apply for an Employer Identification Number (EIN) through the IRS website.

- Set up financial systems, including a business bank account and payroll if needed.

- State Compliance

- Register for any required state taxes.

- Obtain necessary permits or licenses.

- Schedule reminders for annual filings and compliance checks.

Record Keeping

Keep your records organized by maintaining:

- Formation documents.

- Meeting minutes.

- Financial records.

- Logs of major business decisions.

- Compliance certificates.

Next Steps

To wrap up your LLC setup, follow these final steps to ensure everything is in order.

Organize Your Business Management System

Create a centralized system to manage documents and compliance tasks efficiently. This system should help you:

- Track key filing deadlines

- Securely store formation documents

- Get automated compliance reminders

- Manage your registered agent service

- Handle virtual mailbox and document-related tasks

Once your system is ready, proceed with the formation process.

Start Your Michigan LLC

- Perform a name search and gather details for your registered agent and members.

- Digitally back up all formation documents to ensure they’re easily accessible.

Stay Compliant

After forming your LLC, focus on maintaining compliance by following these steps:

- Open a dedicated business bank account (as discussed earlier).

- Implement a bookkeeping system to track finances.

- Create a calendar to stay on top of annual filings.

- Maintain detailed records of all business transactions.

Also, make it a habit to periodically review and update your operating agreement.

Get Professional Assistance

Consider using Business Anywhere for services like U.S. business registration, registered agent support, virtual mailboxes, online notary services, and compliance tracking. Their integrated dashboard and timely alerts can help you stay organized and keep your Michigan LLC in good standing.

FAQs

Why should I create an Operating Agreement for my Michigan LLC if it’s not legally required?

While Michigan law doesn’t require LLCs to have an Operating Agreement, creating one is highly beneficial. An Operating Agreement outlines the ownership structure, roles, and responsibilities of members, as well as how the LLC will be managed. This document helps prevent misunderstandings and disputes by clearly defining expectations upfront.

Additionally, an Operating Agreement can strengthen your LLC’s limited liability protection by demonstrating that the business operates as a separate legal entity. It’s also a valuable tool for securing financing or partnerships, as it shows professionalism and provides clarity on how your business is run. Even if you’re the sole owner, having an Operating Agreement can protect your personal assets and simplify decision-making in the long run.

How do I select the right registered agent for my Michigan LLC, and what happens if I don’t have one?

Selecting the right registered agent for your Michigan LLC is essential because they handle critical legal and official documents, such as lawsuits and government notices, on behalf of your business. Your registered agent must have a physical address in Michigan and be available during regular business hours to ensure no important communications are missed.

If you fail to maintain a registered agent, your LLC risks losing its good standing with the state, which can lead to penalties, fines, or even the dissolution of your business. To avoid these issues, choose a reliable and professional service that ensures compliance and peace of mind.

What licenses or permits does my Michigan LLC need, and how can I determine which ones apply to my business?

The licenses and permits your LLC needs in Michigan depend on your business type, location, and industry. Common examples include local business licenses, professional licenses, health permits, or specialized industry permits.

To find out what applies to your LLC, check with the Michigan Department of Licensing and Regulatory Affairs (LARA), your local city or county government, and any relevant professional boards. Consulting a legal or business professional can also help ensure you meet all compliance requirements specific to your business.