Delaware is renowned as a business-friendly state, with more than 1.1 million business entities calling it their legal home. Whether you’re planning to form a new business entity in Delaware or need information about an existing one, conducting a proper business entity search is a crucial first step. This comprehensive guide will walk you through the entire process of using the Delaware Division of Corporations’ search portal, understanding search results, and taking appropriate next steps.

What is the Delaware Division of Corporations Business Entity Search Tool?

The Delaware Division of Corporations maintains the official database of all registered business entities in the state. Their Entity Search Tool provides real-time access to critical information about businesses registered in Delaware, including corporations, LLCs, limited partnerships, and other entity types.

The search portal is maintained by the Delaware Secretary of State’s Division of Corporations and serves as the authoritative source for entity information in the state. The tool is especially valuable considering that Delaware is home to more than 55% of all U.S. publicly-traded companies and 65% of the Fortune 500 companies.

Step-by-Step Guide to the Delaware Business Entity Search

Let’s walk through exactly how to use the Delaware Division of Corporations Entity Search Tool:

Step 1: Access the Official Portal

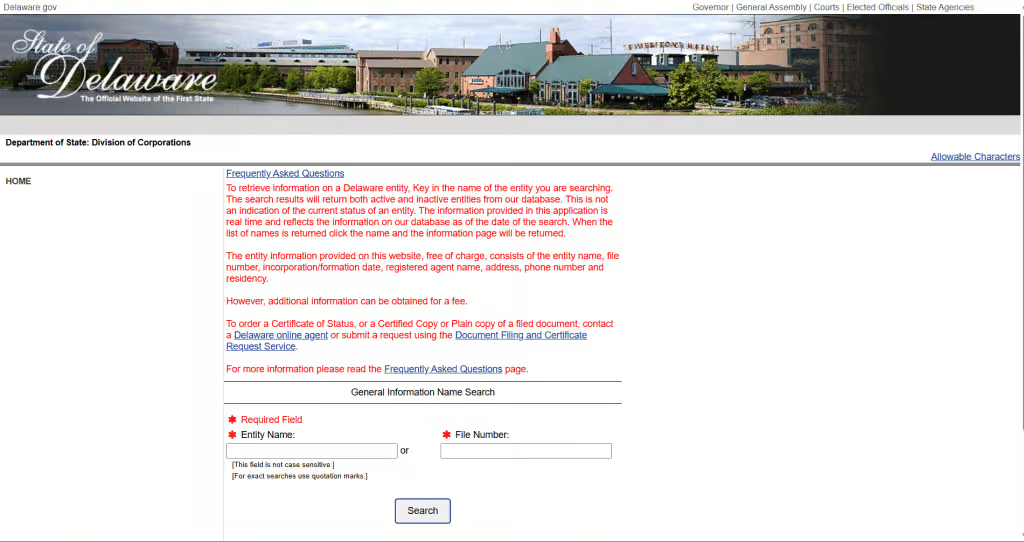

Visit the official Delaware Division of Corporations Entity Search portal at: https://icis.corp.delaware.gov/ecorp/entitysearch/namesearch.aspx

Step 2: Enter Your Search Criteria

The search interface is remarkably straightforward, offering two primary search options:

- Entity Name Search: Type the name (or partial name) of the business entity you’re searching for in the “Entity Name” field. The search is not case-sensitive, so don’t worry about capitalization.

- File Number Search: If you know the specific file number assigned to the entity by the Delaware Division of Corporations, you can enter it in the “File Number” field for a direct search.

Step 3: Execute Your Search and Review Results

Click the “Search” button to generate results. The system will display a list of matching entities in a table format with two columns:

- File numbers (on the left)

- Entity names (on the right)

The search results include both active and inactive entities that match your search criteria. Up to 50 results can be displayed per page.

Step 4: Access Detailed Entity Information

To view comprehensive details about a specific entity, click on the entity’s name in the results list. This will take you to the “Entity Details” page, which provides the following information:

- Entity name

- File number

- Entity type/classification

- Formation/incorporation date

- Entity status (active, void, forfeited, etc.)

- Registered agent information, including:

- Name

- Address

- Phone number

- Residency status

Special Features and Search Tips

For more effective searches on the Delaware Entity Search portal:

- Quotation Marks: Use quotation marks around a name for an exact match search

- Single-Word Searches: These provide the broadest results if you’re unsure of the complete name

- Partial Name Searches: The system will find all entities containing your search term

- Spaces and Punctuation: The system doesn’t display punctuation marks, so avoid using them in searches

- Entity Type Awareness: The system searches across all entity types (corporations, LLCs, etc.) by default

What Delaware Business Entity Statuses Mean

When reviewing your search results, you may encounter different status designations for entities. Here’s what the common status terms mean:

Active/Good Standing

An entity in “good standing” has met all statutory requirements including:

- Paid all franchise taxes and fees

- Filed all required reports

- Maintained a registered agent in Delaware

Void

An entity becomes “void” for the following reasons:

- Corporations: Failure to pay franchise taxes for 1+ years

- Foreign corporations: Failure to file annual reports for 2+ years

- LLCs/LPs: Failure to pay annual tax for 3+ years

When void, an entity:

- Loses its good standing status

- Loses limited liability protection in Delaware

- Cannot receive a Certificate of Good Standing

- The entity name becomes available for use by others

Forfeited

A business becomes “forfeited” when it no longer has a registered agent on file with the Delaware Division of Corporations. This typically happens when:

- The entity fails to pay the annual registered agent fee

- The registered agent resigns (typically after 90 days of non-payment)

- The entity doesn’t appoint a new registered agent within 30 days of resignation

Tax Delinquent Statuses

You might also see these tax-related statuses:

- “Ceased Good Standing”: Entity didn’t pay taxes on time

- “AR filed, Tax delinquent”: Annual Report filed, but taxes not paid

- “AR delinquent, Tax due”: Both Annual Report not filed and taxes not paid

Beyond the Basic Search: Obtaining Additional Information

While the basic entity search provides fundamental information for free, the Delaware Division of Corporations offers additional services for more detailed information:

Online Status Check Options

- $10 Status Option: Returns a screen displaying the current status of the requested entity

- $20 Status with Tax & History Option: Provides more detailed information including:

- Current status

- Last 5 filings

- Franchise tax assessment

- Total authorized shares (if applicable)

- Current tax due

Official Certificates and Document Copies

For official documentation, you can request:

- Certificate of Good Standing/Status ($50 for short form, $175 for long form)

- Certified Copies of Filed Documents

- Plain Copies of Filed Documents

These requests must be submitted through:

- The Document Filing and Certificate Request Service on the Division website

- A Delaware online agent

- Mail to: Division of Corporations – 401 Federal Street – Suite 4 – Dover, DE 19901

Note: The online search tool does NOT generate official certificates or show document images. Annual reports for corporations contain officer and director information but are not available through the online search – you must request copies separately.

Checking Name Availability for a New Delaware Business

If you’re searching to determine if a business name is available for your new entity, follow these additional considerations:

Delaware Naming Guidelines

Your desired business name must comply with Delaware’s naming requirements:

For LLCs:

- Must contain “Limited Liability Company” or abbreviation (LLC, L.L.C.)

- Must be distinguishable from existing names

- Cannot contain terms that suggest it’s a government department

- Cannot use financial, medical, or insurance industry terms without proper licensing

For Corporations:

- Must contain “Corporation,” “Incorporated,” “Company,” or abbreviation (Corp., Inc., Co.)

- Must be distinguishable from existing names

- Restricted words (bank, university, etc.) require additional approvals

Sample Search Scenario

Let’s walk through a simulated business name search:

- Enter search term: Type “Blue Diamond Consulting” in the entity name field

- Review results: Let’s say the results show “Blue Diamond Consulting Inc.” but not “Blue Diamond Consulting LLC”

- Analyze availability: While “Blue Diamond Consulting Inc.” exists, an LLC with a similar name might be possible (though not recommended due to potential confusion)

- Check results page: The system shows both active and inactive entities, so verify the status by clicking on the entity name

The Results Page

When you click on “Blue Diamond Consulting Inc.” in our example, you’d see details like:

- File Number: (e.g., 5432198)

- Entity Type: Corporation

- Incorporation Date: (e.g., 03/15/2018)

- Status: (e.g., Active)

- Registered Agent: (Name, address, and contact information)

Reserving a Business Name in Delaware

Once you’ve confirmed your desired name is available, you may want to reserve it while preparing your formation documents:

Reservation Process

- Online Reservation: Visit the Name Reservation site at https://icis.corp.delaware.gov/ecorp/namereserv/namereservation.aspx

- Complete Application: Fill out the name reservation application

- Pay Fee: $75 per name (as of May 2025)

- Reservation Period: Name is reserved for 120 days

- Payment Methods: ACH checking/savings or credit card (Visa, MasterCard, American Express, Discover)

What to Do After Your Delaware Business Entity Search

After completing your search, your next steps depend on your findings and goals:

Starting a New Business:

- Reserve the name if it’s available and you’re not ready to form immediately

- Prepare formation documents specific to your entity type:

- Certificate of Incorporation (for corporations)

- Certificate of Formation (for LLCs)

- Choose a registered agent in Delaware

- Submit documents and fees to the Division of Corporations

- Pay initial taxes and fees

Researching an Existing Entity:

- Purchase detailed information if needed for due diligence

- Request official certificates for legal or financial purposes

- Contact the registered agent if trying to reach the entity

Reviving a Void or Forfeited Entity:

- Pay all delinquent taxes and fees owed to the state

- File appropriate revival documents:

- Certificate of Revival (for void corporations)

- Certificate of Renewal and Revival (for forfeited corporations)

- Certificate of Reinstatement (for LLCs)

- Pay revival filing fees ($189 plus additional per-page fees)

- Reappoint a registered agent if forfeited

Filing Fees and Annual Requirements (2025)

Keep these important fees and requirements in mind:

Entity Formation Fees

- Corporations: $89 minimum (varies based on authorized shares)

- LLCs: $90 filing fee

- Limited Partnerships: $200 filing fee

Annual Requirements

- Corporations:

- Annual Report filing by March 1st ($50 filing fee)

- Franchise Tax ($175-$250,000 based on calculation method)

- $200 penalty plus 1.5% monthly interest for late filings

- LLCs and LPs:

- Annual Tax of $300 due by June 1st

- No annual report required

- Penalties for late payment

Name Reservation

- $75 for 120-day reservation

Status/Certificate Fees

- Online Status Check: $10 (basic) or $20 (with tax & history)

- Certificate of Good Standing: $50 (short form) or $175 (long form)

FAQs About Delaware Business Entity Searches

What does an “Active” status mean on a Delaware entity search?

An “Active” status indicates the entity is currently registered with the Delaware Division of Corporations and is in good standing, having met all state requirements including tax payments and maintaining a registered agent.

How long does a Delaware name reservation last?

A Delaware business name reservation lasts for 120 days from the date of approval. The reservation fee is $75 and can be paid online.

What happens if my Delaware LLC or corporation becomes “Void”?

When an entity becomes “Void,” it loses its good standing status and limited liability protection in Delaware. The company name becomes available for others to use, and you cannot obtain certificates for the entity. To restore a void entity, you must pay all delinquent taxes and file a Certificate of Revival with the appropriate fees.

Does the Delaware business entity search show owner names?

No, the Delaware business entity search does not display owner, member, or shareholder information. For corporations, officer and director information is maintained in annual reports, which must be requested separately. Delaware is known for its privacy protections for business owners.

What should I do if my desired name is taken in Delaware?

If your desired business name is already taken, you have several options:

- Choose a completely different name

- Add words or modify the name to make it sufficiently different

- Use a different entity designator (LLC vs. Inc.) if appropriate

- Seek written consent from the existing entity (rarely granted)

- Wait to see if the entity with your desired name becomes void or dissolves

Additional Resources for Delaware Business Entities

For more information about Delaware business entities, consult these resources:

- Delaware Division of Corporations

- Delaware Business First Steps

- Delaware Franchise Tax Calculator

- Delaware Online Document Filing

- Business Anywhere – Registered Agent Services

Other State Business Entity Searches

Looking to search for business entities in other states? Check out our comprehensive guides for:

- How to Do a Business Entity Search in New York

- How to Do a Business Entity Search in California

- How to Do a Business Entity Search in Texas

- How to Do a Business Entity Search in Pennsylvania

- How to Do a Business Entity Search in Michigan

- How to Do a Business Entity Search in Indiana

- How to Do a Business Entity Search in Mississippi

- How to Do a Business Entity Search in South Carolina

- How to Do a Business Entity Search in Tennessee

- How to Do a Business Entity Search in Vermont

Conclusion

The Delaware Division of Corporations Business Entity Search tool is an invaluable resource for anyone looking to form a new business or research existing entities in the state. By following this comprehensive guide, you can efficiently navigate the search process and understand the results to make informed business decisions.

Remember that while the basic search is free, additional information and official certificates require fees. Always ensure you’re using the official state website for your searches to obtain the most accurate and up-to-date information.

For assistance with Delaware business formations, name reservations, or obtaining certificates, contact Business Anywhere – we can help streamline the process and ensure your Delaware business entity complies with all state requirements.

Disclaimer: The information contained on this site is not and should not be construed as legal advice. This article provides general information about Delaware business entity searches and related processes. Business requirements and fees are subject to change. Please consult with a qualified attorney or the Delaware Division of Corporations for specific legal advice or the most current information.