Last updated: September 2025 | Verified with current Georgia Secretary of State requirements

Bottom Line Up Front: Georgia offers one of the most cost-effective LLC formation processes in the US. With a $105 total filing fee and 7-day processing, plus $50 annual maintenance, Georgia provides excellent value for entrepreneurs. This guide covers everything you need to successfully form and maintain your Georgia LLC.

Why Choose Georgia for Your LLC in 2025?

Georgia has earned its reputation as a business-friendly state through concrete advantages that benefit entrepreneurs at every stage.

Financial Benefits

Low Formation Costs:

- Articles of Organization: $105 online filing ($100 filing fee + $5 service charge)

- Annual registration: $50 per year (among the lowest in the nation)

- Late filing penalty: Only $25 (very reasonable compared to other states)

Tax Advantages:

- Corporate income tax: 5.19% (reduced from 5.75% in 2024)

- No franchise tax for LLCs

- Flat personal income tax rate: 5.39%

Operational Efficiency

Streamlined Systems:

- Modern online filing through Georgia eCorp portal

- 7-day standard processing for online filings

- Same-day expedited service available ($275 additional fee)

Business Environment: Georgia ranked #4 in CNBC’s Top States for Business 2024, reflecting strong infrastructure, workforce, and regulatory environment supporting business growth.

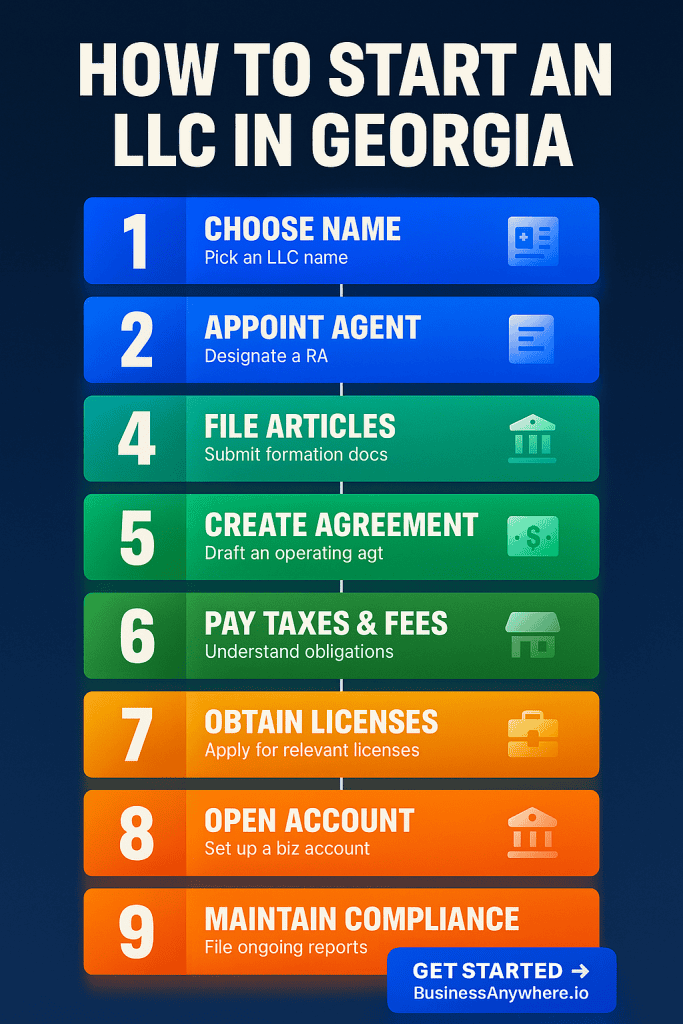

Step 1: Choose and Reserve Your LLC Name

Your LLC name isn’t just branding—it’s a legal requirement with specific Georgia mandates that affect your business operations.

Georgia Name Requirements

Legal Mandates:

- Must end with “Limited Liability Company,” “LLC,” or “L.L.C.”

- Must be distinguishable from existing Georgia entities

- Cannot suggest government affiliation without proper authorization

Name Research Process

Availability Verification:

- Search Georgia’s Business Entity Database for exact matches and similar names (detailed search guide here)

- Check domain availability for .com, .co, and .io extensions

- Search USPTO trademark database for potential conflicts

- Verify social media handle availability across platforms

Strategic Naming Considerations:

- Include relevant keywords for SEO benefits

- Avoid geographic limitations if planning expansion

- Ensure pronunciation clarity for voice search optimization

- Consider international appeal for global business plans

Name Reservation

Georgia allows 30-day name reservations for $25, providing time to complete formation preparations while securing your preferred name.

Pro Tip: Reserve your name if you need time for financing, partnership agreements, or trademark applications.

Step 2: Appoint Your Registered Agent

Georgia law requires every LLC to maintain a registered agent—your business’s official contact point with the state.

Legal Requirements

Registered Agent Obligations:

- Maintain physical Georgia street address (P.O. boxes not acceptable)

- Available during business hours (9 AM – 5 PM, weekdays)

- Receive and forward legal documents, government notices, and service of process

- Maintain current address information with the state

Service Options Comparison

Self-Service Approach:

Advantages:

- No ongoing service fees

- Direct document control

Disadvantages:

- Personal address becomes public record

- Required physical presence during business hours

- Risk of missing critical legal documents

- Privacy and security concerns

Professional Registered Agent Service:

Benefits:

- Privacy protection (your address stays private)

- Guaranteed availability during required hours

- Professional document handling and forwarding

- Compliance deadline tracking and reminders

- Location independence for remote businesses

Investment: Professional services typically cost $100-$300 annually—a small price for privacy protection and compliance assurance.

Choosing Professional Services

Evaluation Criteria:

- Physical presence and reliability in Georgia

- Document scanning and digital delivery capabilities

- Compliance tracking and automated reminders

- Transparent pricing without hidden fees

- Multi-state support for business expansion

Business Anywhere’s registered agent service provides comprehensive Georgia coverage with automated compliance management, ensuring you never miss critical deadlines while maintaining complete privacy.

Step 3: File Your Articles of Organization

The Articles of Organization legally creates your LLC with Georgia’s Secretary of State—essentially your business’s birth certificate.

Required Information

Essential Details for Filing:

- Exact LLC name including required designator

- Registered agent information and signed consent

- Principal business address

- Management structure (member-managed or manager-managed)

- Organizer name and address

- Effective date (immediate or future date up to 90 days)

Filing Process and Options

Online Filing (Recommended):

- Cost: $105 total ($100 filing fee + $5 service charge)

- Processing: 7 business days standard

- File through Georgia eCorp portal

- Immediate confirmation and electronic document delivery

Expedited Service Options:

- 2-day processing: Additional $120

- Same-day processing: Additional $275 (must submit before noon)

- 1-hour processing: Additional $1,200

Mail Filing:

- Cost: $110 ($100 filing fee + $10 service charge)

- Processing: Approximately 15 business days

- Higher risk of delays or document issues

Management Structure Decision

Member-Managed Structure:

- All owners participate in daily business operations

- Suitable for small businesses with hands-on owners

- Simpler decision-making process

- All members can legally bind the LLC

Manager-Managed Structure:

- Designated managers handle day-to-day operations

- Better for businesses with passive investors

- Clear authority delegation and operational control

- Managers may be members or outside parties

Decision Factors: Choose member-managed for simple, owner-operated businesses. Select manager-managed for complex ownership structures or when bringing in passive investors.

Step 4: Create Your Operating Agreement

Though not legally required in Georgia, an Operating Agreement provides essential protection and prevents costly disputes.

Why Operating Agreements Matter

Legal Protection Benefits:

- Reinforces limited liability protection in legal proceedings

- Prevents Georgia’s default LLC statutes from controlling your business

- Provides clear evidence of separate business entity status

- Required by most financial institutions for business banking

Operational Clarity:

- Defines ownership percentages and rights

- Establishes decision-making procedures and voting requirements

- Creates profit and loss distribution methods

- Sets procedures for member admission and departure

Essential Operating Agreement Components

Ownership and Management:

- Member names, addresses, and ownership percentages

- Capital contribution requirements and methods

- Management structure and authority limitations

- Voting procedures for major business decisions

Financial Provisions:

- Profit and loss allocation formulas

- Distribution timing and approval processes

- Additional capital contribution procedures

- Banking authority and financial management rules

Transfer and Succession:

- Membership interest transfer restrictions

- Buy-sell agreement provisions and valuation methods

- Right of first refusal procedures

- Death and disability succession planning

Single-Member LLC Considerations

Even solo entrepreneurs benefit from Operating Agreements:

- Liability reinforcement: Demonstrates legitimate business operations

- Banking requirements: Most banks require Operating Agreements for account opening

- Succession planning: Clear procedures if owner becomes incapacitated

- Future planning: Framework for bringing on partners later

Real Example: A Georgia consultant without an Operating Agreement faced a 6-month delay opening business banking when the bank required additional documentation proving business legitimacy. A simple Operating Agreement would have prevented this costly delay.

Step 5: Obtain Your Federal EIN

An Employer Identification Number (EIN) serves as your business’s Social Security number and is free directly from the IRS.

When You Need an EIN

Required Situations:

- Opening business bank accounts

- Hiring employees or independent contractors

- Filing partnership or corporate tax returns

- Applying for business licenses and permits

- Establishing business credit lines

Free EIN Application Process

Online Application (Fastest):

- Apply free at IRS.gov EIN Application

- Immediate processing during business hours

- Must complete in single session (expires after 15 minutes inactivity)

- Requires SSN or ITIN for responsible party

Alternative Methods:

- Fax Form SS-4: 4 business days processing

- Mail Form SS-4: 4-5 weeks processing

- Phone (international applicants only): 267-941-1099

Application Requirements

Essential Information:

- Legal LLC name exactly as filed with Georgia

- Responsible party’s SSN or ITIN

- Principal business address

- Business formation date

- Primary business activity description

Important Notes:

- Form LLC with Georgia before applying for EIN

- Responsible party’s information permanently links to EIN

- Choose someone who will remain with business long-term

EIN Application Options

Direct Application: Apply free through the IRS.gov official application for immediate processing during business hours.

Professional Assistance: Many business owners prefer professional EIN application services to ensure accuracy and save time during the formation process.

Step 6: Register for Georgia State Taxes

Georgia tax registration depends on your specific business activities and revenue levels.

Sales Tax Registration

When Required:

- Selling tangible goods in Georgia

- Providing certain taxable services

- Meeting economic nexus thresholds: $100,000+ in Georgia sales OR 200+ transactions annually

Registration Process: Apply through Georgia Tax Center to obtain your sales tax permit and account number.

Current Rates:

- State sales tax: 4%

- Local taxes: Vary by municipality (1-5%)

- Combined rates: Typically 5-9% depending on location

Employment Tax Registration

Required When:

- Hiring employees in Georgia

- Paying Georgia residents

- Meeting payroll thresholds

Registration Types:

- Withholding tax for employee income taxes

- Unemployment insurance through Georgia Department of Labor

- Workers’ compensation insurance (required for most employees)

Income Tax Considerations

Default LLC Taxation:

- Single-member LLC: Taxed as sole proprietorship (Schedule C)

- Multi-member LLC: Taxed as partnership (Form 1065)

- Georgia personal income tax: 5.39% flat rate

Optional Tax Elections:

- S Corporation: Potential self-employment tax savings for profitable businesses

- C Corporation: 5.19% corporate income tax rate

Step 7: Open Your Business Bank Account

Separate business banking maintains liability protection and provides professional credibility essential for legitimate business operations.

Required Documentation

Standard Banking Requirements:

- Certified copy of Articles of Organization from Georgia Secretary of State

- EIN confirmation letter from IRS

- Operating Agreement (required by most institutions)

- Valid photo identification for account signatories

- Initial deposit (varies by institution: $25-$500 typical)

Banking Options for Georgia LLCs

Traditional Banks with Georgia Presence:

- Truist: Strong regional presence, competitive business accounts

- Synovus: Southeast focus with local relationship banking

- Wells Fargo, Bank of America, Chase: National banks with comprehensive services

Online Business Banks:

- Mercury: $0 monthly fees, designed for startups and online businesses

- Novo: Free business banking with accounting software integration

- BlueVine: No monthly fees, includes invoicing and payment tools

Essential Banking Features

Must-Have Capabilities:

- Online and mobile banking platforms

- ACH transfers and wire transfer capabilities

- Business debit cards and check writing privileges

- Integration with accounting software (QuickBooks, Xero)

- Multiple user access and permission controls

Growth-Oriented Features:

- Business credit cards and lines of credit

- Merchant services for payment processing

- International wire transfer capabilities

- Cash management and automated savings tools

Pro Tip: For location-independent businesses, choose banks offering extensive ATM networks, mobile check deposit, and international-friendly policies.

Step 8: Secure Required Licenses and Permits

Georgia’s licensing requirements operate at multiple levels: state, county, municipal, and federal.

License Research Strategy

State-Level Requirements:

- Professional services: Check Georgia professional licensing boards

- Industry-specific permits: Food service, construction, healthcare

- Specialized business activities: Alcohol, tobacco, financial services

Local Requirements:

- General business licenses: Apply through county/city offices

- Zoning compliance certificates

- Health department permits (food service businesses)

- Fire department approvals and safety inspections

Federal Requirements:

- Industry-specific regulations: Aviation, broadcasting, transportation

- Environmental permits: EPA compliance for applicable industries

- Import/export licensing: International trade businesses

Common Industry Licensing

Professional Services:

- Legal services: Georgia Bar admission required

- Healthcare providers: Georgia Composite Board licensing

- Real estate agents: Georgia Real Estate Commission license

- CPAs: Georgia State Board of Accountancy certification

Retail and E-commerce:

- Sales tax permit: Register through Georgia Tax Center

- Local business license: Apply through municipal offices

- Consumer protection compliance: FTC guidelines for online businesses

Construction and Contracting:

- Contractor licensing: Georgia Secretary of State regulation

- Trade-specific licenses: Electrical, plumbing, HVAC specialties

- Workers’ compensation insurance: Required for employees

- Bonding requirements: Varies by project size and type

License Planning Tips

Timeline Considerations:

- Research requirements before business launch

- Some professional licenses require 30-90 days processing

- Plan for examination schedules and background checks

- Budget for initial fees and annual renewal costs

Compliance Management:

- Create calendar reminders for renewal deadlines

- Monitor regulatory changes affecting your industry

- Maintain required insurance and continuing education

- Keep documentation organized for renewal applications

Step 9: Maintain Your Georgia LLC for Long-term Success

Proper LLC maintenance preserves liability protection and ensures legal compliance.

Annual Registration Requirement

Filing Details:

- Due date: Between January 1 and April 1 each year

- Cost: $50 annually (exceptionally competitive)

- Late penalty: $25 (reasonable compared to other states)

- Filing location: Georgia eCorp portal

Filing Options:

- One-click registration: If no information changes and current on fees

- Online through eCorp account: Allows updates to business information

- Mail filing: Additional $10 service charge, slower processing

Ongoing Compliance Requirements

Regular Obligations:

- Annual registration filing with Georgia Secretary of State

- Federal and state tax return submissions

- Business license renewals (industry-dependent)

- Registered agent service maintenance

- Corporate record keeping for major business decisions

Documentation Management:

- Maintain meeting minutes for significant decisions

- Keep financial records and bank statements (7+ years recommended)

- Store tax returns and supporting documentation

- Preserve contracts, agreements, and legal correspondence

- Document any changes to membership or management structure

Compliance Calendar

Annual Tasks:

- Georgia annual registration (January 1 – April 1)

- Federal tax return filing (March 15 for partnerships, April 15 for others)

- State tax return submission (April 15)

- Business license renewals (varies by license type)

Quarterly Tasks:

- Sales tax returns (if applicable)

- Estimated tax payments (if required)

- Financial statement review

- Compliance status assessment

Common Georgia LLC Formation Mistakes to Avoid

Using Personal Address for Business Registration

The Problem: Your home address becomes part of public records, creating privacy and security risks while appearing unprofessional to clients and vendors.

The Solution: Use professional registered agent service for legal compliance and virtual mailbox service for business correspondence.

Skipping the Operating Agreement

The Problem: Without clear operating procedures, member disputes become expensive legal battles, and banks often refuse account opening.

The Solution: Create comprehensive Operating Agreement addressing ownership, management, and succession—even for single-member LLCs.

Ignoring Multi-State Tax Obligations

The Problem: Online businesses often trigger sales tax obligations in multiple states through economic nexus rules ($100,000+ sales or 200+ transactions annually).

The Solution: Monitor sales by state and register for sales tax permits before exceeding thresholds.

Mixing Personal and Business Finances

The Problem: Commingled funds can “pierce the corporate veil,” eliminating liability protection and complicating tax preparation.

The Solution: Open dedicated business banking immediately and maintain strict financial separation.

Falling Behind on Compliance

The Problem: Missing annual registrations or tax deadlines leads to penalties, loss of good standing, and potential administrative dissolution.

The Solution: Implement automated compliance tracking or use professional services for deadline management.

Georgia LLC vs. Other Business Structures

LLC vs. Corporation

LLC Advantages:

- Tax flexibility with multiple election options

- Simplified management without board requirements

- Flexible profit distribution regardless of ownership percentages

- Fewer formal compliance requirements

Corporation Benefits:

- Preferred structure for venture capital investment

- Employee stock option capabilities

- Established legal precedents for complex transactions

- Perpetual existence independent of ownership changes

LLC vs. Sole Proprietorship

Protection Comparison:

- LLC: Limited liability protection, separate legal entity status

- Sole Proprietorship: No liability protection, unlimited personal risk

Professional Credibility:

- LLC: Enhanced professional image, easier banking relationships

- Sole Proprietorship: Limited business credibility with vendors and clients

Tax Considerations:

- LLC: Multiple tax election options including S Corporation treatment

- Sole Proprietorship: All income subject to self-employment tax

Professional Formation vs. DIY Approach

DIY Formation Considerations

Benefits:

- Lower upfront costs (only state filing fees)

- Complete control over timing and decisions

- Direct learning experience about business requirements

Potential Challenges:

- Significant time investment (10-20+ hours for research and completion)

- Risk of errors requiring expensive amendment filings

- Ongoing compliance management responsibility

- No professional guidance for complex situations

Professional Service Advantages

Expertise Benefits:

- High first-time approval rates (95%+)

- Experience with Georgia-specific requirements

- Comprehensive compliance tracking systems

- Professional guidance on structure optimization

Efficiency Gains:

- Handle formation while you focus on business development

- Automated reminder systems for ongoing obligations

- Professional document preparation reducing error risk

- Ongoing support for questions and compliance issues

Making the Right Choice

Choose DIY If:

- You have legal or business formation experience

- Your business structure is very simple

- You have time for thorough research and follow-through

- You’re comfortable managing ongoing compliance independently

Choose Professional Services If:

- You want to focus on business development over paperwork

- Your business involves any complexity (multiple members, special requirements)

- You value error prevention and professional guidance

- You need ongoing compliance support and management

Business Anywhere’s formation services combine 20+ years of experience with modern technology, handling all aspects of Georgia LLC formation and ongoing compliance management.

Frequently Asked Questions

How much does it cost to form an LLC in Georgia in 2025?

Required State Costs:

- Articles of Organization: $105 online filing

- Annual registration: $50 per year

Additional Recommended Costs:

- Registered agent service: $100-$300 annually

- Operating Agreement preparation: $300-$1,500

- Business banking setup: $0-$500 initial deposit

Total First-Year Investment: $205-$2,000+ depending on service level and business complexity.

Can foreign nationals start an LLC in Georgia?

Yes, Georgia welcomes international entrepreneurs. Requirements include a registered agent with a Georgia address and obtaining an EIN from the IRS (may require ITIN for non-US persons).

How long does Georgia LLC formation take?

Standard online processing takes 7 business days. Expedited options include 2-day service ($120 extra) and same-day service ($275 extra if submitted before noon).

What are the ongoing obligations for a Georgia LLC?

Annual Requirements:

- Annual registration filing due January 1 – April 1 ($50 fee)

- Federal tax return filing (Form 1040 Schedule C or Form 1065)

- State tax compliance based on business activities

- Business license renewals (industry-dependent)

How are Georgia LLCs taxed?

Default Structure:

- Single-member: Sole proprietorship taxation (profits on personal return)

- Multi-member: Partnership taxation (Form 1065 filing required)

- Georgia personal income tax: 5.39% flat rate on LLC profits

Optional Elections:

- S Corporation: Potential self-employment tax savings for profitable businesses

- C Corporation: 5.19% corporate tax rate on retained earnings

Can I change my LLC name after formation?

Yes, through Articles of Amendment filed with Georgia Secretary of State. Cost is $25 for the amendment filing, plus time to update banking, contracts, and business materials.

What happens if I miss the annual registration deadline?

Georgia charges a reasonable $25 late penalty for annual registrations filed after April 1. Extended non-compliance can lead to administrative dissolution, requiring reinstatement proceedings and additional fees.

Do I need a lawyer to form a Georgia LLC?

No legal requirement exists for attorney involvement. Many entrepreneurs successfully form LLCs independently or through professional formation services like Business Anywhere that provide expert guidance without premium legal fees.

Your Georgia LLC Formation Action Plan

Immediate Actions (This Week)

Name and Structure Planning:

- Research and finalize your LLC name using Georgia’s business search

- Check domain availability and secure .com extension

- Determine management structure (member-managed vs. manager-managed)

- Choose registered agent approach (self-service or professional)

Formation Process (Weeks 2-3)

Official Filing Steps:

- Complete Articles of Organization with accurate information

- File through Georgia eCorp portal with $105 payment

- Monitor processing status and receive confirmation

- Obtain EIN from IRS immediately after LLC approval

Business Setup (Weeks 3-4)

Operational Establishment:

- Draft comprehensive Operating Agreement

- Open business bank account with required documentation

- Register for applicable Georgia taxes through Tax Center

- Apply for required business licenses and permits

- Implement accounting systems and financial management

Ongoing Success Management

Compliance Excellence:

- Set up annual registration reminders for January-April deadline

- Establish quarterly tax review procedures

- Monitor license renewal requirements

- Maintain clean financial records and corporate documentation

Take Action: Start Your Georgia LLC Today

Georgia’s combination of low costs, efficient processing, and business-friendly environment makes it an excellent choice for LLC formation in 2025. The state’s modern online systems and reasonable ongoing requirements provide a solid foundation for business growth.

Ready to begin? Start your Georgia LLC formation with Business Anywhere and benefit from professional expertise, automated compliance management, and comprehensive support designed for modern entrepreneurs.

Need privacy protection? Combine your LLC formation with professional registered agent service and virtual mailbox solutions to maintain privacy while building professional credibility.

Want ongoing support? Business Anywhere’s integrated platform provides formation services, compliance management, and business tools in one comprehensive solution—helping you focus on growing your business rather than managing paperwork.

Related Georgia Business Resources

- How to Start an LLC in Florida: Complete Guide

- Professional Registered Agent Services: What to Expect

- Virtual Mailbox for Business: Complete Guide

This guide reflects current Georgia LLC requirements as of September 2025. Business formation involves legal and tax considerations that may vary based on your specific situation. Consider consulting qualified legal and tax professionals for personalized advice regarding your business formation and ongoing compliance needs.

Related Posts

- How to Start an LLC in Alabama: A Straightforward Guide for New Business Owners

- How to Start an LLC in Arkansas: Simple Steps to Get Your Business Registered

- How to Start an LLC in Delaware in 2025

- How to Start an LLC in Florida (The Right Way)

- How to Start an LLC in Kentucky: What You Need to Know to Launch Legally

- How to Start an LLC in Louisiana: The Simplified Filing and Tax Guide

- How to Start an LLC in Mississippi: Easy Filing Process for First-Time Founders

- How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

- How to Start an LLC in North Carolina: Step-by-Step Guide

- How to Start an LLC in South Carolina: Your Complete Startup Checklist

- How to Start an LLC in Tennessee: The No-Fluff Business Formation Guide

- How to Start an LLC in Texas: A No-Nonsense Guide for 2025

- How to Start a Wyoming LLC in 2025