Thinking about starting your business in Illinois and wondering how the heck to set up an LLC without wasting weeks buried in paperwork or Googling your life away? You’re in the right place.

I’ve helped set up more LLCs than I can count—some for brick-and-mortar shops in Chicago, others for remote service businesses in Peoria. Setting up an LLC in Illinois isn’t rocket science, but there are a few key steps and some common traps you’ll want to dodge. If you skip the foundational stuff, it’ll come back to bite you later—usually right when you’re about to close your first big deal or open that business bank account.

Let’s walk through this like we would on a call. I’ll even throw in a checklist so you don’t have to keep notes.

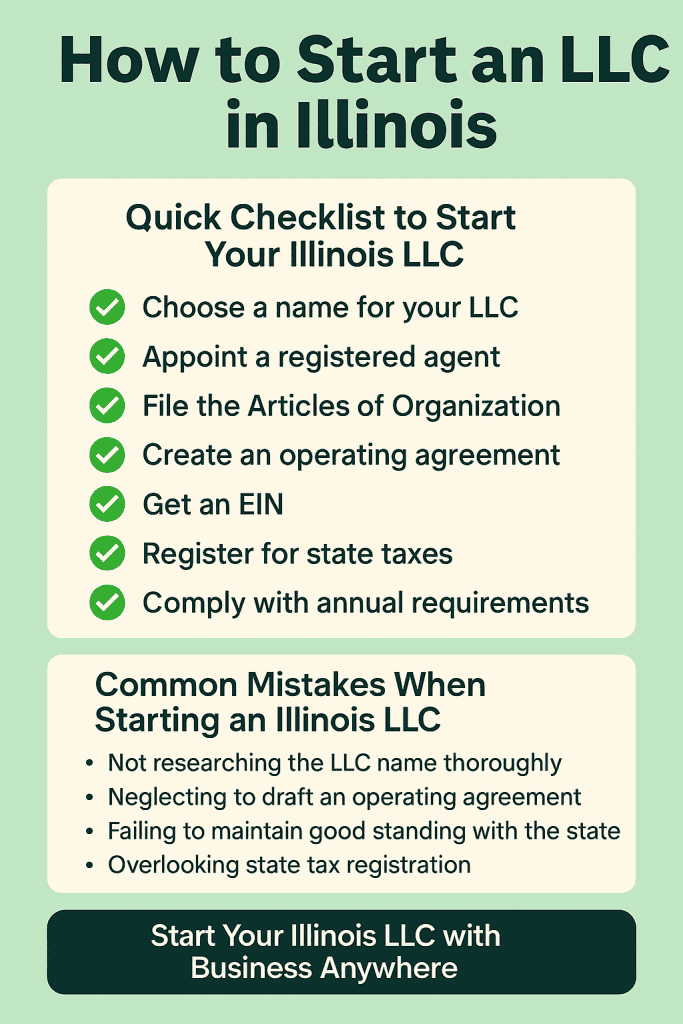

Quick Checklist to Start Your Illinois LLC

- Choose your LLC name (and make sure it’s available)

- Appoint a registered agent

- File Articles of Organization with the Illinois Secretary of State

- Create an Operating Agreement

- Get an EIN from the IRS

- Register for state taxes (if applicable)

- Maintain compliance (annual reports, fees, etc.)

Each of these steps plays a critical role in not only forming your LLC but also laying a strong foundation for long-term business success in Illinois.

Step 1: Choose a Name for Your Illinois LLC

Your LLC name isn’t just a label—it’s your first impression. In Illinois, the name must include “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” That tells the world (and the state) that you’re a legit business entity with liability protection. It also makes it clear to clients and vendors that they’re dealing with a formal legal entity, not just a side hustle operating under your personal name.

You also need to make sure your name is distinguishable from others already registered in the state. The Illinois Secretary of State’s Business Entity Search makes it easy to check for name availability. Don’t skip this step, or you risk getting your application rejected—which slows everything down.

You can also check our step-by-step guide on How to Perform an Illinois Business Entity Search. This guide will walk you thru the steps to search for your desired business name, check availability, check any legal or naming restrictions, and ensure you don’t skip this critical step.

Pro tip: Think beyond the legal name. Grab the .com domain and the social media handles while you’re at it. Branding matters, and consistency across platforms builds trust. If the domain’s taken, you might consider using a unique brand word or geographic tag to stand out.

And if you plan to operate under a different name than your LLC’s legal name (say, your LLC is “Lakeview Marketing LLC” but you want to go by “BrightBeam Creative”), you’ll need to file for an Assumed Name (also known as a DBA) in Illinois. It’s not complicated, but it’s an extra step that people often forget.

Step 2: Designate a Registered Agent in Illinois

Illinois law requires your LLC to designate a registered agent. This is someone who can accept legal papers and official mail during normal business hours. That includes lawsuits (yep, even if you’re innocent), government notices, tax forms, and annual report reminders.

You can be your own agent, but here’s the truth: it’s a pain. You don’t want your home address on public record, and you don’t want to worry about missing critical mail because you were out for lunch or on vacation. Plus, having a process server show up at your house in front of your neighbors? Not ideal.

A professional registered agent gives you privacy, flexibility, and peace of mind. BusinessAnywhere offers affordable Registered Agent Services that keep your name and address off public filings. We handle all the boring (but critical) stuff so you don’t have to.

Also worth noting: if your registered agent is out of compliance or can’t be reached, the state can administratively dissolve your LLC. Yikes. That means your limited liability protections are suspended, and you could be personally liable for your business obligations.

Step 3: File Your Articles of Organization with the Illinois Secretary of State

This is the big step that legally forms your LLC. You’ll file Form LLC-5.5 (Articles of Organization) with the Secretary of State. It includes your LLC name, address, registered agent info, business purpose, and whether the LLC is managed by members or managers.

- Fee: $150 (as of 2025)

- Where to file: Online through cyberdriveillinois.com or by mailing the form

You’ll also need to decide on a business address, which will be listed publicly. If you’re working from home and want to avoid putting your personal address on state documents, a virtual mailbox is a clean, professional alternative.

Once you’ve submitted the form, approval usually takes about 10 business days for online submissions (sometimes faster). Paper filings take longer, sometimes up to 3–4 weeks. Once approved, the state sends back a stamped copy of your Articles of Organization. Save this. You’ll need it when opening a business bank account or applying for business credit cards.

Step 4: Draft an Operating Agreement

Even though Illinois doesn’t require LLCs to have an Operating Agreement, you really should create one. It’s like a prenup for your business—it outlines who owns what, how profits are split, who makes decisions, and what happens if someone wants out.

Without one, state default rules apply. And those rules aren’t always friendly. For example, they may assume equal ownership—even if one person contributed 90% of the startup capital. An Operating Agreement protects you from future disputes and clearly documents your intentions from day one.

If you’re a solo founder, it still matters. An Operating Agreement reinforces your limited liability status, which is essential if you’re ever sued or audited. It also signals to banks, partners, and potential investors that you’re serious and professional.

We include customizable Operating Agreement templates with every LLC package we file. You can tailor them to your unique ownership structure, whether you’re a one-person shop or have multiple members.

Step 5: Get an EIN from the IRS

Your Employer Identification Number (EIN) is essential. Think of it as a Social Security number for your business. You’ll need it to:

- Open a business bank account

- Hire employees

- File federal and state taxes

- Apply for business credit or loans

- Register for certain state and local permits

Getting one is free and takes about 10 minutes on the IRS website. You can apply online Monday to Friday, 7 a.m. to 10 p.m. Eastern.

Make sure the name on your EIN application matches your LLC name exactly as it appears in your Articles of Organization. Mismatches or typos can cause annoying delays or even IRS rejections.

Even if you don’t plan to hire employees, you still need an EIN to open a business bank account. Banks won’t let you open one with just your personal Social Security number.

Step 6: Register for Illinois State Taxes (If Applicable)

Not every LLC will need to register for state-level taxes, but many do. It depends on what you’re selling, how you deliver it, and whether you have employees.

Here are common tax registrations in Illinois:

- Sales and Use Tax: Required if you sell taxable goods or services, even online. This applies to physical products and many digital products.

- Employee Withholding Tax: If you hire employees, you’re required to withhold and remit state income taxes from their paychecks.

- Unemployment Insurance Tax: Required for employers to contribute to the state unemployment fund.

You can register for these through the MyTax Illinois portal. It’s an all-in-one system for registering and filing state business taxes. If your business operates in Chicago, you’ll also want to check if additional local licenses or taxes apply.

Some professional services (like contractors or barbers) may need licensing through specific boards. Always double-check.

Step 7: File Your Annual Report and Maintain Compliance

Once your LLC is up and running, don’t forget the maintenance. Illinois requires every LLC to file an Annual Report each year. The report updates your contact and ownership information with the state.

- Due date: The first day of your anniversary month (every year)

- Fee: $75

If you file late, you’ll get slapped with a $100 late fee—and if you ignore it for too long, your LLC could be involuntarily dissolved. That means your business name could be up for grabs, and you’d lose your liability protection until you reinstate.

There’s also the matter of keeping good internal records. You don’t have to file financials with the state, but you should keep meeting notes (even if it’s just you), a ledger of ownership units, and receipts for major decisions or purchases. These are especially important if your LLC is ever audited.

We offer ongoing compliance services that track your deadlines and handle your filings. It’s one less thing for you to stress about.

Common Mistakes When Starting an Illinois LLC

- Using your home address on public records. You’ll get junk mail, and it exposes your privacy. Use a virtual mailbox instead. It looks more professional and keeps your personal life separate.

- Missing your annual report deadline. A lot of people forget this until they get a notice or fine. Automate it or use a filing service that sends reminders.

- Not opening a separate business bank account. Commingling personal and business funds is a recipe for losing your liability protection. You need clean books.

- Thinking an Operating Agreement is optional. It’s not—at least not if you want to avoid future drama, protect your equity, or attract investors.

- Hiring employees before registering for withholding and UI taxes. The state doesn’t care if you were “figuring it out later.” Get the tax stuff squared away before you onboard.

FAQ: Starting an LLC in Illinois

How much does it cost to start an LLC in Illinois?

It costs $150 to file your Articles of Organization with the Illinois Secretary of State. You may also pay for a registered agent, operating agreement, and other startup services.

How long does it take to start an LLC in Illinois?

Online filings take 7–10 business days. Mail filings take 3–4 weeks. Expedited service isn’t available online but may be requested for paper filings.

Do I need a business license in Illinois?

It depends on your business type and location. Illinois doesn’t have a statewide general business license, but cities like Chicago have their own licensing rules.

Can I be my own registered agent in Illinois?

Legally, yes. But practically? Not recommended. It puts your personal address on public record and ties you to regular business hours.

Does Illinois require an Operating Agreement?

No, but it’s smart to have one. It protects your liability status and helps avoid disputes between members.

Skip the Paperwork Headaches – Start Your Illinois LLC Today

Look, you could do this all yourself—but why?

BusinessAnywhere can handle the filings, the registered agent service, and the compliance tracking. You focus on getting your first customer or building your product.

Related Posts

- How to Start an LLC in Delaware in 2025

- How to Start an LLC in Florida

- How to Start an LLC in Indiana: Fast, Simple, and State-Compliant

- How to Start an LLC in Iowa: A Step-by-Step Filing and Compliance Guide

- How to Start an LLC in Kansas: Filing Instructions, Costs, and Setup Tips

- How to Start an LLC in Kentucky: What You Need to Know to Launch Legally

- How to Start an LLC in Michigan: Your Complete Setup Checklist

- How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

- How to Start an LLC in Ohio: Everything You Need to Know

- How to Start a Wyoming LLC in 2025