Connecticut entrepreneurs and business professionals need accurate information about existing business entities before registering a new company. For this, conducting a Connecticut Business Entity Search is vital. The Connecticut Secretary of State’s Business Registry maintains official records of all registered businesses in the state. This comprehensive guide will walk you through exactly how to use the Connecticut Business Registry Search Tool, interpret results, and take the next steps for your business.

What is the Connecticut Business Registry Search?

The Connecticut Secretary of State’s “Business Registry Search” is the official database where all registered business entities in Connecticut are recorded. This online portal allows you to search for:

- Existing business names

- Business details and status

- Filing history

- Registered agent information

- Principal member details

- Annual report status

Why is this important? Before establishing your LLC, corporation, or other business entity in Connecticut, you must verify your desired business name is available and not already in use by another registered business.

How to Access the Connecticut Business Registry Search Portal

The official Connecticut Business Registry Search is maintained by the Connecticut Secretary of State’s office and can be found at:

Connecticut Business Registry Search Portal

The search portal is completely free to use and requires no login or registration to perform basic searches.

Connecticut Business Entity Search: Step-by-Step Guide

Let’s walk through exactly how to perform a business entity search in Connecticut, using the official portal:

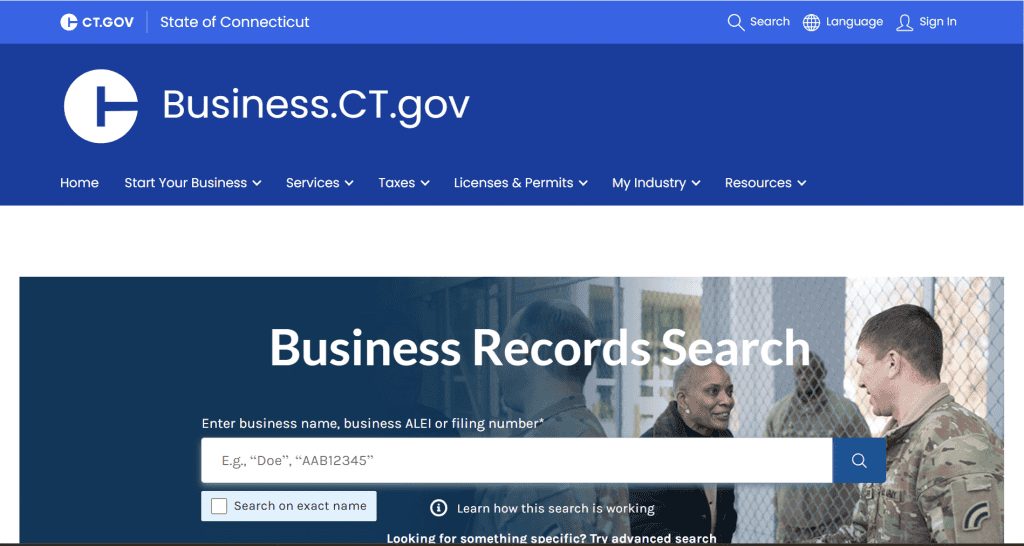

Step 1: Navigate to the Connecticut Business Registry Search Portal

Visit the Connecticut Business Registry Search website. You’ll see a clean interface with a prominent search bar at the top.

Step 2: Enter Your Search Terms

In the main search field, you can enter any of the following:

- Business name (full or partial)

- Business ALEI (Business ID number)

- Filing number

Pro Tip: When searching for business names, you don’t need to include designators like “LLC,” “Inc.,” or “Corporation” to get accurate results.

Step 3: Use Advanced Search Options (If Needed)

For more targeted results, click the “Advanced Search” button, which reveals additional search parameters:

- Business name

- Business address

- Business ALEI

- Filing number

- Principal name (owner/member)

- Agent name (registered agent)

- Business city

Unique Connecticut Feature: Unlike many states, Connecticut allows you to search by principal member name, which can be helpful if you’re trying to find all businesses associated with a particular individual.

Step 4: Review Search Results

After submitting your search, you’ll see a list of matching business entities. Each listing displays:

- Business name

- Business address

- Principal name

- Registered agent name

- Business status (Active, Dissolved, Forfeited, or Withdrawn)

The results can be sorted by:

- Business name (alphabetical)

- Business ALEI (numerical)

- ZIP code (geographical)

Step 5: Access Detailed Business Information

Click anywhere within a business listing box to view comprehensive details about the selected entity. The detailed view includes:

Business Overview:

- Full legal business name

- Current status (Active, Dissolved, etc.)

- Citizenship/place of formation

- Physical business address

- Annual report due date

- NAICS code and sub-code

- Business ALEI (unique identifier)

- Formation date

- Business type (LLC, Corporation, etc.)

- Mailing address

- Last report filed date

Principal Members Section:

- Names of all principals/members

- Titles/positions

- Business addresses

- Residence addresses (when available)

Filing History Section:

- Chronological list of all filings

- Download options for filed documents

- Filing dates and types

Additional Sections:

- Name history (if the business has changed names)

- Share information (for corporations)

Sample Connecticut Business Entity Search (Simulated Example)

Let’s walk through a simulated search to demonstrate how the Connecticut Business Registry works in practice:

- I enter “Coastal Solutions” in the main search field

- After clicking search, I receive 7 results containing those words

- The results page shows:

- Coastal Solutions LLC (Active) – Stamford

- Coastal Property Solutions Inc. (Active) – Greenwich

- Connecticut Coastal Solutions Group LLC (Active) – New Haven

- Coastal Home Solutions LLC (Dissolved) – Bridgeport

- Coastal Business Solutions Corporation (Forfeited) – Hartford

- Eastern Coastal Solutions LLC (Active) – Mystic

- Coastal Environmental Solutions Inc. (Active) – Norwalk

- I click on “Coastal Solutions LLC” and see it was formed in 2018, has an active status, and is due to file its annual report next month.

- The principal members section shows John Doe as Managing Member with a Stamford business address.

- The filing history shows regular annual report filings and an amendment from 2020 when they changed their registered agent.

What This Means: If I wanted to use “Coastal Solutions” for my business, I would need to choose a different name or add distinctive words to make it unique from existing entities.

Understanding Connecticut Business Status Labels

When reviewing search results, you’ll encounter several status labels. Here’s what each means:

Active: The business is in good standing with the Connecticut Secretary of State and has filed all required reports and fees.

Dissolved: The business has formally ended its existence, either voluntarily through proper dissolution filing or involuntarily due to failure to comply with state requirements.

Forfeited: The business has failed to maintain good standing (typically by not filing annual reports or paying required fees) and has lost its right to conduct business in Connecticut.

Withdrawn: Applies to foreign entities (businesses formed outside Connecticut) that have formally withdrawn their registration to do business in Connecticut.

Cancelled: The business registration was cancelled, often before the business began operations.

What to Do After Your Connecticut Business Entity Search

Once you’ve completed your business entity search, here are the logical next steps:

If Your Desired Business Name is Available:

- Reserve the Name (Optional): Connecticut allows you to reserve a business name for 120 days for a $60 fee. This gives you time to prepare formation documents without worrying about someone else registering the name. Reserve a Business Name in Connecticut

- Check Domain Availability: Before finalizing your business name, verify that suitable domain names are available. A consistent online presence is crucial for modern businesses.

- Form Your Business Entity: Ready to register? Connecticut offers several business structures:

- Limited Liability Company (LLC): $120 filing fee

- Corporation: $250 filing fee

- Limited Partnership: $120 filing fee

- Sole Proprietorship: No state filing required, but may need local permits

- Obtain an EIN: After registration, obtain a federal Employer Identification Number (EIN) from the IRS.

- Register for State Taxes: Register with the Connecticut Department of Revenue Services for applicable state taxes.

If Your Desired Business Name is Already Taken:

- Modify Your Business Name: Add distinctive words or phrases to differentiate your business.

- Check Trademark Status: Even if the exact name is available in Connecticut, check the USPTO trademark database to ensure it’s not federally trademarked.

- Consider a DBA: You can register a “Doing Business As” (DBA) name in Connecticut at the local level, which allows you to operate under a different name than your legal business name.

Connecticut Business Entity Search: FAQs

How much does it cost to search for a business entity in Connecticut?

Answer: The Connecticut Business Registry Search is completely free to use. There is no fee for searching the database or viewing business details. The state only charges fees when you take action like reserving a name or filing formation documents.

How long does a business name reservation last in Connecticut?

Answer: Connecticut allows you to reserve a business name for 120 days for a $60 fee. This is particularly useful if you’ve found an available name but aren’t quite ready to file your formation documents. The reservation prevents others from registering the same name during this period.

Can I see the actual documents filed by a business in Connecticut?

Answer: Yes. Connecticut’s Business Registry allows you to view and download most documents filed by businesses, including Articles of Organization/Incorporation, Annual Reports, and Amendments. Standard business document copies cost $40, while certified copies cost $50. Some documents are available for immediate download after payment.

What if the Connecticut business name I want is slightly different from an existing one?

Answer: Connecticut law prohibits business names that are “deceptively similar” to existing entities. The Secretary of State’s office has discretion in determining what qualifies as too similar. Generally, simply adding “The” or changing “LLC” to “Inc.” will not be sufficient differentiation. Adding distinctive words or completely changing parts of the name is recommended.

How often do Connecticut businesses need to file reports?

Answer: Connecticut requires Annual Reports from all domestic and foreign business entities. LLCs and corporations must file these reports yearly, due by the end of the anniversary month of the business’s formation. The filing fee is $80 for LLCs and $150 for corporations. Failure to file annual reports can result in a business being administratively dissolved.

Does Connecticut require businesses to have a registered agent?

Answer: Yes. All formal business entities in Connecticut must maintain a registered agent with a physical address in Connecticut. The registered agent is responsible for receiving legal documents, service of process, and official government communications on behalf of your business. You can serve as your own registered agent if you have a physical address in Connecticut, or you can hire a registered agent service.

Advanced Connecticut Business Search Tips

Searching by Industry

Connecticut assigns NAICS (North American Industry Classification System) codes to registered businesses. While you can’t search directly by these codes in the public portal, the detailed business information displays these codes, which can help you identify competitors or potential partners in your industry.

Finding Dissolved Businesses

If you’re researching business history or trying to determine if a previously existing company is truly gone, make sure to check the “Include Inactive Businesses” option in your search. This will show businesses that have been dissolved, forfeited, or withdrawn.

Business Name Considerations Unique to Connecticut

Connecticut has some specific rules regarding business names:

- Names must contain a proper designator (LLC, Inc., Corporation, etc.)

- Names cannot imply a different business structure than what is being registered

- Names cannot contain words like “Bank,” “Insurance,” or “Trust” without special approval

- Professional service businesses must include “Professional” in their name or the designation “P.C.” or “P.L.L.C.”

Connecticut Secretary of State Contact Information

If you encounter issues with the business search portal or have questions about business registration, contact the Connecticut Secretary of State’s office:

- Phone: (860) 509-6002

- Email: [email protected]

- Office Hours: Monday-Friday, 8:30 AM – 4:30 PM EST

- Mailing Address: Commercial Recording Division, P.O. Box 150470, Hartford, CT 06115-0470

Starting Your Connecticut Business: Next Steps

After confirming your business name availability, you’re ready to move forward with establishing your Connecticut business. Here are the essential next steps:

- Choose a Business Structure: Learn about Connecticut business structures and select the one that best fits your needs.

- Register Your Business: Use BusinessAnywhere’s registration service to easily register your new entity while only paying state fees.

- Get Your EIN: Every business needs an Employer Identification Number for tax purposes, even if you don’t have employees.

- Open a Business Bank Account: Separate your personal and business finances with a dedicated business account.

- Obtain Required Licenses and Permits: Depending on your industry and location, you may need specific licenses to operate legally in Connecticut.

Why Connecticut is a Good State for Business in 2025

Connecticut offers several advantages for entrepreneurs:

- Strategic Location: Positioned between Boston and New York City with access to major markets

- Educated Workforce: Home to Yale University and other prestigious educational institutions

- Business Support Programs: The state offers various incentives and programs for small businesses

- Quality of Life: Consistently ranked high for livability and education

With a mid-tier GDP of approximately $350 billion, Connecticut provides a balance of established economic stability and room for growth, especially in technology, manufacturing, and professional services sectors.

Additional BusinessAnywhere Resources

Business Entity Search Guides for Other States

Looking to expand your business beyond Connecticut or comparing different states? Check out our comprehensive guides for conducting business entity searches in other states:

- How to Do a New York Business Entity Search

- How to Do a Texas Business Entity Search

- How to Do a California Business Entity Search

- How to Do a Florida Business Entity Search

- How to Do a Pennsylvania Business Entity Search

LLC Formation Resources

Ready to form your LLC? These resources will guide you through the process:

- How to Get an LLC and Start a Limited Liability Company

- How to Start an LLC in California

- How to Start an LLC in Texas

- How to Start an LLC in Illinois

- Can I Start a Business Without an LLC?

Business Address and Privacy Resources

These additional resources will help you manage your Connecticut business address and privacy needs:

- Registered Agent Services

- Virtual Mailbox Services

- How to Register an LLC Without Using Your Home Address

- Is a Registered Agent the Same as a Virtual Office?

- How to Set Up an LLC With a Virtual Office

Conclusion

Conducting a thorough Connecticut business entity search is an essential first step in your entrepreneurial journey. By following this guide, you can confidently navigate the Connecticut Business Registry, understand what the results mean, and take appropriate next steps whether your desired name is available or not.

Remember that business name availability can change daily as new entities are registered, so it’s best to conduct your search shortly before you plan to register. Once you’ve confirmed availability, don’t delay in taking action to secure your business name.

Ready to start your Connecticut business? Register with BusinessAnywhere today for hassle-free business formation with the support of experienced professionals.