[4 Minute Read]

This article will guide you through the world of complicated business structures like a C corporation, an S Corporation, and a Limited Liability Company (LLC).

Keep reading to find out what a C Corporation is, how it differs from an LLC, and how to form a C Corporation.

What Is a Business Structure?

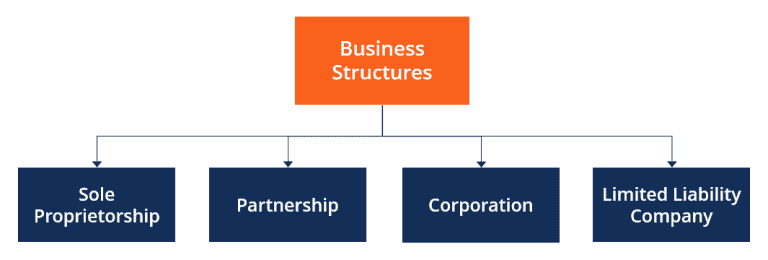

Good question! To put it simply, a business structure is what will determine how your business pays tax, what kind of things it can do, and how it is seen by the state.

There are a few different types of business structures to choose from. This is because businesses vary. It would be impossible for every business to fit under the same structure without someone losing out.

How to Choose a Business Structure

If you’re looking into business structures, it’s probably because you want to incorporate your business.

Choosing the right business structure is like setting the right foundation for your business.

The best way to choose your business structure is to think about where your business is right now, and which structure will offer you the best protection, best tax rates, and least amount of paperwork.

If you start small, you might be able to change your business structure at a later point when your business expands and requires it.

What is a C-Corporation Business Structure?

Let’s start off by saying that, in general, the ‘Corporation’ business structure has three options. The C Corporation, S Corporation, B Corporation, and a Corporation – Non-profit.

These define the way the corporation is taxed.

How Does a Corporation Differ from Other Structures?

Corporations are different because they follow a specific structure that includes the management, the board, and shareholders. Corporations allow for outside investors, stock trading, and the sale of the business.

A corporation becomes a legal entity that is separate from the owners. It’s all down to who owns how many shares. But the shares can be sold, passed on, etc. This means that if the corporation is sued for money, for example, the owners aren’t liable to pay. The corporation is. This is what’s known as limited liability.

As a separate legal entity, the corporation can also own property, enter into contracts, and has to pay tax.

A corporation must follow specific rules set out by the government to maintain its corporate status. The requirements are annual meetings for shareholders and directors, keeping official records of major decisions, separate bank accounts, and in-depth financial records.

How Is a C Corporation Taxed?

A C Corporation follows the regular corporation tax route. This means that it has to file a Form 1120 annually to report its income. This income is then taxed. The tax thresholds for corporations are not adjusted for inflation, like personal income thresholds. They will only change if Congress passes corporate tax legislation that sets these changes.

Currently, there is a flat-rate corporate income tax of 21%. Corporations also pay state tax on top, depending on the state of incorporation.

Double Taxation With C Corporations

When the corporation makes profits, it distributes the profit as dividends to the shareholders. The shareholders might also get paid a salary through the corporation. What this means is that the profits of the corporation are double taxed. Once at the corporation level, and once at the individual shareholder level.

So, if you register your business as a C corporation, the profits your business makes will be taxed twice.

How to Form a C Corporation

Forming a C Corporation involves a few additional steps, in comparison to an LLC for example. You wanna get these right to avoid penalties and complications later down the line.

Step 1: Choose a State for Incorporation

You already know that each state has its own rules and regulations with regard to pretty much everything. So, it makes sense that they all differ hugely in terms of tax rates.

Choosing the right state for incorporation can save you a nice chunk of money.

Some states, for example, Washington, Nevada, Ohio, and Texas don’t have a corporate income tax. Most states average at around 5%, but there are some that go up to almost 10%.

Now, if you are tied to a state with an already existing office or warehouse, then you have to incorporate over there. If, however, you don’t have nexus in any state, you can choose anyone you like.

If you need help choosing the right state, the right business structure, and with incorporation; let us take the headache out of it. We’re specialists in remote company formation.

Click here to find out more.

Step 2: Choose a Business Name

Each state has similar rules when it comes to naming a corporation. These usually relate to avoiding misleading names that make it sound like your business is a governmental body or a bank.

Step 3: Appoint the Directors

Get your formalities in order before filing your articles of incorporation.

Step 4: File the Articles of Incorporation

This is one of the more complicated steps. Each state has different procedures and filing charges. So make sure to take your time with this step.

If you’re worried about making mistakes, try our remote company formation service. All you have to do is fill out a simple form, and we’ll incorporate it on your behalf. Taking care of all the formalities.

Step 5: Register For an Employer Identification Number (EIN)

This is the tax identification number for your corporation. It’s important when filing tax returns but also you’ll need it to open a bank account for your business.

C Corporation vs. S Corporation

By now, you should have a good understanding of what a C Corporation is. What you might be wondering is how is a C Corporation different from an S Corporation.

An S Corporation is a common business structure in the USA. It solves the double taxation problem, as it utilizes the ‘pass-through’ taxation system. However, there are eligibility criteria for obtaining this status, and not all businesses are able to.

If however, your business qualifies to obtain the S Corporation tax status, the profits and some of the losses, can pass through directly to the owners. This means that the profits are never taxed at the corporate income tax level, just at the personal tax level.

An S Corporation differs slightly in terms of ownership restrictions. An S Corporation is limited to 100 shareholders and they all must be U.S. citizens. This doesn’t apply to a C Corporation, it can have an unlimited number of shareholders and they don’t all have to be U.S. citizens.

In order for your S Corporation to have the S Corporation tax status, you have to file separately with the IRS. As mentioned above, you’ll have to meet specific requirements.

C Corporation vs. Limited Liability Company

Now that you understand what the C and the S Corporations are, the only thing you’re missing is a comparison between the two and an LLC.

An LLC is a slightly different business structure.

First of all, it’s much less complicated.

An LLC doesn’t require regular meetings and as much in-depth paperwork. It doesn’t allow you to sell stock. It doesn’t allow you to buy, sell, or transfer shares either.

You can own an LLC with other people, and they don’t have to be U.S. citizens, nor do you. The catch is that if you or one of the other shareholders die, the LLC will dissolve.

When you incorporate an LLC, the filing fees will be much lower than those of a corporation. And when it comes to tax; well, you choose.

You can choose how you’d like your LLC to be taxed. You can either go down the personal income tax route, where all of the profits are taxed at your personal income tax level. Or, you can go down the corporation tax route. It’s up to you.

In that sense, an LLC is much easier and much more suitable for smaller businesses that aren’t raising capital. The good thing about an LLC is that most states allow you to convert an LLC into a corporation. So, you can start small, and as the need arises you can change your structure.

Form Your Business Today

Incorporation is important. It’ll govern how much tax you pay and what you can do. Get it right the first time. Hire experts.

We’re the leader in company formation for U.S. citizens and non-resident aliens.

Get advice on the right state and the right company structure. Get your business incorporated in just a few days, without having to leave your house or stay on the line for hours.