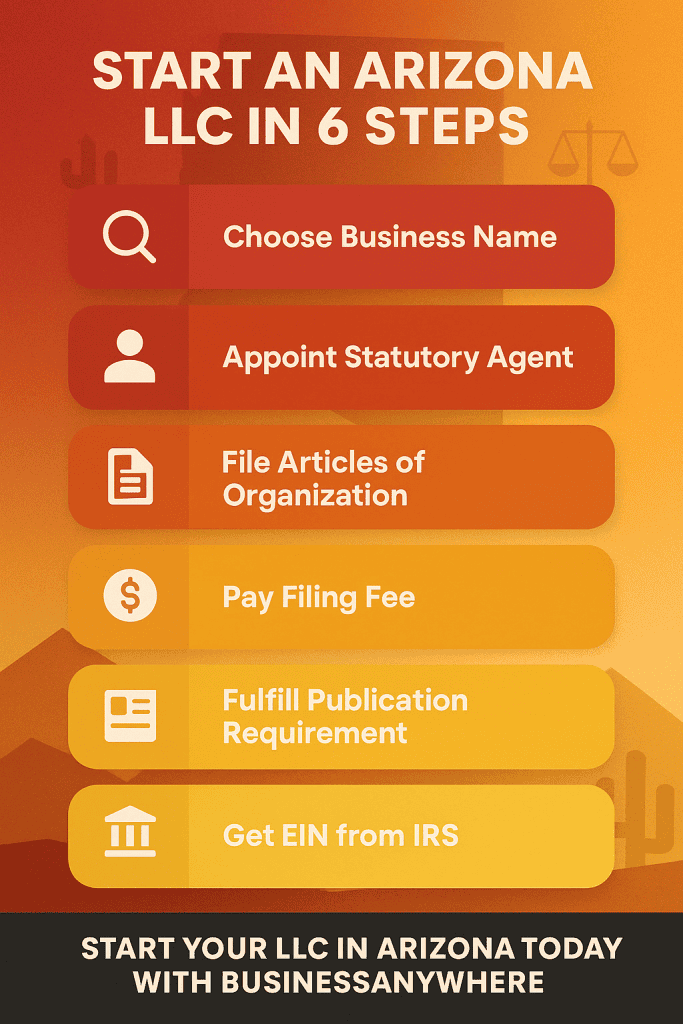

Starting an LLC in Arizona is straightforward, but there’s one unique requirement you need to watch out for: the publication rule. Here’s what you need to know:

- Key Steps to Form an LLC in Arizona:

- Pick a unique LLC name that meets state guidelines.

- Select a statutory agent with a physical Arizona address.

- File your Articles of Organization with the Arizona Corporation Commission (ACC).

- Pay the filing fee (starts at $50, with expedited options available).

- Meet the publication requirement (if your county requires it).

- Get an EIN from the IRS for taxes and banking.

- File a BOI Report with FinCEN (new as of 2024).

- Publication Requirement:

- Within 60 days of forming your LLC, publish a notice in a state-approved newspaper (if required by your county).

- This step can cost extra, and missing it may lead to compliance issues.

- Unique Advantages of Arizona LLCs:

- No annual reports required.

- Affordable filing fees.

- Flexible management structures.

Quick Tip: Avoid common mistakes like missing the publication deadline, choosing the wrong statutory agent, or skipping necessary business licenses.

Follow these steps to set up your LLC and stay compliant in Arizona.

Basic LLC Requirements in Arizona

Before setting up your Arizona LLC, it’s crucial to understand the specific requirements and guidelines.

What Sets an Arizona LLC Apart

Arizona has some distinct features that make it stand out:

- No annual reports: Unlike many states, Arizona LLCs are not required to file yearly reports.

- Publication requirement: You must notify locals about your LLC formation through an approved newspaper.

- Flexible management options: Choose between member-managed or manager-managed structures without extra fees.

- Affordable filing fees: Initial costs are lower compared to many other states.

Role of the Arizona Corporation Commission

The Arizona Corporation Commission (ACC) handles several key aspects of LLC formation, including:

- Reserving and registering business names

- Processing Articles of Organization

- Recording statutory agent appointments

- Managing the publication requirement

- Ensuring compliance with state regulations

The ACC offers an online system that simplifies these tasks, making the formation process more efficient.

Pre-Formation Checklist

Knowing the regulatory details ahead of time can help you gather everything needed for a smooth LLC setup.

| Requirement | Description | Notes |

|---|---|---|

| Physical Address | Must provide a valid Arizona street address | Address must be verifiable |

| Statutory Agent | An individual or company based in Arizona | Must be available during business hours |

| Business Name | A unique name ending in “LLC” or similar | Check availability through the ACC |

| Initial Members | At least one member is required | Can be an individual or an entity |

| Formation Budget | Filing fee: Around $50 (excludes publication costs) | Additional fees may apply |

Key Documentation to Prepare

Here are the essential documents and details you’ll need:

- Government-Issued ID

Required for verifying your identity during the filing process. - Business Information

Collect the following details:- Principal business address

- Member or manager information

- Business purpose

- Initial capital

- Payment Method

The ACC accepts credit cards for online filings, while checks or money orders can be used for mail-in applications. Keep in mind that publication costs are separate from state filing fees.

With these items in hand, you’re ready to proceed with the step-by-step process of forming your LLC.

7 Steps to Form an Arizona LLC

Here’s a clear breakdown of how to form your Arizona LLC, from picking a name to completing all necessary filings. Let’s dive in.

1. Pick Your LLC Name

Choosing the right name is a crucial first step. Your LLC name must:

- Include “LLC”, “L.L.C.”, “Limited Liability Company”, or “Limited Company.”

- Avoid terms like “Corporation”, “Corp.”, or “Inc.”

- Be unique within Arizona.

- Not suggest government ties or professional services unless properly licensed.

Tip: Before finalizing your name, check its availability in trademark databases and on social media to ensure it’s free for broader use.

2. Select a Statutory Agent

Your statutory agent is responsible for receiving legal documents on behalf of your LLC. Here’s what you need to know:

- The agent must be at least 18 years old if an individual.

- They must have a physical address in Arizona (P.O. boxes aren’t allowed).

- They need to be available during regular business hours.

- You can act as your own agent, designate another LLC member, or hire a professional service.

3. Submit Articles of Organization

Next, file your Articles of Organization with the Arizona Corporation Commission. You’ll need to provide:

- Your LLC’s name and address.

- Information about your statutory agent.

- Details on whether the LLC is member-managed or manager-managed.

- Names and addresses of members or managers.

- The purpose of your business.

- Whether the LLC is perpetual or has a set end date.

4. Submit Filing Fees

Here’s what you’ll pay to file your LLC, depending on the processing speed you choose:

| Service | Cost | Processing Time |

|---|---|---|

| Standard Filing | $50 | 10-15 business days |

| Expedited Filing | $85 | 2-3 business days |

| Same-Day Filing | $185 | Same business day |

5. Create an Operating Agreement

While Arizona doesn’t require an Operating Agreement, it’s a smart move to have one. This document helps:

- Define ownership percentages.

- Outline how the LLC is managed.

- Set rules for profit distribution.

- Clarify member responsibilities.

- Plan for succession or other major changes.

6. Get Your EIN

An Employer Identification Number (EIN) is essential for handling taxes and banking. You can get it for free on the IRS website in about 15 minutes. With your EIN, you can:

- Open business bank accounts.

- Hire employees.

- File federal taxes.

- Apply for necessary business licenses.

7. File BOI Report

Starting January 1, 2024, most LLCs must file a Beneficial Ownership Information (BOI) report with FinCEN. The report includes:

- Details about your LLC’s owners.

- Information on who controls the company.

- Filing deadline: Within 30 days of forming your LLC. (No filing fee applies.)

Important: Failing to file the BOI report could result in penalties of up to $500 per day and even criminal charges.

Final Checklist

Keep copies of all your filing documents, including your Articles of Organization approval and publication affidavit. These will be essential for tasks like opening bank accounts or securing loans.

Need assistance? Start Your Arizona LLC Now {.cta-button}

Publication Requirements for Arizona LLCs

Once you’ve started forming your LLC in Arizona, there’s an additional compliance step you might need to complete: meeting the state’s publication requirement. Whether this applies to you depends on the county where your statutory agent is located.

Publication Rules and Timelines

First, check if your statutory agent’s county requires publication. If it does, you’ll need to publish a notice of your LLC’s formation. This notice must include all required details about your LLC and appear in an approved newspaper for the specified number of times. Be sure to budget for publication costs, as they can vary depending on the newspaper.

County Publication Requirements

Not all counties in Arizona require this step. It all depends on where your LLC’s statutory agent is located. Confirm your county’s specific rules to see if publication is necessary for your business. Once confirmed, you can move forward with the process.

Steps to Publish Your Notice

- Choose an Approved Newspaper

Select a newspaper that circulates in the county where your statutory agent operates. It must meet Arizona’s standards for approved publications. - Draft Your Notice

Ensure your notice includes all the legally required details about your LLC. - Submit and Confirm

Work with the newspaper to submit your notice, verify the publication schedule, and obtain confirmation.

Obtaining Your Publication Affidavit

After your notice has been published, you’ll need to get an affidavit as proof of compliance. Request the affidavit of publication from the newspaper and keep the original with your LLC records. It’s also a good idea to make digital copies for safekeeping. This affidavit serves as official evidence that you’ve met Arizona’s publication requirement.

Skip the publication hassle – let us handle your Arizona LLC formation

sbb-itb-ba0a4be

5 Common LLC Formation Mistakes

When setting up an LLC in Arizona, avoiding these mistakes can save you time, money, and frustration:

Missing the Publication Deadline

Arizona requires LLCs to publish a notice of formation within 60 days. Missing this deadline won’t immediately dissolve your LLC, but it can lead to:

- Limited access to business banking services

- Difficulty securing contracts

- Legal validity concerns

- Extra compliance fees

Tip: Set a reminder around the 30-day mark to ensure you complete the publication process on time.

Choosing the Wrong Statutory Agent

Your statutory agent plays a key role in maintaining your LLC’s compliance. Common errors include:

- Picking someone without regular business hours or a stable address

- Choosing an unreliable person or entity

- Using a P.O. box or other non-compliant address

If your statutory agent misses legal notices, you could face default judgments or missed deadlines.

Filing Errors

The Arizona Corporation Commission frequently rejects LLC applications for these reasons:

- Incomplete member or manager details

- Missing signatures

- Incorrect statutory agent information

- Using an ineligible business name

- Skipping the name availability check

Carefully review all forms before submitting them to avoid delays in the formation process.

Not Keeping Publication Records

Keep both digital and physical copies of the following:

- Publication affidavit

- Published notices

- Payment receipts

- Confirmation of publication dates

These documents are essential for proving compliance during legal or business-related situations.

Forgetting Business Licenses

An LLC alone doesn’t cover all your legal requirements. Depending on your business, you may need:

- City business licenses

- Industry-specific permits

- Professional certifications

- Sales tax licenses (Transaction Privilege Tax)

- Federal permits

Tip: Check with your local Chamber of Commerce for a complete list of required licenses based on your business type.

By steering clear of these mistakes, you’ll set your LLC up for success. Next, let’s look at tools and resources to simplify the formation process.

Let us take care of your Arizona LLC formation

Tools and Support

Here’s a breakdown of resources to help you set up and manage your Arizona LLC while staying compliant.

Government Forms and Links

ACC eCorp Portal: https://ecorp.azcc.gov

- Submit Articles of Organization online

- Check if your desired business name is available

- Access forms for statutory agents

- Download publication templates

Arizona Department of Revenue: https://azdor.gov/business

- Register for Transaction Privilege Tax (TPT)

- Access tax-related forms and guides

- Stay updated on filing deadlines

Tip: Save these links for quick access during your LLC formation and compliance tasks.

These official tools are essential for smooth filings and keeping your business aligned with state requirements.

Business Anywhere Services

Formation Services

- Assistance with filing Articles of Organization

- Publication requirement management

- Help creating an Operating Agreement

- Support for obtaining your EIN

Ongoing Support

- Statutory agent services with instant notifications

- Digital tools for document storage and management

- Alerts and reminders for compliance deadlines

- Virtual mailbox for receiving business mail

Take advantage of these services to simplify your LLC management and stay organized.

Additional LLC Resources

Document Templates

- Sample Operating Agreements

- Member resolution forms

- Templates for meeting minutes

- Formats for publication notices

Compliance Tools

- Annual report reminder services

- Tax deadline tracking calendar

- Tools for license renewal management

- Guides for BOI reporting

Store all your formation documents, affidavits, and compliance records in a secure digital system for easy, on-demand access.

Get Your Personalized Compliance Calendar

FAQ

Here are answers to common questions about forming an Arizona LLC and meeting publication requirements.

Publication Rules by County

Q: Which counties in Arizona require LLC publication?

A: Arizona law mandates publishing a notice of LLC formation in a newspaper that circulates in the county where your statutory agent’s main office is located. Make sure the newspaper complies with state rules.

LLC Formation Timeline

Q: How long does it take to form an Arizona LLC?

A: Filing times can differ, but you must publish your LLC notice within 60 days of formation.

Missed Publication Consequences

Q: What are the consequences of missing the publication deadline?

A: If you miss the deadline, your LLC’s powers may be suspended.

Next Steps

Set your business up for success by tackling these key steps after forming your LLC.

Organize with a Management System

Stay on top of essential business tasks by tracking:

- Publication deadlines and affidavits

- Annual report filings

- Tax schedules

- Business license renewals

- Document storage and organization

Smooth Business Operations

Keep your LLC running efficiently by:

- Securing both digital and physical records

- Setting up automated reminders for important deadlines

- Systematically tracking all business transactions

- Monitoring compliance requirements

- Keeping statutory agent details up to date

Leverage Digital Tools

Simplify your processes with platforms that offer:

- Registered agent services

- Virtual mailbox options

- Online document management

- Compliance alerts

- Digital record storage

Compliance Checklist

| Timeframe | Action Item | Notes |

|---|---|---|

| First 60 days | Complete publication requirement | Applies in most counties |

| Immediately | Obtain necessary business licenses | Varies by industry and location |

| Within 90 days | Apply for EIN if needed | Required for hiring employees |

| Ongoing | Maintain statutory agent | Ensure contact info is always current |

| Annual | Review operating agreement | Update as needed |

Stay up to date with the Arizona Corporation Commission to ensure your business details are accurate. By using the right tools, you can manage your LLC effortlessly and dedicate more time to growing your business.

Streamline Your Arizona LLC Management Today