Dissolving an LLC in California involves several legal and financial steps to avoid penalties and ongoing obligations. Here’s a quick summary of what you need to do:

- Why It’s Important: Avoid $800 annual franchise tax, penalties, and personal liability.

- Steps to Dissolve:

- Get member approval to dissolve (majority or unanimous vote).

- Notify creditors and settle all debts.

- File required forms: Certificate of Dissolution (Form LLC-3) and/or Certificate of Cancellation (Form LLC-4/7).

- Submit final tax returns to the California Franchise Tax Board.

- Cancel business licenses and close accounts.

- Key Deadlines: File dissolution forms within 12 months of your final tax return.

- Short Form Option: If your LLC is less than 12 months old and hasn’t done business, you can file a simpler Short Form Cancellation Certificate (Form LLC-4/8).

Quick Tip: California charges no filing fees, but the process can take 3–4 weeks. Missing steps can lead to penalties, so follow the process carefully.

For a detailed walkthrough of each step, keep reading.

California LLC Dissolution Requirements

California’s Revised Uniform Limited Liability Company Act (RULLCA) lays out the legal steps for dissolving an LLC, including notifying creditors, settling debts, filing necessary paperwork, and distributing assets. Understanding these steps is essential to avoid errors and ensure compliance with state laws.

There are two main ways to dissolve an LLC in California: voluntary dissolution and involuntary dissolution. Each process follows different rules and leads to distinct outcomes. Knowing which path applies to your situation is key to navigating the process effectively. Let’s break down the steps for both options to help you determine the right course of action.

Voluntary vs. Involuntary Dissolution

Voluntary dissolution happens when LLC members decide to close the business. This can occur for various reasons, such as achieving the LLC’s original goals, retirement, shifting to new opportunities, or financial challenges that make continuing operations impractical. In this case, members maintain control over the timing and process, ensuring a smoother wind-down.

Involuntary dissolution, on the other hand, is initiated by external forces, such as a court order or state actions. Common triggers include failing to file required reports, unpaid taxes or fees, legal disputes, or fraudulent activities. Creditors, shareholders, or government agencies often drive this process.

Here’s a quick comparison of the two:

| Feature | Voluntary Dissolution | Involuntary Dissolution |

|---|---|---|

| Initiation | LLC Members | Court or State |

| Control | Members | Third Party |

| Reasons | Achieving purpose, retirement, financial challenges | Noncompliance, disputes, fraud |

| Process | Member vote, filing paperwork, settling debts | Notice of issues, chance to resolve, potential receiver appointment |

| Consequences | Controlled wind-down, fewer penalties | Higher legal and financial risks, possible lawsuits |

While voluntary dissolution allows for a structured and member-driven process, involuntary dissolution can lead to more serious financial and legal repercussions. For example, the Secretary of State may issue a notice of dissolution, giving the LLC an opportunity to fix the problem. If unresolved, the state could appoint a receiver to oversee the closure.

Why Compliance Matters During Dissolution

Meeting California’s dissolution requirements is critical to protecting yourself from ongoing obligations and personal liability. Failing to follow the proper steps can expose LLC members to personal financial risk, as creditors might pursue personal assets to settle unpaid debts.

Additionally, neglecting to file final tax returns or obtain tax clearance from the California Franchise Tax Board can result in fines, penalties, and accumulating interest. Until the dissolution is officially completed, the LLC remains responsible for the $800 annual franchise tax and may need to continue filing annual reports.

California law also requires notifying known creditors by mail. Skipping this step could leave you open to future claims and complicate the process of fully closing your business relationships. If your LLC’s operating agreement doesn’t outline a dissolution procedure, the default rules under RULLCA will apply, making it even more important to review your organizational documents thoroughly.

Preparing Your LLC for Dissolution

Before filing dissolution paperwork, it’s essential to handle internal procedures and settle all outstanding obligations. These steps ensure your LLC meets legal requirements and shields its members from potential future liabilities.

Getting Member Approval and Reviewing Documents

The first step in dissolving your California LLC is securing member approval through a formal vote. Start by reviewing your articles of organization and operating agreement, as these documents typically outline the rules for dissolution. For instance, your operating agreement might specify the percentage of members required for approval – such as two-thirds voting in favor. If the documents don’t address dissolution, California law states that a majority vote (at least 50% of voting interests) is sufficient.

Once the rules are clear, hold a meeting as outlined in your operating agreement, secure the necessary vote, and document the resolution. If all members unanimously agree, you may skip filing a Certificate of Dissolution and simply note this decision on the Certificate of Cancellation.

After documenting member approval, the next step is addressing financial obligations.

Settling Debts and Closing Business Accounts

California law mandates that all debts be resolved before distributing any remaining assets to members. Start by notifying creditors and claimants in writing. Then, pay off or otherwise address all outstanding liabilities, including taxes. It’s important to note that no state allows an LLC to complete its termination without settling its tax obligations first.

When closing your business bank accounts, follow these steps:

- Ensure all payments have cleared.

- Cancel any direct debits.

- Submit a formal closure request signed by authorized personnel.

- Transfer remaining funds, if necessary.

Check your account agreements for any required notice periods or fees, and gather key documents like proof of your business name and address, incorporation details, and the formal closure request. If you need temporary banking services, set up a new account and move all funds there before closing the old one.

Additionally, cancel any business licenses, permits, or registrations, and resolve any remaining contracts. Keep critical business records – such as tax filings, contracts, and employment documents – for at least seven years. Close or transfer linked accounts, including merchant services, credit lines, or loans, and notify vendors, clients, and other relevant parties about the dissolution. Be cautious about leaving dormant accounts open, as they can lead to security risks or incur inactivity fees.

Filing Required Dissolution Documents

Once internal matters are settled, the next step is to file the necessary dissolution paperwork with the California Secretary of State. The specific forms you’ll need depend on your LLC’s situation and how the decision to dissolve was made.

Certificate of Dissolution and Certificate of Cancellation

For most LLCs, two documents are essential: the Certificate of Dissolution (Form LLC-3) and the Certificate of Cancellation (Form LLC-4/7). However, if all members unanimously agree to dissolve the LLC, you only need to file the Certificate of Cancellation.

When completing Form LLC-4/7, you’ll need to provide key details, including the contact information of the person submitting the form, the LLC’s legal name, file number, and principal office address. If unanimous consent was reached, make sure to check the corresponding box on the form. An authorized member or manager must also sign the document.

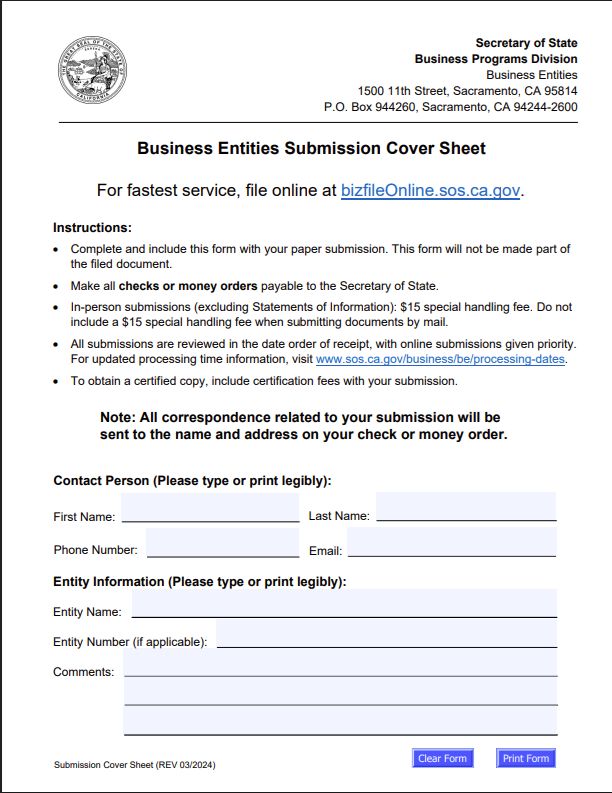

There’s no filing fee for this process. You can submit the Certificate of Cancellation by mail, in person, by fax, or online through the Secretary of State’s bizfile Online system. Standard processing typically takes 3–4 weeks, though expedited processing is available for fees ranging from $15 to $750. For online submissions, visit the Secretary of State’s website, search for your LLC by name, select "File Amendment", and choose "Terminate – CA and Out-of-State LLC." Complete the required sections to finalize the process.

If mailing is your preferred option, print and sign the form along with a Submission Cover Sheet. Send the documents to:

California Secretary of State,

Business Programs Division – Business Entities,

PO Box 944260,

Sacramento, CA 94244-2600.

For LLCs formed within the past year with limited activity, a simpler process is available, as explained below.

Short Form Cancellation for New LLCs

California provides a streamlined option for LLCs that were formed within the last 12 months, have no debts aside from state taxes, and have not conducted any business. In this case, you can file a Short Form Cancellation Certificate (Form LLC-4/8). This process requires less documentation and is often quicker. Like the standard dissolution forms, there’s no filing fee, and the short form can also be submitted online.

To complete the dissolution, you’ll need to file your LLC’s final tax returns with the California Franchise Tax Board at the same time you submit your dissolution documents.

sbb-itb-ba0a4be

Final Steps After Filing Dissolution

Once the California Secretary of State processes your dissolution documents, there are still a few crucial steps to fully close your LLC and avoid future liabilities. These steps are essential to wrap up your business properly and ensure you meet all remaining obligations.

Distributing Remaining Assets

After your dissolution is approved, the next step is to distribute your LLC’s remaining assets. Here’s the order to follow:

- Pay off all creditors completely.

- Refund members their original capital contributions.

- Distribute any leftover assets based on ownership percentages.

Your operating agreement should outline how these distributions are handled. If you don’t have an operating agreement or it doesn’t cover asset distribution, California’s Revised Uniform Limited Liability Company Act (RULLCA) provides default rules.

Make sure to document every distribution thoroughly. Record details like the type of asset, its fair market value, who received it, and the date of transfer. This paperwork can protect you from future claims. Under California law, members could still face claims against the dissolved LLC, but only up to the value of the assets they received.

If you’re unsure about any part of this process, consult a legal professional to ensure everything is done correctly and to minimize potential liabilities. Once the assets are distributed, you can move on to completing your final tax and regulatory obligations.

Final Tax Returns and Agency Notifications

After distributing assets, the next step is to finalize your tax filings and notify the necessary agencies. Filing a final tax return with the California Franchise Tax Board is a required part of closing your LLC. Be sure to check the "Final Return" box on the first page of your return and write "final" at the top.

The type of tax return you file depends on how your LLC is classified for federal tax purposes:

- Partnerships: File Form 1065 and check the "Final Return" box.

- Corporations: File Form 1120 (C corporations) or Form 1120-S (S corporations), marking it as a final return.

- Single-member LLCs: File Schedule C with your personal tax return.

Timing is critical here. You must file your dissolution documents with the Secretary of State within 12 months of submitting your final tax return. Additionally, your LLC must stop all business activities in California after its final taxable year. Keep in mind, the $800 minimum franchise tax may still apply for the year in which you dissolve your LLC.

Don’t forget to file your federal tax return and close your business tax account. This includes making all final employee tax deposits, if applicable.

You’ll also need to cancel any business licenses, permits, and fictitious business name registrations. Contact the agencies that issued these documents to settle any outstanding fees and complete the cancellation process. If you filed a fictitious business name statement, cancel it with your county clerk’s office.

The California Franchise Tax Board requires all delinquent tax returns to be filed and any outstanding tax balances – along with penalties, fees, and interest – to be paid before your dissolution is finalized. Even after filing your final tax return, it may still be audited until the statute of limitations expires.

Lastly, keep all business records, even after your LLC is dissolved. These records may be needed for tax audits, legal matters, or other issues that could arise later.

How BusinessAnywhere Can Help with Dissolution

Dissolving an LLC in California involves juggling a lot of moving parts – documents, deadlines, and compliance requirements. BusinessAnywhere steps in to simplify the process with tools and support designed to help you close your LLC while staying on top of state regulations.

Document Management and Compliance Alerts

Handling dissolution paperwork, final tax filings, and asset distribution can quickly become overwhelming. BusinessAnywhere makes it easier with a centralized document management dashboard. This feature keeps all your dissolution-related documents in one secure place, so you can track what’s been completed and what still needs attention.

The platform also includes compliance alerts to ensure you never miss critical filing deadlines. From initial filings to meeting final compliance requirements, their team offers support at every stage. Whether you need help with standard forms or custom paperwork like Operating Agreements or Banking Resolutions, BusinessAnywhere has you covered. These tools are designed to make every step of the dissolution process as smooth as possible.

In addition to keeping your paperwork in order, BusinessAnywhere helps you stay connected with essential state communications.

Registered Agent and Mail Services

Having your documents organized is one thing, but staying on top of important legal notices is just as crucial. BusinessAnywhere’s registered agent services act as your official point of contact, ensuring you promptly receive legal notices, tax documents, and other critical correspondence on behalf of your LLC.

Their virtual mailbox service adds another layer of convenience. It provides unlimited scanning and secure storage for your business mail, giving you instant access to important notices. Need mail forwarded? BusinessAnywhere can handle that too. Plus, the platform keeps your registered agent information up-to-date with state records and simplifies access to confirmation notices and follow-ups.

Together, these services allow you to manage the entire dissolution process remotely, making it not only easier but far less stressful.

Conclusion

Closing an LLC in California requires careful attention to state regulations. You’ll need to follow specific steps, including getting approval from LLC members, settling debts, filing a Certificate of Dissolution and Certificate of Cancellation with the Secretary of State, and submitting your final tax returns. Missing any of these can lead to ongoing tax obligations, penalties, or even personal liability.

Financial obligations also continue until the dissolution is finalized. For instance, California LLCs are required to pay an $800 annual tax until the process is complete, with penalties stacking up for missed filings. While the state doesn’t charge a fee for filing dissolution paperwork, the process can take around 3 to 4 weeks to be processed by the Secretary of State. Juggling deadlines, legal requirements, and paperwork can quickly become overwhelming if you’re handling it all on your own.

That’s where BusinessAnywhere can step in to make things easier. With its secure document dashboard, compliance alerts, and registered agent services, BusinessAnywhere ensures you stay on top of everything. Plus, its virtual mailbox lets you manage the entire process remotely, giving you peace of mind that all correspondence and legal notices are handled properly.

FAQs

What happens if you don’t properly dissolve an LLC in California?

If you don’t properly dissolve an LLC in California, you could end up dealing with some serious legal and financial headaches. For one, unresolved debts or obligations might leave LLC members personally on the hook, especially if creditors aren’t notified or claims are left hanging. On top of that, the California Secretary of State could forfeit your business, leading to penalties and the loss of your ability to operate in the state.

And don’t forget about taxes. Until your LLC is officially dissolved, you’re still on the hook for annual fees like the $800 minimum franchise tax. Skipping these steps could also expose you to lawsuits or additional penalties. Taking the time to dissolve your LLC the right way is crucial to steering clear of future troubles.

What’s the difference between voluntary and involuntary dissolution of an LLC in California?

When an LLC decides to close its doors willingly, it’s called voluntary dissolution. This process is initiated by the members themselves and usually starts with a formal vote to dissolve the business. From there, the LLC must file a Certificate of Dissolution with the state, settle any outstanding debts, and distribute any remaining assets among the members.

Involuntary dissolution, however, is a different story. This happens due to external factors, such as failing to meet state regulations, legal actions, or court or government orders. Unlike voluntary dissolution, this process often involves administrative penalties or legal proceedings, making it more complicated and less within the LLC’s control.

What should I do if my LLC’s operating agreement doesn’t include instructions for dissolution in California?

If your LLC’s operating agreement doesn’t specify how to dissolve the business, you’ll need to follow the default legal steps set by California. First, hold a vote among the LLC members to approve the decision to dissolve. Once everyone agrees, file the required paperwork with the California Secretary of State. This is usually the Certificate of Dissolution (Form LLC-3), or a simpler form if all members give unanimous consent.

After filing, notify creditors, settle any outstanding debts, and distribute any remaining assets to the members. Make sure to adhere to California’s legal guidelines to wrap up the process correctly and completely.