Starting a Limited Liability Company (LLC) in Indiana has never been more attractive for digital nomads, remote entrepreneurs, and location-independent business owners. With Indiana’s business-friendly environment, affordable filing fees, and streamlined processes, the Hoosier State offers an ideal foundation for modern businesses that operate anywhere in the world.

This comprehensive guide walks you through every step of forming an LLC in Indiana, from initial planning to post-formation requirements. Whether you’re launching a consulting firm, e-commerce business, or digital agency, this step-by-step roadmap ensures you establish your business correctly and efficiently.

Why Choose Indiana for Your LLC Formation?

Economic Advantages of Indiana LLCs

Indiana’s robust economy provides a solid foundation for new businesses. With a gross state product (GSP) of $355.9 billion as of 2022—representing 1.8% growth from 2017—the state demonstrates consistent economic expansion that benefits entrepreneurs and business owners.

Key Economic Benefits:

- Low Cost of Living: Indiana ranks among the most affordable states for business operations

- Strategic Location: Central location provides easy access to major markets across the Midwest

- Business-Friendly Tax Structure: Competitive corporate tax rates and business incentives

- Growing Tech Sector: Expanding technology and innovation hubs in Indianapolis, Fort Wayne, and Bloomington

Legal and Operational Advantages

Indiana LLCs offer several advantages for modern entrepreneurs:

- Limited Personal Liability: Protect personal assets from business debts and legal issues

- Tax Flexibility: Choose how your LLC is taxed (sole proprietorship, partnership, S-Corp, or C-Corp)

- Minimal Compliance Requirements: No annual reports or franchise taxes required

- Privacy Protection: Use a registered agent to keep your personal address private

- Operational Flexibility: Few restrictions on ownership structure or management

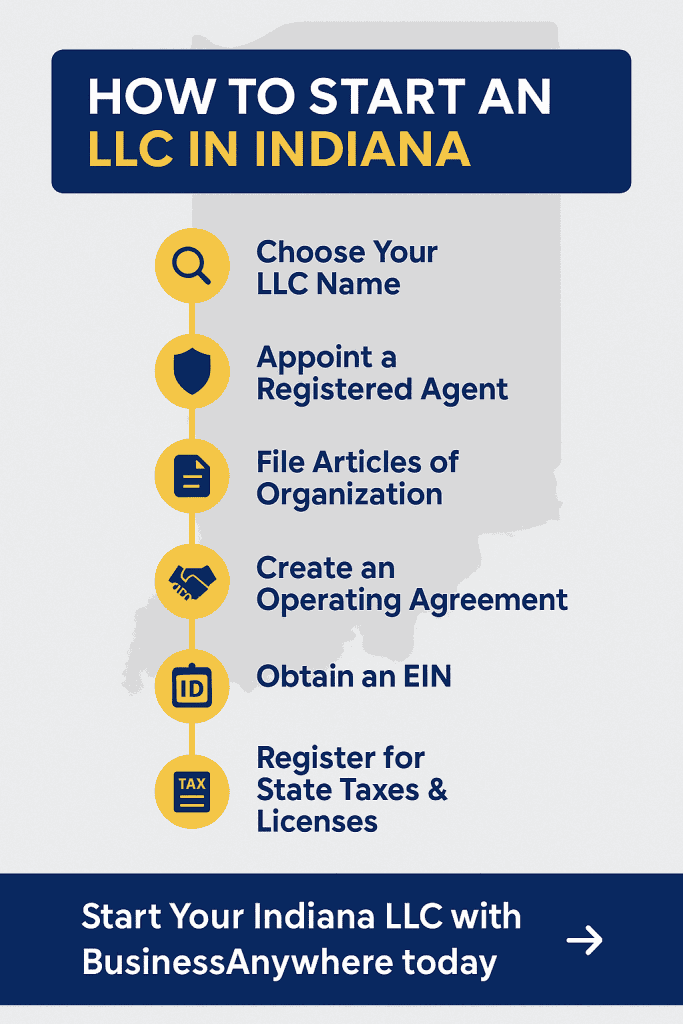

Step-by-Step Guide: How to Form an LLC in Indiana

Step 1: Choose Your Indiana LLC Name

Selecting the right business name is crucial for branding, legal compliance, and search engine optimization. Your LLC name will appear on all legal documents, contracts, and marketing materials.

Indiana LLC Name Requirements

Your business name must comply with Indiana Secretary of State requirements:

- Must include “Limited Liability Company,” “LLC,” or “L.L.C.” in the name

- Must be distinguishable from existing registered business names in Indiana

- Cannot include restricted words such as “Bank,” “Insurance,” or “University” without proper licensing

- Cannot mislead the public about the nature of your business

How to Check Name Availability

Before settling on a name, verify its availability using these methods:

- Indiana Secretary of State Business Entity Database: Search the official database for existing registrations

- Federal Trademark Search: Check the USPTO database for potential trademark conflicts

- Domain Name Availability: Ensure matching domain names are available for your website

- Social Media Handles: Verify availability across major social platforms

Reserved Name Process

Once you’ve identified your preferred name, consider filing a Reservation of Business Name:

- Duration: Reserves your name for 120 days

- Cost: $20 filing fee

- Filing Method: Must be completed online through the Indiana Secretary of State portal

- Extension: Can be renewed for additional 120-day periods if needed

Using a Trade Name (DBA)

Indiana allows LLCs to operate under a fictitious business name or “Doing Business As” (DBA) name:

- Flexibility: Use a different name for marketing while maintaining your legal LLC name

- Filing Requirements: Must register the trade name with the Indiana Secretary of State

- Fees: $20 online filing or $30 mail filing

- Use Cases: Ideal for businesses with multiple brands or customer-facing names

Step 2: Select and Appoint Your Registered Agent

Every Indiana LLC must maintain a registered agent—a critical requirement that ensures your business receives important legal documents and official correspondence.

What is a Registered Agent?

A registered agent is an individual or business entity designated to:

- Receive legal documents including lawsuits, subpoenas, and tax notices

- Accept service of process on behalf of your LLC

- Maintain regular business hours and a physical Indiana address

- Forward important documents to appropriate LLC members or managers

Registered Agent Requirements in Indiana

Your registered agent must meet these criteria:

- Physical Address: Must have a street address (not P.O. Box) in Indiana

- Availability: Must be available during normal business hours (typically 9 AM – 5 PM)

- Residency/Authorization: Must be an Indiana resident or business entity authorized to conduct business in Indiana

- Consent: Must agree to serve as your registered agent

Should You Serve as Your Own Registered Agent?

While Indiana allows LLC members to serve as their own registered agent, this approach has significant drawbacks:

Disadvantages of Self-Service:

- Privacy Loss: Your name and address become public record

- Availability Requirements: Must be present during business hours to receive documents

- Professional Image: May appear less professional to clients and partners

- Travel Restrictions: Cannot travel or relocate without updating registered agent information

Professional Registered Agent Services

Most successful entrepreneurs choose professional registered agent services for these benefits:

- Privacy Protection: Keep your personal information confidential

- Reliability: Guaranteed availability during business hours

- Document Management: Secure handling and forwarding of legal documents

- Compliance Monitoring: Alerts about important deadlines and requirements

- Professional Image: Enhanced credibility with clients and partners

BusinessAnywhere.io offers comprehensive registered agent services specifically designed for digital nomads and remote entrepreneurs who need reliable, professional representation regardless of their physical location.

For remote entrepreneurs who need reliable business mail handling, consider setting up a virtual business address alongside your LLC formation to maintain professionalism while working from anywhere.

Step 3: Prepare and File Your Articles of Organization

The Articles of Organization is the foundational legal document that officially creates your LLC in Indiana. This document establishes your business as a legal entity and provides essential information to the state.

Required Information for Articles of Organization

Your Articles of Organization must include:

- LLC Name: Your chosen business name (including LLC designation)

- Principal Office Address: Your business address (can be your registered agent’s address)

- Registered Agent Information: Name and Indiana address of your registered agent

- Duration: Specify if the LLC is perpetual (ongoing) or has a specific termination date

- Management Structure: Indicate whether the LLC is member-managed or manager-managed

- Organizer Information: Name and signature of the person filing the Articles

Management Structure Options

Choose between two management structures:

Member-Managed LLC:

- All owners (members) participate in daily business decisions

- Simple structure ideal for small businesses with few owners

- All members have authority to bind the LLC in business transactions

Manager-Managed LLC:

- Designated managers handle daily operations

- Other members serve as passive investors

- Better for larger LLCs or when some members prefer limited involvement

Filing Process and Fees

Online Filing (Recommended):

- Cost: $100 filing fee

- Processing Time: Typically 1-3 business days

- Method: File through the Indiana Secretary of State online portal

- Confirmation: Receive electronic confirmation and certificate

Mail Filing:

- Cost: $100 filing fee (same as online)

- Processing Time: 7-10 business days

- Method: Mail completed forms to Indiana Secretary of State Business Services Division

- Address: 302 W. Washington St., Room E018, Indianapolis, IN 46204

After Approval

Once approved, you’ll receive:

- Certificate of Organization: Official proof of your LLC’s legal existence

- State File Number: Unique identifier for your LLC

- Legal Status: Your LLC becomes an official business entity

Step 4: Create Your LLC Operating Agreement

While Indiana doesn’t legally require an Operating Agreement, this document is essential for protecting your business interests and preventing future disputes. Learn more about how to set up an LLC with proper documentation.

Why You Need an Operating Agreement

An Operating Agreement provides several critical benefits:

Legal Protection:

- Maintains LLC Status: Helps preserve liability protection by demonstrating business formality

- Prevents Default Rules: Avoids Indiana’s default LLC laws that may not suit your business

- Court Protection: Provides clear guidance if disputes arise

Operational Clarity:

- Decision-Making Process: Establishes how business decisions are made

- Profit Distribution: Defines how profits and losses are allocated

- Member Rights: Clarifies each member’s rights and responsibilities

Essential Elements of an Operating Agreement

Your Operating Agreement should address:

- Company Information

- LLC name and principal address

- Business purpose and duration

- Management structure

- Membership Details

- Names and contact information of all members

- Ownership percentages

- Capital contributions (money, property, or services)

- New member admission process

- Management and Voting

- Day-to-day management responsibilities

- Voting procedures for major decisions

- Manager duties and compensation (if manager-managed)

- Financial Provisions

- Profit and loss distribution

- Capital account maintenance

- Additional capital requirements

- Financial reporting procedures

- Member Changes

- Transfer of membership interests

- Member withdrawal procedures

- Death or disability provisions

- Buy-sell agreements

- Dissolution and Termination

- Events triggering dissolution

- Winding up procedures

- Asset distribution

Professional Operating Agreement Creation

While templates are available online, consider professional assistance for:

- Complex Ownership Structures: Multiple members with different contributions

- Investment Requirements: Outside investors or complex financing

- Specialized Industries: Businesses with unique regulatory requirements

- Tax Elections: Specific tax treatment elections (S-Corp, etc.)

Step 5: Obtain Your Federal Employer Identification Number (EIN)

An Employer Identification Number (EIN), also called a Federal Tax ID Number, is a unique nine-digit identifier assigned by the IRS for tax purposes.

When You Need an EIN

You must obtain an EIN if your LLC:

- Has multiple members (multi-member LLCs are required to have an EIN)

- Has employees or plans to hire employees

- Elects corporate tax treatment (S-Corp or C-Corp election)

- Opens a business bank account (most banks require an EIN)

- Applies for business licenses or permits

Single-Member LLC Considerations

Single-member LLCs have more flexibility:

- Not Required: Can use the owner’s Social Security Number for tax purposes

- Recommended: Still beneficial for banking and business purposes

- Privacy: Helps separate personal and business finances

- Future Planning: Easier to add members or employees later

How to Apply for an EIN

The IRS offers several application methods:

Online Application (Recommended):

- Cost: Free (beware of third-party websites charging fees)

- Speed: Receive EIN immediately

- Availability: Monday-Friday, 7 AM – 10 PM EST

- Website: Apply directly at IRS.gov

Other Methods:

- Phone: Call (800) 829-4933 (international applicants only)

- Mail/Fax: Complete Form SS-4 and submit

After Receiving Your EIN

Once you receive your EIN:

- Keep Records: Store your EIN letter in a secure location

- Update Documents: Add the EIN to your Operating Agreement and other business documents

- Open Bank Account: Use the EIN to establish business banking

- File Taxes: Use the EIN for all tax filings and business correspondence

Post-Formation Requirements and Best Practices

Open a Business Bank Account

Separating personal and business finances is crucial for:

- Liability Protection: Maintains the corporate veil that protects personal assets

- Tax Compliance: Simplifies bookkeeping and tax preparation

- Professional Image: Demonstrates business legitimacy to clients and vendors

- Financial Management: Better tracking of business income and expenses

Choosing the Right Business Bank

Consider these factors when selecting a business bank:

Digital Banking Features:

- Online Banking: Robust online and mobile banking platforms

- API Integration: Compatibility with accounting software

- International Services: Foreign exchange and international wire transfers

- Remote Deposit: Mobile check deposit capabilities

Fee Structure:

- Monthly Maintenance Fees: Many banks waive fees with minimum balances

- Transaction Limits: Understand limits on monthly transactions

- Cash Deposit Fees: Important if you handle cash transactions

- International Fees: Critical for global businesses

Business Services:

- Merchant Services: Credit card processing capabilities

- Business Credit Cards: Help build business credit history

- Lines of Credit: Access to business financing

- Treasury Management: Advanced cash management tools

Obtain Necessary Business Licenses and Permits

License requirements vary based on your business type, location, and industry:

Federal Licenses

Required for specific industries such as:

- Transportation and logistics

- Firearms and ammunition

- Alcohol and tobacco

- Broadcasting and communications

State of Indiana Licenses

Indiana requires licenses for various professions and businesses:

- Professional Services: Accounting, legal, medical, real estate

- Retail Businesses: Tobacco, alcohol, motor vehicle sales

- Service Industries: Barber/beauty shops, contractors, security services

Local Licenses and Permits

City and county requirements may include:

- Business License: General license to operate in the city/county

- Zoning Permits: Ensure your business location complies with zoning laws

- Building Permits: Required for renovations or new construction

- Health Permits: Food service, childcare, and healthcare businesses

Set Up Business Insurance

Protecting your LLC with appropriate insurance coverage is essential:

Essential Insurance Types

General Liability Insurance:

- Coverage: Third-party bodily injury and property damage claims

- Cost: Typically $400-$800 annually for small businesses

- Importance: Protects against common business risks and lawsuits

Professional Liability Insurance:

- Coverage: Errors, omissions, and negligence claims

- Target Audience: Service-based businesses, consultants, contractors

- Benefits: Covers legal defense costs and settlements

Cyber Liability Insurance:

- Coverage: Data breaches, cyber attacks, and technology failures

- Growing Need: Increasingly important for digital businesses

- Protection: Customer data, business operations, and regulatory compliance

Business Personal Property:

- Coverage: Equipment, inventory, and business property

- Location: Coverage at your business location and sometimes off-site

- Remote Work: Important for home-based and remote businesses

Workers’ Compensation Insurance

Required in Indiana if you have employees:

- Legal Requirement: Mandatory for businesses with employees

- Coverage: Medical expenses and lost wages for work-related injuries

- Exemptions: Generally not required for LLC members/owners

Establish Business Credit

Building business credit separate from personal credit provides several advantages:

Steps to Build Business Credit

- Obtain a Business EIN: Required for business credit applications

- Open Business Bank Accounts: Establish banking relationships

- Apply for a Business Credit Card: Start with secured cards if necessary

- Register with Credit Bureaus: Dun & Bradstreet, Experian Business, Equifax Business

- Establish Trade Lines: Work with suppliers who report to business credit bureaus

- Monitor Your Credit: Regularly check business credit reports

Understanding Indiana LLC Taxes

Federal Tax Elections

Indiana LLCs have flexibility in how they’re taxed at the federal level:

Default Tax Treatment

Single-Member LLC:

- Disregarded Entity: Taxes pass through to the owner’s personal tax return

- Schedule C: Business income and expenses reported on Schedule C

- Self-Employment Tax: Owner pays self-employment tax on business profits

Multi-Member LLC:

- Partnership Taxation: LLC files Form 1065 (information return)

- Pass-Through: Profits and losses pass through to members’ personal returns

- Schedule K-1: Members receive Schedule K-1 showing their share of income/loss

Optional Tax Elections

S-Corporation Election:

- Form 2553: Elect S-Corp tax treatment with the IRS

- Benefits: Potential self-employment tax savings

- Requirements: Restrictions on number and type of owners

- Payroll: Required to run payroll for owner-employees

C-Corporation Election:

- Form 8832: Elect corporate tax treatment

- Double Taxation: Corporation pays tax, owners pay tax on distributions

- Benefits: Lower corporate tax rates, greater deduction opportunities

Indiana State Taxes

No Annual Franchise Tax

Unlike many states, Indiana doesn’t impose an annual franchise tax or fee on LLCs.

State Income Tax

- Pass-Through: LLC income passes through to members’ personal returns

- Rate: Indiana individual income tax rate (currently 3.23%)

- Filing: Members report their share on Indiana individual tax returns

Other State Taxes

- Sales Tax: Required if selling taxable goods or services

- Employment Taxes: Required if you have employees

- Property Tax: On business personal property and real estate

Quarterly Tax Considerations

Federal Quarterly Payments:

- Estimated Taxes: Required if you expect to owe $1,000 or more

- Due Dates: April 15, June 15, September 15, and January 15

- Calculation: Based on current year income or prior year safe harbor

Indiana Quarterly Payments:

- State Estimated Taxes: Required if federal estimates are required

- Coordination: Can coordinate with federal payment schedule

Maintaining Your Indiana LLC

Annual Compliance Requirements

Indiana has minimal ongoing compliance requirements:

No Annual Reports

Unlike many states, Indiana doesn’t require LLCs to file annual reports or pay annual fees.

Update Registered Agent

- Address Changes: Update promptly when registered agent address changes

- Agent Changes: File appropriate forms when changing registered agents

- Consequences: Failure to maintain current registered agent can lead to administrative dissolution

Good Business Practices

Maintain Corporate Formalities

- Operating Agreement: Keep updated as business evolves

- Meeting Minutes: Document important business decisions

- Separate Records: Maintain separate business records and finances

- Written Resolutions: Document major business decisions in writing

Regular Review and Updates

- Annual Review: Review and update Operating Agreement annually

- Member Changes: Document any changes in ownership or management

- Business Evolution: Update documents as business model evolves

- Legal Changes: Stay informed about changes in state and federal law

Special Considerations for Digital Nomads and Remote Entrepreneurs

Operating Your Indiana LLC Remotely

Indiana’s business-friendly environment makes it ideal for location-independent entrepreneurs:

Registered Agent Services

- Critical for Remote Owners: Professional registered agent services are essential

- Mail Forwarding: Ensure important documents reach you anywhere in the world

- Compliance Monitoring: Professional services help maintain compliance

Virtual Office Solutions

- Business Address: Professional business address for correspondence

- Phone Services: Local phone number with professional answering

- Mail Handling: Secure mail receipt and forwarding services

For remote entrepreneurs, consider our comprehensive virtual mailbox services that provide a professional business address while maintaining location independence.

International Considerations

Tax Obligations

- U.S. Tax Filing: Required regardless of your physical location

- Foreign Tax Credits: May be available for taxes paid to other countries

- Tax Treaties: Consider impact of tax treaties between U.S. and your residence country

- Professional Advice: Consult international tax professionals

Banking and Finance

- U.S. Bank Account: Maintaining U.S. banking relationships

- International Transfers: Efficient methods for moving money internationally

- Currency Exchange: Managing currency fluctuations in international business

Common Mistakes to Avoid

Formation Mistakes

Remember, every state has different requirements and costs for LLC formation. If you’re considering other states for your business, explore our guides on LLC costs by state to make an informed decision.

- Choosing Generic Names: Select distinctive, brandable names

- Skipping Name Searches: Always verify name availability thoroughly

- Self-Registered Agent: Using personal address creates privacy and logistical issues

- Incomplete Operating Agreement: Comprehensive agreements prevent future disputes

- Mixing Personal and Business Finances: Maintain strict separation from day one

Digital nomads and remote entrepreneurs should also consider whether they need virtual office services to maintain a professional business presence while traveling.

Ongoing Compliance Mistakes

- Ignoring Tax Elections: Missing beneficial tax election deadlines

- Poor Record Keeping: Inadequate documentation of business decisions

- Registered Agent Lapses: Failing to maintain current registered agent information

- License Oversights: Missing required business licenses or renewals

- Insurance Gaps: Inadequate insurance coverage for business risks

Working with Professional Services

When to Seek Professional Help

Consider professional assistance for:

Formation Services

- Complex Structures: Multiple members, complex ownership arrangements

- Time Constraints: Need rapid formation for business opportunities

- Compliance Assurance: Ensuring all requirements are met correctly

- Ongoing Support: Registered agent and compliance services

Legal Assistance

- Operating Agreements: Complex ownership or management structures

- Contract Review: Important business contracts and agreements

- Compliance Issues: Regulatory compliance in specialized industries

- Dispute Resolution: Business disputes or legal challenges

Accounting and Tax Services

- Tax Planning: Optimizing tax structure and elections

- Bookkeeping: Professional financial record keeping

- Tax Preparation: Business and personal tax return preparation

- Financial Planning: Business financial planning and projections

BusinessAnywhere.io Services

BusinessAnywhere.io specializes in helping digital nomads and remote entrepreneurs establish and maintain their businesses:

Formation Services:

- Complete LLC formation packages

- Professional registered agent services

- Operating Agreement preparation

- EIN application assistance

Ongoing Support:

- Annual compliance monitoring

- Document updates and amendments

- Virtual office and mail services

- Professional business consultation

Frequently Asked Questions (FAQs)

Frequently Asked Questions

How long does it take to form an LLC in Indiana?

Online filing typically takes 1-3 business days for approval, while mail filing takes 7-10 business days. You can expedite the process by filing online and ensuring all information is accurate and complete. After approval, you’ll receive your Certificate of Organization confirming your LLC’s legal existence.

Can I form an Indiana LLC if I live in another state or country?

Yes, you can form an Indiana LLC regardless of where you live. However, you must have a registered agent with an Indiana address. This makes Indiana particularly attractive for digital nomads and remote entrepreneurs who need a stable business base while traveling or living abroad.

What are the ongoing requirements for maintaining an Indiana LLC?

Indiana has minimal ongoing requirements: no annual reports, no franchise taxes, and no annual fees. You must maintain a registered agent with an Indiana address and file tax returns as required. Keep your business records separate, maintain your Operating Agreement, and comply with any industry-specific licensing requirements.

Do I need an EIN for my single-member Indiana LLC?

While not legally required for single-member LLCs, obtaining an EIN is highly recommended. Most banks require an EIN to open business accounts, and having one provides better privacy protection and simplifies future business expansion. The application is free and can be completed online immediately.

Can I change my Indiana LLC’s management structure after formation?

Yes, you can change from member-managed to manager-managed (or vice versa) by filing an Amendment to Articles of Organization with the Indiana Secretary of State. This requires a $30 filing fee and should be accompanied by updates to your Operating Agreement to reflect the new management structure.

What business licenses do I need for my Indiana LLC?

License requirements depend on your business type, location, and industry. Most businesses need a general business license from their city or county. Professional services may require state licensing, while certain industries need federal permits. Research requirements early in your formation process to ensure compliance before starting operations.

How is my Indiana LLC taxed?

By default, single-member LLCs are taxed as sole proprietorships, and multi-member LLCs as partnerships, with income passing through to members’ personal tax returns. You can elect S-Corp or C-Corp tax treatment for potential tax advantages. Indiana has no franchise tax, and you’ll pay Indiana’s 3.23% individual income tax rate on your share of LLC profits.

Conclusion: Launch Your Indiana LLC Today

Starting an LLC in Indiana offers digital entrepreneurs, remote workers, and location-independent business owners an ideal combination of legal protection, tax flexibility, and minimal ongoing requirements. With low formation costs, no annual fees, and business-friendly regulations, Indiana provides an excellent foundation for modern businesses operating in today’s global economy.

Key Takeaways:

- Simple Formation Process: Online filing takes just 1-3 business days with a $100 fee

- Minimal Ongoing Requirements: No annual reports or franchise taxes required

- Tax Flexibility: Choose the most advantageous tax treatment for your situation

- Professional Support: Registered agent services essential for remote entrepreneurs

- Growth-Friendly: Easy to add members, employees, or change structure as you scale

The most successful entrepreneurs act quickly when opportunities arise. With this comprehensive guide, you have everything needed to form your Indiana LLC correctly and efficiently.

Ready to Start Your Indiana LLC?

Don’t let administrative tasks delay your entrepreneurial dreams. BusinessAnywhere.io specializes in helping digital nomads and remote entrepreneurs establish their businesses quickly and correctly.

Our Indiana LLC Formation Package Includes:

- Complete Articles of Organization preparation and filing

- Professional registered agent service (first year included)

- EIN application assistance

- Operating Agreement template

- Ongoing compliance support

- Expert guidance throughout the process

Start Your Indiana LLC Today →

Take the first step toward business ownership and legal protection. Join thousands of successful entrepreneurs who’ve chosen Indiana as their business home base while maintaining the freedom to work from anywhere in the world.

This guide provides general information about Indiana LLC formation and should not be considered legal or tax advice. Consult with qualified professionals for advice specific to your situation. Business laws and requirements may change, so verify current requirements with the Indiana Secretary of State and relevant agencies.

Additional Resources: LLC Formation Guides by State

Looking to compare Indiana with other business-friendly states? Check out our comprehensive LLC formation guides for popular entrepreneur destinations:

Business-Friendly States

- How to Start an LLC in Delaware – Known for strong legal protections and business courts

- How to Start an LLC in Wyoming – Offers excellent privacy protection and low costs

- How to Start an LLC in Texas – No personal income tax and business-friendly environment

Major Market States

- How to Start an LLC in California – Access to major markets and venture capital

- How to Start an LLC in Illinois – Central location and strong economy

- How to Start an LLC in North Carolina – Growing tech hub with business incentives

Growing Entrepreneur Hubs

- How to Start an LLC in Colorado – Thriving startup ecosystem and outdoor lifestyle

- How to Start an LLC in Minnesota – Strong economy and business support resources

Each state offers unique advantages for different types of businesses. Consider factors like taxes, compliance requirements, legal protections, and your target market when choosing where to incorporate.

Need help comparing states or forming your LLC? BusinessAnywhere.io provides expert guidance to help you choose the best state for your specific business needs and handle all the formation paperwork professionally.