Running a small business can be rewarding, yet challenging. And, to keep costs down, you may be running the whole show on your own and/or with your fellow LLC owners.

But there comes a time when you’ll need more hands on deck. Finding the right people to come into your business and help you out with much-needed tasks can be long and trying, but once you’re done, you’ll have a much easier time with your company.

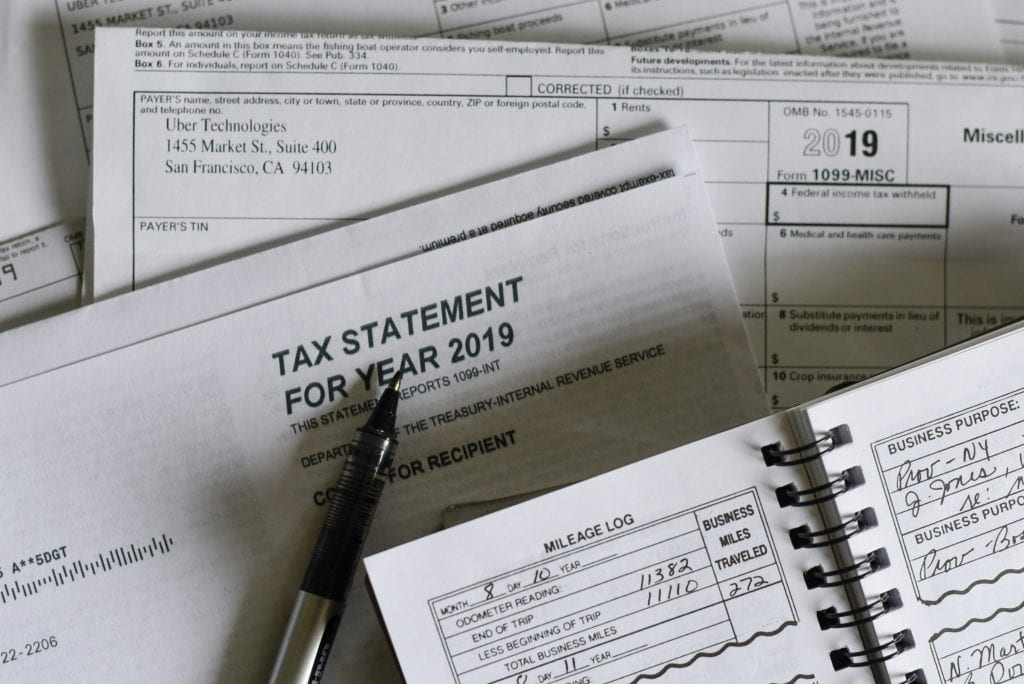

During the hiring process, a question you may have is this: Can an LLC have 1099 employees? Keep reading to find out.

Can an LLC Hire Independent Contractors?

Let’s first answer this question, as the information here will be pertinent for later sections.

Yes, LLCs can absolutely hire independent contractors. If this answer has bolstered your confidence in starting a company, then use our business registration service. We have many other services that also help entrepreneurs.

Keep in mind that the term “independent contractor” isn’t synonymous with “employee.” Not only do they both work on different terms, but they’re taxed differently as well.

Here are the main differences between independent contractors and employees.

Control and Independence

Independent contractors typically have more control over how they perform their work. They decide when, where, and how to complete the tasks.

On the other hand, employees generally work under the direction and control of the employer. The employer dictates the tasks to be completed, as well as how and when they’re done.

Duration of Work Relationship

When you work with independent contractors, it’s usually project-based or for a specific duration. Once the project is completed or the contract expires, the relationship may end.

Employee relationships are typically ongoing, with no predetermined end date. Employment can be terminated by either party with notice, subject to applicable laws and employment contracts.

Liability and Legal Protections

Employees may be covered by certain legal protections and benefits provided by labor laws. For example, they may have protection against discrimination, harassment, and wrongful termination.

Typically, independent contractors are responsible for their own liabilities arising from their work.

Tax Treatment

Independent contractors are responsible for paying their own taxes, including income taxes and self-employment taxes (Social Security and Medicare). Employees have income taxes, Social Security, and Medicare taxes withheld from their paychecks by their employer, who then remits these taxes to the government.

Benefits and Protections

Employees get the perks of things such as health insurance, retirement contributions, paid time off, and protections under employment laws. These include minimum wage laws, overtime pay, and unemployment insurance.

Unfortunately, independent contractors don’t receive such benefits. This is why they’re able to charge more for their services, as they must cover the above benefits themselves.

Can an LLC Have 1099 Employees?

Now that you know the difference between independent contractors and employees, we can tackle the nuances of this question.

An LLC can have individuals working for it who are considered independent contractors. In that case, the LLC may issue them 1099 forms to report their income.

However, it’s important to note that these individuals aren’t technically employees. Instead, they’re self-employed workers or freelancers.

If an LLC wants to have actual employees, then these people are typically classified as W-2 workers. Then, the LLC would need to comply with various employment laws and regulations, such as withholding taxes, paying employer taxes, providing benefits, etc.

Hiring Employees as an LLC

An LLC and 1099 employees don’t mix. If you’re not going to hire contractors for your LLC, then you’ll have to bring in employees.

How things work will depend on the circumstances; more specifically, your business structure. Find out more below.

Sole Proprietorships and Partnerships

If you have a sole proprietorship (meaning you’re the only LLC owner), then you may have chosen to have your company treated as a disregarded entity (it’s a separate entity by default). Otherwise, if there are other LLC members, then you’re considered a partnership.

Either way, you can hire both employees and independent contractors. The difference is that in a sole proprietorship, you’re taxed on your personal tax return since all the profit’s yours. However, with multi-member LLCs, each owner will pay taxes based on their percentage of ownership.

Corporations

Here, you can hire both employees and independent contractors too. The main difference is that you don’t pay on your personal income tax return for LLC profits, as the LLC isn’t a pass-through entity. The LLC will file and pay its own taxes, and you’ll report your revenue on a Schedule K-1 (Form 1065).

Hiring Independent Contractors

This process is pretty straightforward. You can hire anyone you wish, but pay attention to how much you pay them in a year.

If they’re paid $600 or more, then you’ll have to file Form 1099-NEC. Do note that no matter how much they earn (even if it’s under $600), they must still pay taxes on the earnings.

Hire the Right People for Your Company

So the answer to the question, “Can an LLC have 1099 employees?” is nuanced. Yes, your company can have employees, but they wouldn’t receive Form 1099; instead, they’d receive Form W-2.

But if you hire independent contractors, they’d definitely receive 1099s. In that case, they wouldn’t technically be employees, but rather, freelancers or self-employed workers.

Sign up with Business Anywhere now to set up your LLC. The process involves easy and straightforward steps, and you can use any device you wish to fill out our simple form.