- Protect your personal assets: An LLC separates your personal assets from business liabilities.

- Affordable and easy: Ohio has a $99 filing fee and a fast online system for LLC formation.

- Steps to start: Choose a name, appoint a registered agent, file Articles of Organization, get an EIN, and set up operations.

- Stay compliant: Keep business records, file reports, and maintain a registered agent.

Ohio’s business-friendly environment, low fees, and strong economy make it a great place to start your LLC.

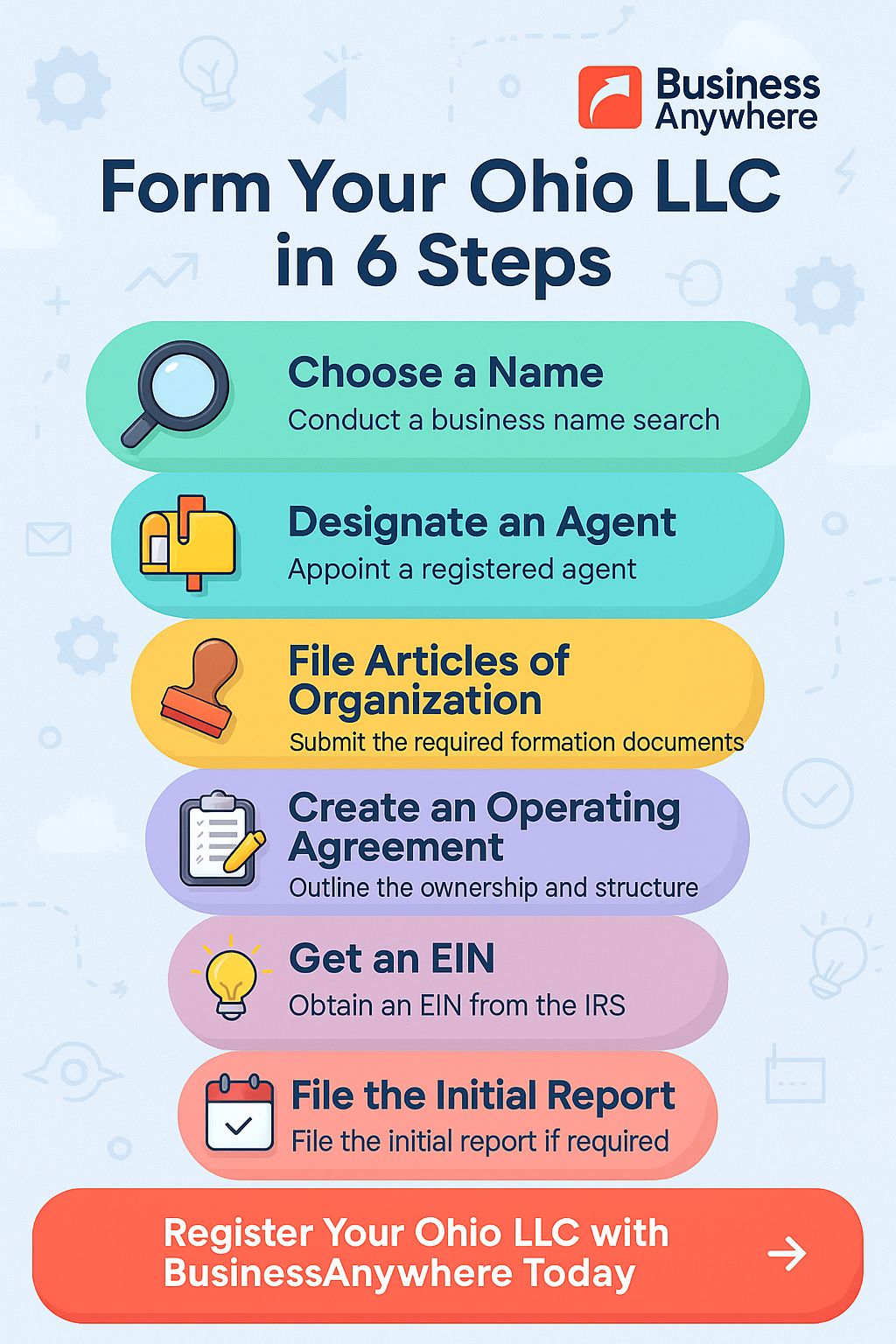

Essential Steps to Form an Ohio LLC

These steps outline specific requirements for setting up an LLC in Ohio.

1. Choose Your LLC Name

When naming your LLC in Ohio, you’ll need to follow these rules:

- The name must include a valid LLC designator, like "LLC" or "Limited Liability Company."

- It must be distinct from any other registered business in Ohio.

- Restricted words (e.g., "Bank", "Insurance") require proper authorization.

- Avoid names that suggest a connection to government agencies.

To confirm your desired name is available, search the Ohio Secretary of State‘s business name database.

2. Appoint a Registered Agent

Your LLC needs a registered agent to handle official legal documents. In Ohio, the agent must meet these criteria:

- Have a physical address in Ohio (P.O. boxes are not allowed).

- Be available during standard business hours.

- Be either an Ohio resident (18 or older) or a business entity authorized to operate in the state.

Using a professional registered agent service can help maintain privacy and ensure consistent availability.

LLC Compliance Requirements

Business Record Management

Keeping your business records organized is vital for staying compliant as an LLC. While specific requirements depend on your state, you’ll need to securely store and easily access your LLC documents. Using a platform that centralizes your formation documents and offers automated compliance reminders can simplify this process. Additionally, it’s important to keep your registered agent information accurate and up to date.

Registered Agent Rules

In Ohio, your LLC must have accurate registered agent details on file to receive legal and official communications from the state. A reliable platform can help you keep this information current and make compliance easier to manage.

LLC Formation Costs and Timing

State Fees and Processing

Filing the Articles of Organization in Ohio costs $99. You can submit this online or by mail, and the processing time depends on the method you choose.

Additional Setup Costs

Here are some other expenses you might encounter when setting up your LLC:

- Federal EIN: Free through the IRS.

- Operating Agreement: Costs depend on whether you draft it yourself or hire legal assistance.

- Business Licenses: Fees vary based on your industry and location.

- Registered Agent Service: Usually involves an annual fee.

- Business Insurance: Premiums apply for basic coverage.

- Name Reservation (optional): Allows you to temporarily secure your LLC name for an additional fee.

These costs, along with the state filing fee, make up the overall expenses for establishing an LLC in Ohio.

sbb-itb-ba0a4be

Business Anywhere LLC Services

LLC Setup Services

Business Anywhere streamlines the process of forming an LLC in Ohio with a straightforward digital platform. Their services cover everything from filing Articles of Organization and verifying name availability to assisting with EIN applications. All of this is managed through an easy-to-use dashboard. Plus, they offer a $0 initial setup cost, making it an appealing option for first-time entrepreneurs.

They also help you stay compliant with Ohio’s registered agent requirements through their all-inclusive service options.

Mail and Agent Services

Business Anywhere combines registered agent services with mail management features to meet Ohio’s legal standards and make handling business correspondence easier:

| Service Feature | What It Offers |

|---|---|

| Digital Mail Management | Quick scanning and secure storage of your business documents |

| Compliance Notifications | Alerts for important filing deadlines and requirements |

| Secure Document Access | 24/7 access to your business mail via a user-friendly dashboard |

| Mail Forwarding | Option to have physical mail forwarded when necessary |

Compliance Tools

Business Anywhere goes beyond LLC formation and registered agent services by offering tools to help your LLC stay compliant. Their digital dashboard simplifies compliance management with features like automated reminders and secure document storage. Key offerings include:

- Alerts for annual report filings

- Tracking of state-specific requirements

- Centralized document storage and organization

- Automated compliance monitoring

For businesses looking to expand, they also provide additional services like assistance with S-Corp tax filings, all accessible through their centralized platform.

Next Steps

Formation Checklist

Here’s a step-by-step guide to help you set up your Ohio LLC:

- Pre-Formation Tasks

- Check if your desired LLC name is available with the Ohio Secretary of State.

- Prepare your Articles of Organization.

- Select a registered agent.

- Collect all necessary identification and business details.

- Formation Requirements

- File the Articles of Organization (state fee: $99).

- Get an EIN from the IRS.

- Register for Ohio state taxes.

- Open a dedicated business bank account.

- Post-Formation Setup

- Draft an Operating Agreement.

- Set up an accounting system.

- Implement compliance tracking procedures.

- Consider using a virtual mailbox for business correspondence.

Once these steps are complete, focus on building a solid foundation for your LLC.

Success Tips

Here are some practical tips to help your LLC thrive:

Keep Business and Personal Finances Separate

Use dedicated business accounts and credit cards. This not only protects your personal assets but also makes tax filing much easier.

Simplify Administrative Tasks

Use a digital platform to organize LLC documents, track compliance deadlines, and manage business communications in one place.

Maintain Detailed Records

Document all transactions, agreements, and filings meticulously to avoid complications later.

Stay on Top of Compliance

Automate reminders for critical tasks like:

- Tax payments

- License renewals

- Registered agent updates

Protect Your LLC

Take steps to safeguard your business with:

- Liability insurance

- Cybersecurity solutions

- Regular legal reviews

- Backup systems for essential files

These measures will help ensure your LLC operates smoothly and stays protected.

FAQs

What are the advantages of using a registered agent service for your Ohio LLC, and how does it support compliance?

Using a registered agent service for your Ohio LLC provides several key benefits that make managing your business easier and help keep it compliant with state regulations. A registered agent ensures your LLC receives important legal and tax documents, such as service of process notices and compliance reminders, in a timely manner. This helps you avoid missed deadlines or penalties.

Additionally, a registered agent service can help maintain your privacy by using their address instead of your own for public records. This is especially useful if you’re running your business from home. By centralizing essential administrative tasks, these services allow you to focus on growing your business while staying on top of Ohio’s legal requirements.

How do I choose a unique and compliant name for my Ohio LLC?

To ensure your LLC name is unique and meets Ohio’s naming requirements, start by conducting a search through the Ohio Secretary of State’s business name database. This will help you verify that your desired name isn’t already in use. Additionally, your LLC name must include a designator like ‘LLC,’ ‘L.L.C.,’ or ‘Limited Liability Company’ and should not contain restricted words unless you have proper authorization.

Avoid names that could confuse your business with a government agency or other regulated entities. Taking these steps will help you secure a compliant and distinctive name for your Ohio LLC.

What are the ongoing compliance requirements for maintaining an LLC in Ohio, and how can you make them easier to manage?

To keep your Ohio LLC in good standing, you’ll need to meet a few ongoing compliance requirements. These include maintaining a registered agent and ensuring timely filing of any required state documents, such as annual or biennial reports. Staying on top of these tasks is crucial to avoid penalties or administrative dissolution of your LLC.

To simplify compliance, consider using tools or services that help manage deadlines, provide reminders, and streamline filing processes. This way, you can focus on growing your business while staying compliant with Ohio regulations.