Starting an Amazon FBA business without the right business structure is like building a house without a foundation. With over 9.7 million sellers on Amazon worldwide and third-party sellers accounting for 60% of all Amazon sales, choosing the correct business entity can make the difference between scaling successfully and facing costly legal or tax complications down the road.

This comprehensive guide will walk you through every Amazon business structure option available to digital entrepreneurs, location-independent sellers, and small business owners looking to build a legitimate, profitable Amazon business from anywhere in the world.

Why Your Amazon Business Structure Matters More Than Ever

The e-commerce landscape has evolved dramatically since Amazon’s early days. Today’s successful Amazon sellers operate professional businesses that require proper legal protection, tax optimization, and credibility with suppliers and customers alike.

Your business structure affects everything from your personal liability protection to tax obligations, supplier relationships, and even customer trust. A poorly chosen structure can cost you thousands in unnecessary taxes, expose you to personal lawsuits, or limit your growth potential as you scale your Amazon operations.

The Hidden Costs of Wrong Business Structure Choices

Many new Amazon sellers make critical mistakes when selecting their business structure:

- Personal liability exposure: Operating as a sole proprietor leaves your personal assets vulnerable to business lawsuits

- Tax inefficiency: Some structures result in double taxation or higher personal income tax rates

- Limited credibility: Suppliers and customers often view unincorporated businesses as less professional

- Growth restrictions: Certain structures make it difficult to bring in partners or investors later

- Banking complications: Many business banking products require formal business registration

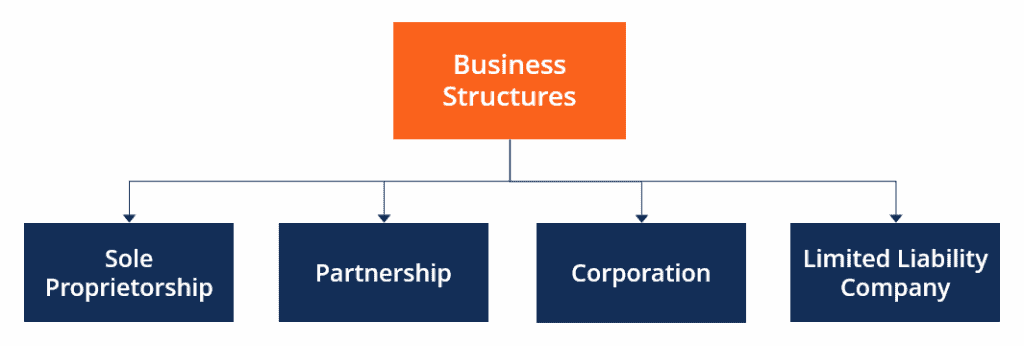

The 3 Primary Amazon Business Structure Options (Detailed Analysis)

Option 1: Sole Proprietorship – The Starting Point for Many

A sole proprietorship is the simplest business structure where you operate your Amazon business under your own name or a registered trade name (DBA – “Doing Business As”). This structure is automatically created when you start selling on Amazon without forming a separate legal entity.

Advantages of Sole Proprietorship for Amazon Sellers:

Simplicity and Speed

- No formal registration required in most jurisdictions

- Minimal paperwork and ongoing compliance requirements

- Direct control over all business decisions

- Easy to dissolve if you decide to exit Amazon selling

Cost-Effective Setup

- No state filing fees for basic sole proprietorship

- Lower accounting and legal costs

- Simplified tax preparation (Schedule C on personal return)

Banking Flexibility

- Can use personal bank accounts (though not recommended)

- Easier to get started without business banking requirements

Disadvantages and Risk Factors:

Unlimited Personal Liability This is the most significant drawback. As a sole proprietor, you are personally liable for:

- Product liability claims from customers

- Supplier disputes and unpaid invoices

- Employment issues if you hire staff

- Any business debts or legal judgments

Tax Disadvantages

- All business income is subject to both income tax and self-employment tax (15.3%)

- No separation between business and personal income

- Limited tax deduction opportunities

- Potential for higher overall tax rates as income grows

Professional Credibility Issues

- Suppliers may view sole proprietors as less established

- More difficult to negotiate favorable payment terms

- Customers may perceive sole proprietorships as less trustworthy

- Harder to build business credit separate from personal credit

Growth Limitations

- Cannot easily bring in partners or investors

- Difficult to transfer ownership

- Limited options for business succession planning

Option 2: Limited Liability Company (LLC) – The Sweet Spot for Most Amazon Sellers

The Limited Liability Company (LLC) has become the preferred business structure for Amazon FBA sellers, and for good reason. It combines the simplicity of a sole proprietorship with the legal protections of a corporation.

Why LLCs Are Perfect for Amazon Businesses:

Asset Protection Benefits An LLC creates a legal barrier between your personal assets and business liabilities. This means:

- Your personal home, cars, and savings are protected from business lawsuits

- Product liability claims are limited to business assets

- Supplier disputes cannot reach your personal accounts

- Greater peace of mind when scaling your operations

Tax Flexibility and Optimization LLCs offer several tax advantages:

- Pass-through taxation: Profits and losses flow through to your personal tax return, avoiding double taxation

- State tax benefits: You can form an LLC in tax-friendly states like Delaware, Wyoming, or Nevada

- Deduction opportunities: Enhanced ability to deduct business expenses

- Election flexibility: Can elect to be taxed as an S-Corp for additional savings

Enhanced Business Credibility

- Suppliers take LLC-registered businesses more seriously

- Better negotiating position for wholesale pricing

- Improved customer trust and confidence

- Professional appearance on Amazon listings and marketing materials

Operational Advantages

- Easy to add partners or investors

- Flexible management structure

- Separate business credit profile

- Professional banking relationships

Step-by-Step LLC Formation Process for Amazon Sellers:

- Choose Your State of Formation

- Consider tax implications, annual fees, and privacy laws

- Popular choices: Delaware (business-friendly), Wyoming (privacy), your home state (simplicity)

- Select Your LLC Name

- Must include “LLC” or “Limited Liability Company”

- Check availability with your chosen state

- Consider trademark implications for your Amazon brand

- File Articles of Organization

- Submit required paperwork to your state’s Secretary of State

- Pay filing fees (typically $50-$500 depending on state)

- Processing time varies from same-day to several weeks

- Obtain Your EIN (Employer Identification Number)

- Free application directly with the IRS

- Required for business banking and tax purposes

- Takes 1-2 weeks if filing by mail, immediate if online

- Create an Operating Agreement

- Not required in all states but highly recommended

- Defines ownership percentages and management structure

- Protects your limited liability status

- Open Business Bank Accounts

- Essential for maintaining LLC liability protection

- Keep business and personal finances completely separate

- Choose banks familiar with e-commerce businesses

LLC Tax Strategies for Amazon Sellers:

Single-Member LLC Tax Treatment

- Default taxation as a “disregarded entity”

- All income and expenses reported on Schedule C of personal return

- Subject to self-employment tax on profits

Multi-Member LLC Considerations

- Taxed as a partnership by default

- Each member receives a K-1 showing their share of profits/losses

- More complex tax preparation requirements

S-Corp Election Strategy For profitable Amazon businesses, electing S-Corp taxation can provide significant tax savings:

- Pay yourself a reasonable salary (subject to payroll taxes)

- Additional profits are distributed as dividends (not subject to self-employment tax)

- Potential savings of thousands in self-employment taxes annually

Option 3: Corporation (C-Corp or S-Corp) – For Serious Scaling

Corporations offer the highest level of formality and structure, making them suitable for Amazon businesses planning significant growth, multiple business lines, or external investment.

C-Corporation Characteristics:

Maximum Liability Protection

- Strongest legal barrier between personal and business assets

- Well-established legal precedent for liability protection

- Additional protection through business insurance and proper corporate formalities

Tax Considerations

- Subject to corporate income tax on profits

- Potential double taxation when profits are distributed as dividends

- Access to additional business deductions and benefits

- Ability to retain earnings in the business at lower tax rates

Growth and Investment Benefits

- Easy to raise capital through stock sales

- Attractive to investors and venture capital

- Clear ownership structure through stock certificates

- Perpetual existence regardless of owner changes

S-Corporation Alternative:

S-Corporations combine corporate liability protection with pass-through taxation:

- No corporate-level income tax

- Profits and losses pass through to shareholders

- Limited to 100 shareholders (all must be U.S. citizens/residents)

- Only one class of stock allowed

- Excellent option for profitable Amazon businesses with U.S. owners

International Considerations for Global Amazon Sellers

U.S. Business Structures for International Sellers

Many international entrepreneurs choose to form U.S. business entities to sell on Amazon.com, taking advantage of:

- Access to the world’s largest e-commerce market

- Established legal and banking systems

- Tax treaty benefits in some cases

- Enhanced credibility with suppliers and customers

Key Requirements for International Sellers:

Tax Obligations

- U.S. business entities are subject to U.S. tax rules

- May need to file U.S. tax returns even if no U.S. source income

- Consider tax treaty benefits between your country and the U.S.

- Consult with international tax professionals

Banking and Financial Requirements

- Many U.S. banks require physical presence for account opening

- Online banking options available for international LLC owners

- Consider U.S. address requirements for banking and legal purposes

Selling on International Amazon Marketplaces

If you’re targeting multiple Amazon marketplaces (UK, Germany, Japan, etc.), consider:

- Local business registration requirements

- VAT registration obligations in the EU

- Import/export compliance issues

- Currency exchange and international banking

Tax Optimization Strategies by Business Structure

Sole Proprietorship Tax Planning

While sole proprietorships offer limited tax benefits, you can still optimize:

- Quarterly estimated payments: Avoid underpayment penalties

- Home office deduction: If you work from home

- Vehicle expenses: For business-related driving

- Equipment depreciation: For computers, packaging equipment, etc.

LLC Tax Optimization Techniques

Business Expense Maximization

- Office supplies and equipment

- Professional development and training

- Business travel and meals

- Software subscriptions and tools

- Packaging and shipping supplies

Retirement Plan Contributions

- SEP-IRA: Contribute up to 25% of net self-employment income

- Solo 401(k): Higher contribution limits for business owners

- Traditional vs. Roth considerations

State Tax Planning

- Form LLC in states with no income tax

- Consider sales tax nexus implications

- Understand state-specific deduction rules

Advanced Corporate Tax Strategies

Timing of Income and Expenses

- Accelerate deductible expenses into current year

- Defer income to lower-tax years when possible

- Strategic equipment purchases for depreciation benefits

Employee Benefits

- Health insurance deductions

- Retirement plan contributions

- Other fringe benefits available to corporate structures

Building Supplier Relationships with Professional Business Structure

Your business structure significantly impacts your relationships with suppliers and manufacturers. Here’s how to leverage your entity choice for better supplier terms:

Why Suppliers Prefer Working with LLCs and Corporations

Perceived Stability and Professionalism

- Formal business registration indicates serious commitment

- Legal entity structure suggests long-term business viability

- Professional appearance in all communications and documentation

Risk Management for Suppliers

- Easier to enforce contracts with formal business entities

- Clear legal recourse if payment disputes arise

- Better credit reporting and tracking capabilities

Negotiating Better Terms with Your Business Structure

Credit Terms and Payment Flexibility

- Established businesses can often negotiate 30-60 day payment terms

- Lower minimum order quantities for professional entities

- Access to business credit lines for inventory financing

Pricing Advantages

- Volume discounts more readily available to registered businesses

- Better wholesale pricing tiers

- Exclusive product lines often reserved for established companies

Communication and Support Benefits

- Dedicated account managers for business customers

- Priority customer service and support

- Access to new product launches and market insights

Amazon-Specific Considerations for Business Structure

Account Registration and Verification

Professional Seller Account Requirements

- Business registration documents often required for approval

- Enhanced verification processes for unregistered sellers

- Faster account approval with proper business documentation

Brand Registry Benefits

- Amazon Brand Registry strongly favors registered businesses

- Trademark protection easier with formal business entity

- Enhanced brand protection tools and resources

Amazon Policy Compliance

Terms of Service Advantages

- Registered businesses have clearer paths for policy appeals

- Account suspension risks may be lower for professional entities

- Better communication channels with Amazon support

International Expansion

- Easier to expand to other Amazon marketplaces with proper business structure

- Simplified tax compliance across multiple countries

- Enhanced credibility with international suppliers

Step-by-Step Action Plan: Choosing and Setting Up Your Amazon Business Structure

Phase 1: Assessment and Planning (Week 1)

Evaluate Your Current Situation

- Calculate your projected annual Amazon revenue

- Assess your personal risk tolerance

- Consider your long-term business goals

- Evaluate your tax situation and state of residence

Research Requirements

- Review your state’s business registration requirements

- Understand tax implications of each structure type

- Research costs associated with setup and maintenance

- Consider any industry-specific regulations

Phase 2: Structure Selection and Setup (Weeks 2-4)

For LLC Formation:

- Choose your state of formation

- Select and verify your business name

- File Articles of Organization

- Obtain EIN from the IRS

- Draft Operating Agreement

- Open business bank accounts

For Corporation Formation:

- Choose between C-Corp and S-Corp election

- File Articles of Incorporation

- Create corporate bylaws

- Issue stock certificates

- Hold initial board meeting

- Obtain necessary licenses and permits

Phase 3: Implementation and Compliance (Week 5+)

Business Operations Setup

- Update Amazon seller account with business information

- Establish business credit with suppliers

- Implement proper bookkeeping systems

- Set up business insurance coverage

- Create business bank account systems

Ongoing Compliance

- File required annual reports with your state

- Maintain proper corporate formalities

- Keep business and personal finances separate

- Document all major business decisions

Common Mistakes to Avoid When Choosing Your Amazon Business Structure

Mistake #1: Waiting Too Long to Formalize

Many Amazon sellers operate as sole proprietors for too long, missing out on:

- Liability protection during critical growth phases

- Tax savings opportunities

- Enhanced supplier relationships

- Professional credibility with customers

Solution: Form your business entity as soon as you’re generating consistent revenue or have significant inventory investments.

Mistake #2: Choosing Based on Cost Alone

While LLCs and corporations have setup costs, the long-term benefits far outweigh the initial investment:

- Legal protection is worth far more than filing fees

- Tax savings can pay for formation costs many times over

- Professional relationships improve business profitability

Solution: Consider the total cost of ownership, including potential liability exposure and tax implications.

Mistake #3: Ignoring State-Specific Advantages

Not all states are created equal for business formation:

- Delaware offers business-friendly courts and laws

- Wyoming provides enhanced privacy protection

- Some states offer significant tax advantages

Solution: Research and compare states based on your specific needs and circumstances.

Mistake #4: Failing to Maintain Business Formalities

Proper business structure only provides protection if you maintain it correctly:

- Keep business and personal finances separate

- Document major business decisions

- File required reports and pay fees on time

- Follow your Operating Agreement or corporate bylaws

Solution: Set up systems and reminders to maintain compliance from day one.

Frequently Asked Questions (FAQ)

What’s the best business structure for a new Amazon FBA seller?

For most new Amazon FBA sellers, an LLC provides the optimal balance of protection, simplicity, and tax benefits. It offers personal liability protection, professional credibility with suppliers, and flexible tax treatment while being relatively simple to set up and maintain. Sole proprietorships expose you to personal liability, while corporations may be unnecessarily complex for beginning sellers. Learn more about LLC benefits for Amazon sellers.

Can I change my business structure later as my Amazon business grows?

Yes, you can convert from one business structure to another, but it may involve tax implications and administrative complexity. For example, you can convert a sole proprietorship to an LLC, or an LLC to a corporation. However, it’s generally easier and more cost-effective to choose the right structure from the beginning rather than converting later.

Do I need a business structure if I’m just testing products on Amazon?

Even if you’re in the testing phase, having a business structure provides valuable protection. Product liability issues can arise even with small-scale selling, and having an LLC protects your personal assets. Additionally, suppliers often provide better pricing and terms to registered businesses, even for small initial orders.

What state should I form my LLC in if I’m selling on Amazon?

The best state depends on your specific situation. If you live in a state with no income tax (like Texas or Florida), forming there might be simplest. For enhanced privacy, Wyoming is excellent. For business-friendly laws and courts, Delaware is popular. Consider factors like annual fees, tax implications, privacy laws, and your physical location when deciding.

How much does it cost to set up and maintain different business structures?

Costs vary by state and structure type:

- Sole Proprietorship: $0-100 for DBA registration

- LLC: $50-500 state filing fee plus $100-800 annually for registered agent and annual reports

- Corporation: $100-300 filing fee plus $200-1,000 annually for compliance and reports

While LLCs and corporations have ongoing costs, the liability protection and tax benefits typically provide excellent return on investment.

Can international sellers form U.S. business entities for Amazon?

Yes, international sellers can form U.S. LLCs and corporations to sell on Amazon.com. This is common practice and provides access to the large U.S. market. However, you’ll need to comply with U.S. tax obligations and may need assistance with banking and address requirements. Consider consulting with professionals familiar with international business formation.

Will having an LLC help me get better wholesale prices from suppliers?

Yes, suppliers typically offer better pricing and terms to registered businesses because:

- LLCs appear more established and professional

- There’s better legal recourse if payment issues arise

- Registered businesses can more easily establish business credit

- Suppliers view LLCs as more likely to be long-term partners

Many suppliers have separate pricing tiers for businesses vs. individual buyers, with registered entities getting access to better wholesale pricing.

Taking Action: Your Next Steps to Amazon Business Success

Choosing the right business structure is one of the most important decisions you’ll make as an Amazon seller. The structure you select today will impact your legal protection, tax obligations, supplier relationships, and growth potential for years to come.

Based on the analysis in this guide, here are your recommended next steps:

For New Amazon Sellers

- Start with an LLC: Unless you have specific reasons to choose otherwise, an LLC provides the best combination of protection and simplicity for most Amazon sellers

- Choose your formation state carefully: Consider tax implications, privacy needs, and annual costs

- Set up proper business banking: Keep your business and personal finances completely separate from day one

For Existing Sole Proprietor Sellers

- Evaluate your liability exposure: If you have significant inventory, revenue, or assets to protect, converting to an LLC should be a priority

- Calculate potential tax savings: Work with a tax professional to understand how an LLC or S-Corp election might reduce your tax burden

- Consider your supplier relationships: Formalizing your business structure can open doors to better wholesale pricing and terms

For Growing Amazon Businesses

- Review your current structure’s limitations: As you scale, ensure your business structure supports your growth plans

- Consider S-Corp election: If your LLC is generating significant profits, electing S-Corp taxation could provide substantial tax savings

- Plan for future needs: Think about bringing in partners, investors, or preparing for eventual sale of your business

The Amazon marketplace continues to evolve, with increasing competition and professionalization. Sellers with proper business structures, professional operations, and strategic planning will be best positioned to succeed in this dynamic environment.

Don’t let an improper business structure limit your Amazon business potential. Take action today to establish the legal foundation that will support your growth, protect your assets, and maximize your profitability as you build your location-independent Amazon empire.

Ready to get started? Contact BusinessAnywhere.io to discuss your specific situation and get professional assistance with forming the right business structure for your Amazon success. Our team specializes in helping digital nomads and location-independent entrepreneurs build proper business foundations that support their global lifestyle and business goals.

This guide provides general information about business structures for educational purposes. Always consult with qualified legal and tax professionals before making business structure decisions, as individual circumstances vary and laws change frequently.