Ready to launch your dream business while protecting your personal assets? This comprehensive guide on how to start an LLC in California walks you through every step of California LLC formation—from choosing the perfect name to maintaining compliance. Based on 20+ years of experience helping thousands of entrepreneurs establish successful businesses.

Starting an LLC in California doesn’t have to feel like navigating a government maze blindfolded. Whether you’re a digital nomad launching your first online business, a remote founder scaling your startup, or an entrepreneur ready to formalize your side hustle, this step-by-step guide eliminates the confusion and gets you up and running fast.

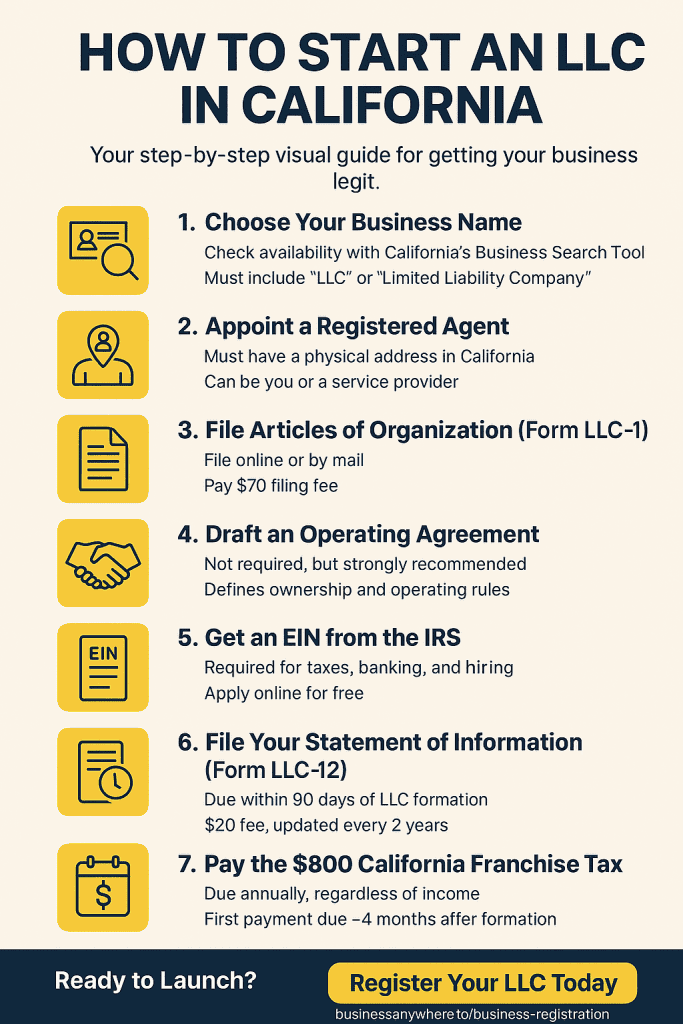

Quick Start Summary: California LLC formation typically takes 5-15 business days and costs $70-$500+ depending on your approach. You’ll need a unique business name, registered agent, Articles of Organization filing, and an Operating Agreement. We’ll cover every detail below.

Why Smart Entrepreneurs Choose California LLCs for Global Success

California offers unmatched advantages for entrepreneurs building location-independent businesses. The state’s robust legal framework, business-friendly environment, and global reputation create opportunities that extend far beyond state borders—making it an ideal choice for ambitious entrepreneurs.

Personal Asset Protection That Actually Works

An LLC creates a legal firewall between your business and personal assets. If your company faces a lawsuit, creditors typically cannot pursue your home, personal savings, or other assets. This protection becomes crucial as your business grows and takes on more risk.

Real-world example: One of our clients, a freelance web developer, had a project go sideways when the client claimed copyright infringement. Because he operated as an LLC, the lawsuit targeted only business assets—not his personal residence or family savings.

Enhanced Business Credibility and Client Trust

Professional clients and partners expect to work with legitimate business entities. An LLC provides instant credibility that sole proprietorships simply cannot match. You’ll need this credibility for:

- Enterprise client contracts that require vendor insurance and business documentation

- Business banking relationships with competitive rates and credit lines

- Payment processing through services like Stripe, PayPal, or Square

- Professional partnerships and joint ventures

- Investment opportunities that require proper business structure

Tax Flexibility for International Operations

California LLCs offer exceptional tax flexibility, especially valuable for location-independent entrepreneurs. You can choose how your LLC gets taxed:

- Default pass-through taxation (profits and losses flow to your personal return)

- S-Corporation election (potential self-employment tax savings)

- C-Corporation election (if planning to raise investment capital)

This flexibility becomes especially valuable when managing international income streams, working with global clients, or planning for future investment rounds.

Banking and Financial Benefits

Separating business and personal finances isn’t just good practice—it’s essential for tax compliance and professional growth. An LLC enables you to:

- Open dedicated business banking accounts with better terms

- Build business credit history separate from personal credit

- Qualify for business loans and lines of credit

- Accept payments under your business name

- Simplify tax preparation and bookkeeping

The Complete California LLC Formation Process: Step-by-Step Guide

Step 1: Choose Your California LLC Name (And Avoid These Common Mistakes)

Your LLC name becomes your legal business identity, so choose wisely. California requires all LLC names to meet specific criteria while remaining available for use.

You can also use our guide for doing a California Business Entity Search to check name availability with the California Secretary of State.

California LLC Name Requirements

Must include: “LLC,” “L.L.C.,” “Limited Liability Company,” or approved abbreviations Cannot include: Restricted words like “bank,” “trust,” “insurance,” “corporation,” or “incorporated” without proper licensing Must be distinguishable: From existing California business entities

Pro Naming Strategies for Long-Term Success

Keep it broad and flexible. Avoid product-specific names that limit future pivots. “Smith Digital LLC” works better than “Smith iPhone Repair LLC” if you might expand services.

Consider domain availability. Check that your preferred .com domain is available—brand consistency across legal and digital presence matters for credibility. If you need help securing a complete business address solution, BusinessAnywhere’s virtual mailbox service provides professional addresses that work for both LLC formation and business banking.

Think international. If you plan to operate globally, ensure your name works across cultures and doesn’t create translation issues.

Plan for trademarks. Search the USPTO database to avoid potential trademark conflicts that could force expensive rebranding later.

How to Check California LLC Name Availability

- Search the California Secretary of State database at bizfileonline.sos.ca.gov

- Check trademark databases through USPTO.gov

- Verify domain availability for your preferred web presence

- Reserve your name if needed (California allows 60-day name reservations for $10)

Pro tip: Consider registering 2-3 name variations if you’re not ready to file immediately. Name availability changes quickly in California’s competitive business environment.

Step 2: Select Your Registered Agent (Critical Decision That Impacts Your Privacy)

Every California LLC must maintain a registered agent—your official point of contact for legal documents, tax notices, and state correspondence. This choice significantly impacts your privacy, compliance, and day-to-day operations.

Registered Agent Requirements in California

- Physical California address (no P.O. boxes)

- Available during standard business hours (9 AM – 5 PM)

- Reliable mail handling for time-sensitive legal documents

- Permanent California residency or licensed service provider

Should You Serve as Your Own Registered Agent?

Potential benefits:

- Saves $100-$300 annually in service fees

- Direct control over all business correspondence

Significant drawbacks:

- Public record exposure: Your personal address appears in searchable state databases

- Availability requirements: Must be present during business hours to accept service

- Legal consequences: Missing important documents can result in default judgments

- Privacy concerns: Anyone can find your personal address through state records

Professional Registered Agent Services: Why Most Entrepreneurs Choose This Route

Professional registered agent services handle document receipt, scanning, and forwarding while keeping your personal address private. This proves especially valuable for:

Digital nomads who travel frequently or lack permanent California addresses Home-based entrepreneurs who want to keep personal addresses off public records Growing businesses that need reliable, professional mail handling Privacy-conscious founders concerned about public record exposure

What to expect: Quality registered agent services charge $100-$300 annually and provide document scanning, instant notifications, and secure online access to all correspondence.

BusinessAnywhere offers comprehensive registered agent services specifically designed for remote entrepreneurs and location-independent businesses. Our California registered agent service includes digital document delivery, instant notifications, and secure online portal access—perfect for entrepreneurs who need reliable service regardless of their location. Learn more about BusinessAnywhere’s registered agent services →

Step 3: File Articles of Organization (Your LLC’s Birth Certificate)

The Articles of Organization officially creates your LLC with the California Secretary of State. This document establishes your business legally and triggers your ongoing compliance obligations.

How to File Your California Articles of Organization Online

Step 1: Access the Official Filing Portal Go directly to the California Secretary of State’s business filing website: bizfileonline.sos.ca.gov

Step 2: Create Your Account Click “Create Account” and provide your email address and contact information. You’ll receive a confirmation email to activate your account.

Step 3: Start Your LLC Filing

- Log into your account and select “File a New Document”

- Choose “Articles of Organization (LLC)” from the document list

- The system will guide you through each required field

Step 4: Complete Required Information The online form requires these specific details:

LLC Name: Your chosen business name including required designators (“LLC” or “Limited Liability Company”) Registered Agent Information: Full name and complete California street address (no P.O. boxes) Management Structure: Select either “Member-managed” or “Manager-managed” Business Purpose: Use general language like “any lawful business activity” to maintain flexibility Principal Office Address: Your main business location (can be same as registered agent) Organizer Information: Name and address of person filing the documents

Step 5: Review and Pay

- Filing fee: $70 (credit card, debit card, or electronic check)

- Processing options: Standard (5-15 days) or expedited ($350 additional for same-day)

- Confirmation: Save your confirmation number and receipt

Alternative Filing Methods

Paper Filing by Mail: Download Form LLC-1 from the Secretary of State website (sos.ca.gov/business-programs/business-entities/forms) and mail to: California Secretary of State Business Entities P.O. Box 944260 Sacramento, CA 94244-2600

In-Person Filing: Visit the Sacramento office at 1500 11th Street, 3rd Floor, Sacramento, CA 95814 (Not recommended due to limited hours and potential wait times)

Common Filing Mistakes That Delay Approval

Incorrect registered agent information: Ensure addresses match exactly with agent authorization and use proper street addresses (no P.O. boxes) Name availability conflicts: Double-check name searches immediately before filing—availability changes rapidly Incomplete electronic signatures: Follow prompts carefully for proper digital signature execution Payment processing errors: Verify credit card information, available funds, and billing address accuracy Missing or incorrect principal office: Provide complete street address, not just city and state

Step 4: Create an Operating Agreement (Even for Single-Member LLCs)

Many entrepreneurs skip this step thinking it’s optional for single-member LLCs. This mistake can create serious legal and financial complications later.

Why Every California LLC Needs an Operating Agreement

Legal protection: Strengthens the corporate veil protecting personal assets Banking requirements: Many banks require operating agreements for business account opening Investment readiness: Essential documentation for future partners or investors Operational clarity: Defines management structure, profit distribution, and decision-making processes Succession planning: Establishes procedures for member changes or business dissolution

Essential Operating Agreement Provisions

Every California LLC Operating Agreement should include these critical components:

Member Information and Ownership Structure

- Complete member names, addresses, and contact information

- Ownership percentages and capital contribution amounts

- Each member’s roles and responsibilities within the business

Management and Decision-Making Framework

- Voting procedures for major business decisions

- Authority levels for day-to-day operations

- Meeting requirements and record-keeping procedures

- Conflict resolution and dispute handling processes

Financial Terms and Distribution Rules

- How profits and losses get allocated among members

- When and how distributions are made to members

- Additional capital contribution requirements for business growth

- Expense reimbursement policies and procedures

Ownership Transfer and Exit Strategies

- Restrictions on selling or transferring membership interests

- Right of first refusal procedures for existing members

- Buy-sell agreement terms and valuation methods

- Death, disability, or withdrawal procedures

Business Dissolution and Asset Distribution

- Circumstances that trigger LLC dissolution

- Step-by-step dissolution procedures and timeline

- How assets and liabilities get distributed among members

- Final tax obligations and compliance requirements

Single-Member vs. Multi-Member Considerations

Single-member LLCs need operating agreements that clearly establish business separation from personal activities. Include specific language about business purposes, record-keeping requirements, and decision-making procedures.

Multi-member LLCs require more complex agreements addressing partner relationships, dispute resolution, and exit strategies. Consider involving legal counsel for multi-member structures involving significant assets or complex partnership arrangements.

Step 5: Obtain an EIN (Employer Identification Number)

Your EIN serves as your business’s Social Security number for tax purposes. Even single-member LLCs typically need EINs for banking and tax compliance.

When California LLCs Need EINs

- Always required for: Multi-member LLCs, LLCs with employees

- Recommended for: Single-member LLCs opening business bank accounts

- Optional for: Single-member LLCs filing as sole proprietorships with no employees

How to File Your California Articles of Organization Online

Step 1: Access the Official IRS Application Go directly to the IRS EIN application portal: irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Step 2: Verify Your Eligibility

- Confirm you have a valid Social Security Number or Individual Taxpayer Identification Number

- Ensure your LLC has been officially formed (you’ll need your Articles of Organization)

- Verify you’re applying for a legitimate business purpose

Step 3: Complete the Online Application (Form SS-4) The IRS online system will guide you through these required fields:

- Legal name of entity: Your exact LLC name as filed with California

- Trade name/DBA: Any “doing business as” names you’ll use

- Mailing address: Where you want to receive EIN confirmation

- Responsible party: The person with ultimate control (typically you)

- Business start date: When you plan to begin operations

- Principal business activity: Select the code that best describes your business

- Reason for applying: Choose “Started new business” for new LLCs

Step 4: Submit and Receive Your EIN

- Processing time: Immediate confirmation during IRS business hours (7 AM – 10 PM ET, Monday-Friday)

- Cost: Completely free when applying directly through the IRS

- Confirmation: Save your EIN confirmation letter—you’ll need it for banking and taxes

Alternative EIN Application Methods

Apply by Mail or Fax: Download Form SS-4 from irs.gov/forms-pubs/about-form-ss-4 and submit to:

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

- Fax: 855-641-6935

- Processing time: 4-6 weeks by mail, 4-5 business days by fax

Apply by Phone: Call the IRS Business & Specialty Tax Line at 800-829-4933

- Available: Monday-Friday, 7 AM – 10 PM ET

- Processing time: Immediate during the call

- Best for: Urgent situations when online portal is unavailable

Step 6: Understand California’s Ongoing Compliance Requirements

California imposes specific ongoing requirements that many new LLC owners overlook—until they receive penalty notices.

Annual Franchise Tax ($800 Minimum)

Every California LLC owes annual franchise tax, due by the 15th day of the 4th month after the tax year ends (typically April 15th). The minimum tax is $800, even for LLCs with no income.

Important exception: New LLCs are exempt from the first-year $800 minimum tax if the LLC is formed and properly dissolved within the same tax year.

Statement of Information Filing

California requires LLCs to file Statement of Information within 90 days of formation and then biennially (every two years). This $20 filing updates your registered agent information and principal office address.

Key dates: Track your filing deadlines carefully. Late filings incur $250 penalties plus potential suspension of business privileges.

Additional Requirements for Specific Business Types

Professional LLCs: Require additional licensing and compliance for licensed professionals (lawyers, doctors, accountants, etc.) Multi-member LLCs: Must file federal partnership tax returns (Form 1065) Foreign income: LLCs with international operations face additional reporting requirements

Common California LLC Formation Mistakes (And How to Avoid Them)

After helping thousands of entrepreneurs through this process, we’ve seen the same mistakes repeatedly. Here’s how to avoid them:

Mistake 1: Rushing the Name Selection

The problem: Choosing names that limit future growth or create trademark conflicts The solution: Invest time in name research and consider hiring professional trademark searches for valuable brands

Mistake 2: Skipping the Operating Agreement

The problem: Assuming single-member LLCs don’t need operating agreements The solution: Create operating agreements for ALL LLCs to strengthen legal protection and prepare for growth

Mistake 3: Ignoring Annual Compliance

The problem: Missing franchise tax payments or Statement of Information filings The solution: Set calendar reminders and consider professional compliance services for busy entrepreneurs

Mistake 4: Mixing Personal and Business Finances

The problem: Using personal accounts for business transactions undermines LLC protection The solution: Open dedicated business banking immediately after receiving your EIN

Mistake 5: DIY Legal Work Beyond Your Expertise

The problem: Complex business structures require legal expertise most entrepreneurs lack The solution: Know when to involve attorneys—typically for multi-member LLCs, complex ownership structures, or significant liability concerns

Advanced California LLC Strategies for Scaling Businesses

Tax Election Optimization

Smart entrepreneurs optimize their tax structure as businesses grow. California LLCs can elect different tax treatments:

S-Corporation Election: When It Makes Financial Sense

LLCs can elect S-Corporation tax treatment to potentially reduce self-employment taxes on business profits. This election allows your LLC to be treated as an S-Corporation for tax purposes while maintaining its legal LLC structure and flexibility.

How S-Corp Election Reduces Self-Employment Tax: By default, LLC owners pay self-employment tax (15.3% for Social Security and Medicare) on all business profits. With S-Corp election, you split profits into two categories:

- W-2 wages (subject to payroll taxes)

- Distributions (not subject to self-employment tax)

When S-Corp Election Makes Financial Sense:

- Generally beneficial when: Annual profits exceed $60,000-$80,000

- Break-even point: Must save enough in self-employment taxes to offset additional payroll and compliance costs

- Sweet spot: Most beneficial for LLCs with $80,000-$500,000 in annual profits

S-Corp Election Requirements:

- File Form 2553: Submit IRS Form 2553 within 75 days of your tax year start

- Payroll setup: Must pay yourself “reasonable compensation” as W-2 wages

- Quarterly filings: Form 941 payroll tax returns and Form 1120-S annual return

- Additional compliance costs: Payroll processing, quarterly tax payments, and professional accounting fees

Real-World Example Calculation: LLC with $100,000 annual profit:

- Without S-Corp election: Pays 15.3% self-employment tax on full $100,000 = $15,300

- With S-Corp election: Pays $50,000 reasonable salary (subject to payroll taxes) + $50,000 distribution (no self-employment tax)

- Annual savings: Approximately $7,650 in self-employment taxes (15.3% × $50,000 distribution)

- Net benefit: $7,650 savings minus additional payroll and compliance costs ($1,000-$3,000 annually)

Important Considerations: The IRS requires “reasonable compensation” for S-Corp owner-employees. You cannot pay yourself $20,000 salary and take $80,000 in distributions—the IRS will challenge unreasonably low salaries. Research comparable salaries in your industry and consult tax professionals for guidance.

Learn more about LLC tax classifications and S-Corporation requirements through official IRS resources.

Multi-State Operations and Nexus Issues

Remote businesses often trigger registration requirements in multiple states. Understanding nexus rules helps avoid surprise tax obligations:

Economic nexus: Revenue thresholds that trigger state registration requirements Physical nexus: Employees, inventory, or offices creating state obligations Compliance strategy: Monitor state-specific thresholds and register proactively

Professional LLC Considerations

Licensed professionals (lawyers, doctors, accountants, architects, engineers) face additional requirements:

Professional licensing: Must maintain appropriate professional licenses Ownership restrictions: Only licensed professionals can own interests Professional liability: Different insurance and liability considerations Additional filings: Professional oversight board registrations may be required

Step-by-Step California LLC Formation Checklist

Phase 1: Pre-Filing Preparation

- [ ] Research and verify business name availability

- [ ] Check trademark databases for potential conflicts

- [ ] Secure domain name and social media handles

- [ ] Choose registered agent (self or professional service)

- [ ] Determine management structure (member-managed vs. manager-managed)

- [ ] Gather required information and documentation

Phase 2: Official Formation

- [ ] File Articles of Organization with California Secretary of State

- [ ] Pay $70 state filing fee

- [ ] Receive official LLC formation confirmation

- [ ] Apply for EIN through IRS (free online application)

- [ ] Draft and execute Operating Agreement

Phase 3: Post-Formation Setup

- [ ] Open dedicated business banking account

- [ ] Obtain necessary business licenses and permits

- [ ] Set up accounting and bookkeeping systems

- [ ] Purchase appropriate business insurance

- [ ] Register for state and local taxes if applicable

Phase 4: Ongoing Compliance

- [ ] File Statement of Information within 90 days of formation

- [ ] Pay annual franchise tax ($800 minimum)

- [ ] Maintain separate business and personal finances

- [ ] Update registered agent information when necessary

- [ ] File required tax returns and business reports

California LLC Costs: Complete Breakdown for Budget Planning

Understanding the full cost picture helps entrepreneurs budget appropriately and avoid surprise expenses.

Required State Fees

- Articles of Organization filing: $70

- Statement of Information: $20 (due within 90 days, then every 2 years)

- Annual franchise tax: $800 minimum (exempt first year if dissolved same year)

- Name reservation (optional): $10 for 60-day hold

Professional Service Costs

- Registered agent service: $100-$300 annually

- Operating Agreement drafting: $300-$1,500+ depending on complexity

- Legal consultation: $300-$600 per hour for complex situations

- Accounting setup: $500-$2,000 for bookkeeping and tax optimization

Additional Business Costs

- Business banking: $10-$50 monthly account fees

- Business insurance: $300-$2,000+ annually depending on industry

- Professional licenses: Varies by industry and profession

- Business permits: $50-$500+ depending on business type and location

Total first-year costs: $800-$3,000+ for most small businesses, with ongoing annual costs of $500-$1,500.

Business Banking for Your New California LLC

Opening a business bank account ranks among your first priorities after LLC formation. This separation protects your limited liability status and simplifies tax compliance.

Required Documentation for Business Banking

- Articles of Organization (certified copy from state)

- EIN confirmation letter from IRS

- Operating Agreement (even single-member LLCs)

- Registered agent information

- Personal identification for all LLC members

- Initial deposit ($100-$1,000 depending on bank requirements)

Choosing the Right Business Bank

Consider these factors:

- Monthly fees and transaction limits

- Online banking capabilities for remote management

- International wire transfer fees (important for global businesses)

- Business credit card offerings and rewards

- Small business lending relationships

Top recommendations for remote entrepreneurs: Banks with strong online platforms, mobile check deposit, and international capabilities serve location-independent businesses best. For non-residents opening LLC bank accounts, our comprehensive banking guide covers specific requirements and solutions.

California Business Licenses and Permits: What You Actually Need

License requirements vary dramatically based on business type, location, and activities. Most online businesses need fewer licenses than physical operations, but some requirements apply broadly.

Universal Requirements for Most Businesses

- Business license from your city or county

- Seller’s permit if selling physical products in California

- Professional licenses for regulated industries

Industry-Specific Requirements

- Food businesses: Health department permits and food handler certifications

- Professional services: State licensing board registrations

- Construction: Contractor licenses and bonding requirements

- Healthcare: Medical board licenses and HIPAA compliance

- Financial services: Securities and banking regulatory compliance

E-commerce and Digital Business Considerations

- Sales tax registration for California sales

- Nexus compliance for multi-state operations

- Data privacy compliance (CCPA/CPRA requirements)

- International regulations for global customer bases

Tax Optimization Strategies for California LLCs

California’s tax landscape offers opportunities for significant savings when structured properly.

Understanding California LLC Tax Obligations

Franchise tax: $800 annual minimum plus income-based fees for profitable LLCs Income tax: Pass-through taxation means profits flow to member personal returns Employment taxes: Payroll taxes if you elect S-Corporation status or hire employees Sales tax: Registration required for businesses selling tangible products

Multi-State Tax Planning for Remote Businesses

Location-independent entrepreneurs often face complex multi-state tax obligations. Key considerations include:

Nexus thresholds: Revenue levels triggering registration requirements in various states Apportionment rules: How multi-state income gets allocated for tax purposes Compliance strategies: Proactive registration vs. reactive compliance approaches

Insurance Protection for Your California LLC

LLC formation provides significant legal protection, but comprehensive insurance coverage fills important gaps.

Essential Insurance Types for Most LLCs

General liability insurance: Protects against third-party injury or property damage claims Professional liability insurance: Coverage for errors, omissions, or negligence in professional services Cyber liability insurance: Increasingly important for businesses handling customer data Business property insurance: Protects equipment, inventory, and other business assets

Industry-Specific Insurance Considerations

Professional services: Errors and omissions coverage tailored to specific professions Product businesses: Product liability coverage for manufacturing or selling physical goods Service businesses: Commercial general liability with appropriate coverage limits Technology companies: Tech E&O, cyber liability, and intellectual property coverage

Cost-Effective Insurance Strategies

Bundle policies: Combine multiple coverages for premium discounts Increase deductibles: Higher deductibles reduce premium costs for businesses with strong cash flow Industry associations: Many professional associations offer group insurance rates Annual reviews: Insurance needs change as businesses grow—review coverage annually

Frequently Asked Questions About California LLC Formation

How long does it take to form an LLC in California?

Standard processing takes 5-15 business days for online filings and 15-30 days for mail filings. Expedited processing is available for additional fees if you need immediate formation.

Can I form a California LLC if I don’t live in California?

Yes, non-residents can form California LLCs. However, you’ll need a California registered agent and must comply with California tax obligations. Consider whether your home state might offer better advantages for your specific situation.

What’s the difference between member-managed and manager-managed LLCs?

Member-managed: All LLC owners participate in daily management decisions (default structure) Manager-managed: Designated managers handle operations while members remain passive investors

Choose manager-managed if you have passive investors or want to separate ownership from management responsibilities.

Do I need a lawyer to form an LLC in California?

Simple, single-member LLCs often don’t require legal counsel. However, consider attorney involvement for:

- Multi-member LLCs with complex ownership structures

- Professional LLCs requiring specialized compliance

- Businesses with significant liability exposure

- Situations involving intellectual property or complex contracts

How do I dissolve a California LLC if my business doesn’t work out?

California LLC dissolution requires:

- Member vote according to Operating Agreement procedures

- Certificate of Dissolution filing with Secretary of State

- Final tax returns and franchise tax obligations

- Asset distribution according to Operating Agreement terms

- Notice to creditors as required by California law

Important: Dissolve properly to avoid ongoing franchise tax obligations.

Can my California LLC operate internationally?

Yes, California LLCs can operate globally. However, international operations may trigger:

- Foreign registration requirements in countries where you conduct business

- Additional tax obligations including potential foreign income reporting

- Compliance requirements varying by country and business type

- Banking considerations for international money movement

What happens if I miss the annual franchise tax payment?

Late franchise tax payments incur penalties and interest. Continued non-payment can result in:

- Suspension of LLC privileges including inability to defend lawsuits

- Additional penalties that compound over time

- Administrative dissolution in extreme cases

- Revival requirements including paying all back taxes and penalties

How do I add members to my LLC after formation?

Adding members requires:

- Operating Agreement amendment documenting new ownership structure

- Membership interest transfer documentation

- New Member admission procedures per Operating Agreement

- Tax election considerations (single-member to multi-member triggers partnership tax status)

- Statement of Information update if management structure changes

Expert Resources for California LLC Success

Government Resources

- California Secretary of State: Official filing portal and business search

- IRS Business Portal: EIN applications and tax guidance

- California Franchise Tax Board: State tax obligations and payments

- Local city/county offices: Business license and permit information

Take Action: Your California LLC Formation Game Plan

You now have everything needed to form your California LLC confidently and correctly. The key to success lies in executing systematically while avoiding common pitfalls that delay formation or create future compliance issues.

Your Next Steps (Do This Week)

- Finalize your LLC name and verify availability through official state records

- Choose your registered agent (professional service recommended for most entrepreneurs)

- Gather required information for Articles of Organization filing

- File Articles of Organization through the California Secretary of State online portal

- Apply for your EIN immediately after receiving LLC confirmation

Set Up for Long-Term Success (Do This Month)

- Draft your Operating Agreement even for single-member LLCs

- Open your business bank account with proper documentation

- Research business license requirements for your specific industry and location

- Set up accounting systems to maintain clean financial records

- Purchase appropriate business insurance to protect your growing venture

Ready to get started? BusinessAnywhere.io has helped thousands of remote entrepreneurs navigate California LLC formation successfully. Our experienced team handles the complexity while you focus on building your business.

Start Your California LLC Today →

BusinessAnywhere.io has guided entrepreneurs through business formation for over 20 years. Our team combines deep expertise in corporate law, tax optimization, and compliance management to help remote founders build legitimate, protected, and scalable businesses. Learn more about our comprehensive business formation services →

- Related Posts

- How to Start an LLC in Alaska: Filing Requirements, Costs, and Tips

- How to Start an LLC in Arizona

- How to Start an LLC in Delaware in 2025

- How to Start an LLC in Florida (The Right Way)

- How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

- How to Start an LLC in New York: The Ultimate Step-by-Step Guide

- How to Start an LLC in Oregon: A Smart Guide for First-Time Business Owners

- How to Start an LLC in Texas: A No-Nonsense Guide for 2025

- How to Start a Wyoming LLC in 2025