Arizona stands as one of America’s most business-friendly states, with over 641,000 small businesses thriving within its borders – representing 99.5% of all state businesses. Whether you’re a digital nomad launching your first venture, a remote entrepreneur scaling your operations, or a small business owner seeking legal protection, forming an Arizona LLC offers unparalleled advantages for location-independent professionals. Learning how to start an LLC in Arizona can be your first step to benefiting from the state’s supportive business environment.

This comprehensive guide walks you through every step of Arizona LLC formation, from initial planning to final compliance requirements. By the end, you’ll have a clear roadmap to establish your business legally and efficiently, regardless of where you’re physically located.

Why Choose Arizona for Your LLC Formation?

Business-Friendly Environment

Arizona consistently ranks among the top states for business formation due to its streamlined processes, reasonable fees, and entrepreneur-friendly regulations. The state’s commitment to supporting small businesses makes it an ideal choice for digital entrepreneurs and remote workers who need flexibility and simplicity.

Key Benefits of Arizona LLCs:

- Limited personal liability protection for business debts and obligations

- Tax flexibility with pass-through taxation options

- Minimal ongoing compliance requirements compared to other states

- No publication requirements in major counties (Maricopa and Pima)

- Reasonable filing fees at just $50 for Articles of Organization

- Online filing availability for faster processing

Perfect for Remote Businesses

Arizona’s LLC structure accommodates location-independent businesses perfectly. You don’t need to be physically present in Arizona to operate your LLC, making it ideal for digital nomads, remote consultants, e-commerce entrepreneurs, and online service providers.

Understanding Arizona LLC Basics: What Every Entrepreneur Needs to Know

What is an Arizona LLC?

A Limited Liability Company (LLC) in Arizona is a business entity that combines the liability protection of a corporation with the tax benefits and operational flexibility of a partnership. This hybrid structure protects your personal assets while allowing profits and losses to pass through to your personal tax return.

Who Should Consider an Arizona LLC?

- Digital nomads seeking business legitimacy while traveling

- Remote consultants and freelancers wanting to separate personal and business finances

- E-commerce entrepreneurs needing liability protection for online sales

- Real estate investors looking for asset protection strategies

- Small business owners planning to scale their operations

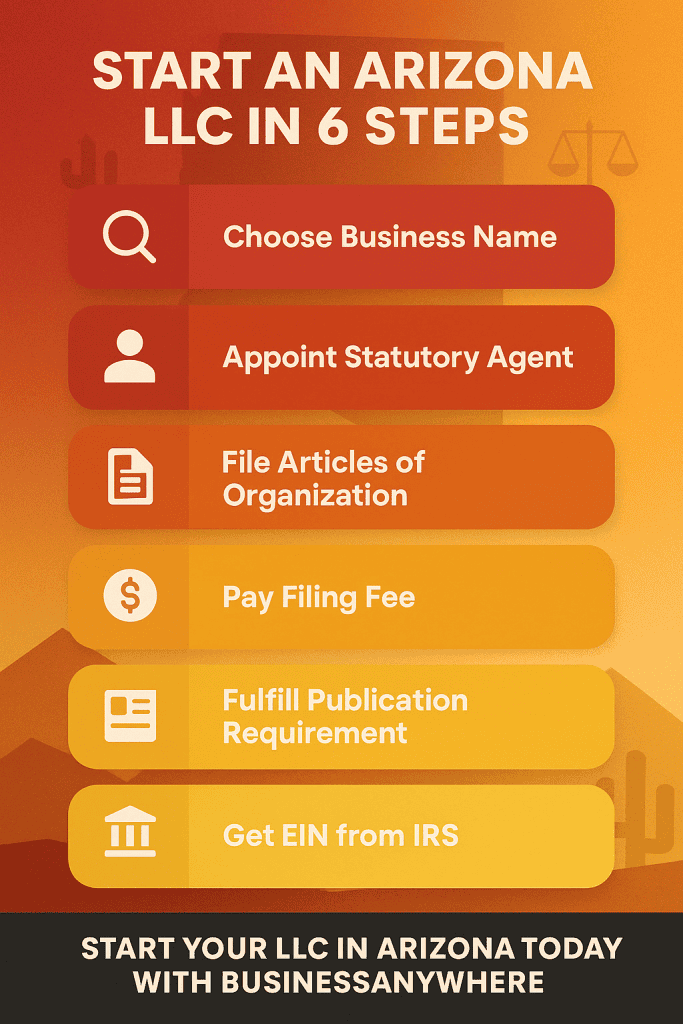

Step 1: Choose Your Arizona LLC Name (With Pro Tips for Digital Businesses)

Your LLC name serves as your business’s first impression and legal identifier. Arizona has specific requirements that must be met before you can proceed with registration. You can check our guide about doing an Arizona Business Entity Search here.

Arizona LLC Name Requirements

Mandatory Designators: Your LLC name must include one of these designators:

- “Limited Liability Company” (full form)

- “LLC” (most common abbreviation)

- “L.L.C.” (with periods)

- “LC” (shorter form)

- “L.C.” (with periods)

For Professional LLCs: If you’re forming a professional LLC (PLLC) for licensed professions like law, medicine, or accounting, you must use:

- “Professional Limited Liability Company”

- “PLC”

- “P.L.C.”

- “PLLC”

- “P.L.L.C.”

Name Availability and Restrictions

Checking Name Availability: Before falling in love with a name, verify its availability through the Arizona Corporation Commission database. This free search tool shows all registered business entities in Arizona.

Prohibited Words: Arizona restricts certain words that might confuse the public or imply government affiliation:

- Government agency acronyms (CIA, FBI, IRS)

- Banking terms without proper licensing

- Insurance terms without authorization

- Professional designations without proper credentials

Restricted Words Requiring Approval: Some words require additional documentation or licensing:

- “Attorney” or “Law”

- “Bank” or “Banking”

- “Insurance”

- “University” or “College”

- “Engineer” or “Engineering”

Pro Tips for Digital Entrepreneurs

Consider Your Online Presence:

- Check domain availability for your chosen name

- Verify social media handle availability across platforms

- Consider SEO implications of your business name

- Think about international markets if you plan global expansion

Trademark Considerations:

- Search the USPTO database for existing trademarks

- Consider filing for trademark protection after LLC formation

- Avoid names too similar to established brands in your industry

Step 2: Reserve Your Business Name (Optional but Recommended)

Name reservation provides security during the formation process, especially important for busy entrepreneurs juggling multiple priorities.

How to Reserve Your Arizona LLC Name

Filing Methods and Costs:

- Online filing: $45 through the Arizona Corporation Commission portal

- Mail filing: $10 (slower processing, 15-20 business days)

- Reservation period: 120 days from approval date

When Name Reservation Makes Sense:

- You need time to gather required documents and information

- You’re comparing formation services or attorneys

- You’re waiting for trademark clearance

- You want to secure the name while finalizing your business plan

Alternative: Doing Business As (DBA)

Arizona allows LLCs to operate under different names through DBA registration:

- Cost: $10 filing fee

- Process: Simple registration with county clerk

- Benefits: Market under multiple names while maintaining single LLC structure

- Perfect for: Digital agencies serving different market segments

Step 3: Select Your Arizona Statutory Agent (Critical for Remote Businesses)

The statutory agent (Arizona’s term for registered agent) serves as your LLC’s official point of contact for legal documents and state communications.

Statutory Agent Requirements

Legal Requirements:

- Must have a physical Arizona address (not a P.O. Box)

- Must be available during regular business hours (9 AM – 5 PM, Monday-Friday)

- Must be a resident of Arizona or a business authorized to conduct business in Arizona

- Must complete and sign a Statutory Agent Acceptance form

Responsibilities Include:

- Receiving service of process and legal documents

- Accepting official state correspondence

- Forwarding important documents to LLC members

- Maintaining current contact information with the state

Options for Statutory Agent Service

Option 1: Self-Service You can serve as your own statutory agent if you:

- Have a permanent Arizona address

- Will be consistently available during business hours

- Are comfortable handling legal document receipt

- Don’t mind your address being public record

Option 2: Professional Statutory Agent Service For remote entrepreneurs and digital nomads, professional services offer superior advantages:

Benefits of Professional Service:

- Privacy protection: Keeps your home address off public records

- Reliability: Guaranteed availability during business hours

- Document management: Professional handling and forwarding of legal documents

- Compliance support: Alerts for important deadlines and requirements

- Geographic flexibility: Operate your business from anywhere while maintaining Arizona compliance

BusinessAnywhere.io Statutory Agent Service: Our registered agent service specifically caters to location-independent entrepreneurs:

- Secure document scanning and digital delivery

- Mobile app notifications for time-sensitive documents

- Annual compliance reminders and deadline tracking

- Mail forwarding services for comprehensive business support

Step 4: File Your Articles of Organization (The Official Formation Step)

The Articles of Organization officially creates your Arizona LLC. This legal document establishes your business entity with the state and provides the foundation for all future operations.

You can file your Arizona LLC articles of organization directly with the Arizona Corporation Commission (ACC).

Required Information for Articles of Organization

Basic LLC Information:

- LLC Name: Exactly as you want it registered, including proper designator

- LLC Address: Can be your statutory agent’s address if you prefer privacy

- LLC Type: Specify standard LLC or professional LLC (PLLC)

- Professional Services Description: Required only for PLLCs

Statutory Agent Details:

- Full legal name of statutory agent

- Complete Arizona address

- Signature on Statutory Agent Acceptance form

Management Structure: Choose between:

- Member-managed: All members participate in daily operations and major decisions

- Manager-managed: Designated managers handle operations while members remain passive investors

Duration:

- Perpetual: LLC continues indefinitely (most common choice)

- Specific term: LLC dissolves on predetermined date

Filing Methods and Fees

- Cost: $50 standard processing

- Expedited processing: Additional $35 (processed within 1-2 business days)

- Processing time: 5-10 business days standard

- Benefits: Immediate confirmation, digital certificate delivery, error checking

Mail Filing:

- Cost: $50 (same as online)

- Processing time: 15-20 business days

- Address: Arizona Corporation Commission 1300 W Washington Street Phoenix, AZ 85007

What Happens After Filing

Once approved, you’ll receive:

- Certificate of Organization: Official proof of LLC formation

- File number: Unique identifier for your LLC

- Effective date: When your LLC legally began existing

Step 5: Create a Comprehensive Operating Agreement

Why Operating Agreements Matter for Remote Businesses

Legal Protection: Without an operating agreement, Arizona state law governs your LLC’s operations. This generic framework may not align with your specific business needs or member relationships.

Operational Clarity: For digital entrepreneurs often working across time zones and jurisdictions, written procedures prevent misunderstandings and conflicts.

Essential Operating Agreement Components

Member Information and Contributions:

- Complete member details (names, addresses, contact information)

- Initial capital contributions (cash, property, services)

- Ownership percentages based on contributions

- Additional capital call procedures

Management Structure and Decision-Making:

- Daily operational responsibilities

- Major decision voting requirements

- Meeting procedures (especially important for remote teams)

- Conflict resolution mechanisms

Financial Provisions:

- Profit and loss distribution methods

- Tax election preferences

- Banking and financial management procedures

- Expense reimbursement policies

Member Changes:

- New member admission procedures

- Member withdrawal or resignation processes

- Buy-sell agreement terms

- Valuation methods for member interests

Dissolution Procedures:

- Triggering events for dissolution

- Asset distribution methods

- Debt responsibility allocation

- Final tax filing requirements

For more detailed guidance on LLC structure and management, see our comprehensive LLC formation checklist.

Special Considerations for Digital Businesses

Remote Work Provisions:

- Virtual meeting procedures and technology requirements

- Electronic signature authorization

- Document storage and access protocols

- Communication standards and response times

Intellectual Property Protection:

- Ownership of business-created IP

- Non-compete and non-disclosure agreements

- Client relationship ownership

- Technology and software usage rights

Step 6: Obtain Your Employer Identification Number (EIN)

The EIN serves as your LLC’s federal tax identification number, essential for banking, tax filing, and business operations.

When You Need an EIN

Required Situations:

- LLC has multiple members

- LLC has employees

- LLC elects corporate tax treatment

- LLC wants to open business bank accounts

- LLC needs to file federal tax returns

Optional for Single-Member LLCs: Single-member LLCs without employees can use the owner’s Social Security Number, but obtaining an EIN offers several advantages:

- Enhanced privacy (SSN not required for business purposes)

- Professional appearance for vendor relationships

- Future-proofing for business growth

- Simplified banking and credit applications

How to Apply for Your EIN

Free Online Application (Recommended):

- Visit the official IRS EIN application website

- Complete the online form (takes 15-20 minutes)

- Receive your EIN immediately upon completion

- Save the confirmation letter for your records

Alternative Methods:

- Fax: Complete Form SS-4 and fax to IRS (4-5 business days)

- Mail: Send completed Form SS-4 (4-6 weeks processing)

- Phone: Call IRS business hotline for immediate issuance

Important EIN Notes for Remote Entrepreneurs

Single Application Rule: Each LLC can only receive one EIN. If you make an error during application, you cannot simply apply again – you must contact the IRS to correct the information.

International Considerations: If you’re a foreign entrepreneur forming an Arizona LLC:

- You can still obtain an EIN

- You may need to provide additional documentation

- Consider consulting with a tax professional familiar with international business structures

- Review our guide on how to get an EIN for your LLC as a non-US resident for specific requirements

Step 7: Publish Notice of LLC Formation (Location-Specific Requirement)

Arizona requires most newly-formed LLCs to publish notice of formation in local newspapers, but this requirement varies by county.

Publication Requirements by County

Exempt Counties (No Publication Required):

- Maricopa County: Home to Phoenix and Scottsdale

- Pima County: Home to Tucson

For LLCs formed in these counties, the Corporation Commission automatically publishes formation notices on their websites, satisfying the legal requirement.

All Other Counties (Publication Required): LLCs formed in Arizona’s other 13 counties must publish notice within 60 days of Articles of Organization approval.

Publication Process and Requirements

Timeline: 60 days from Articles of Organization approval Consequence of non-compliance: LLC may be dissolved by the state

Required Information in Publication:

- Complete LLC name

- LLC business address

- Statutory agent name and address

- Management structure (member-managed or manager-managed)

- Names and addresses of all members or managers

Publication Process:

- Contact newspapers in your LLC’s county of formation

- Request publication rates for legal notices

- Provide required information in proper format

- Pay publication fees (varies by newspaper)

- Obtain proof of publication affidavit

- File proof with Arizona Corporation Commission

Cost Considerations

Publication costs vary significantly by county and newspaper:

- Rural counties: $100-300

- Urban counties: $300-800

- Factors affecting cost: Newspaper circulation, length of notice, local market rates

Step 8: Understand Arizona LLC Tax Obligations

Arizona LLCs enjoy favorable tax treatment, but understanding your obligations ensures compliance and optimal tax planning.

Federal Tax Treatment

Default Classification:

- Single-member LLC: Disregarded entity (income reported on owner’s personal return)

- Multi-member LLC: Partnership (files Form 1065, income passes through to members)

Election Options: LLCs can elect corporate tax treatment by filing Form 8832 with the IRS:

- S Corporation election: Potential payroll tax savings for active members

- C Corporation election: Retained earnings and corporate tax rates

Arizona State Tax Requirements

Transaction Privilege Tax (TPT): Arizona’s equivalent to sales tax applies to many business activities:

- Registration required: Most LLCs must register for TPT

- Monthly filing: Due by the 20th of the following month

- Rates vary: Based on business activity and location

Arizona Income Tax:

- Pass-through taxation: LLC income flows to members’ personal returns

- Arizona Form 140: Personal income tax return including LLC income

- Nonresident considerations: Out-of-state members may owe Arizona taxes on Arizona-source income

Tax Benefits for Digital Entrepreneurs

Home Office Deduction: Remote entrepreneurs can often deduct home office expenses, including:

- Portion of rent or mortgage interest

- Utilities allocable to office space

- Office furniture and equipment

- Internet and phone services

Travel Deductions: Digital nomads and traveling entrepreneurs may deduct:

- Business travel expenses

- Temporary lodging costs

- Transportation between business locations

- Meals during business travel (50% deductible)

Step 9: Open Your Arizona LLC Bank Account

Separating personal and business finances protects your LLC’s liability shield and simplifies tax preparation.

Required Documents for Business Banking

Essential Documentation:

- Articles of Organization (certified copy)

- EIN confirmation letter

- Operating Agreement

- Member identification (driver’s license or passport)

- Initial deposit funds

Additional Requirements (Bank-Specific):

- Business license (if applicable to your industry)

- Assumed name certificate (if using DBA)

- Professional licenses (for PLLCs)

For detailed guidance on banking requirements, including specific considerations for non-US residents, see our article on opening a US bank account for an LLC as a non-resident. You may also want to understand whether you need an EIN to open a bank account for your LLC.

Choosing the Right Bank for Remote Businesses

Online Banking Features:

- Mobile deposit capabilities

- Digital check writing

- International wire transfer options

- Multi-currency account options

- Integration with accounting software

Fee Structure Considerations:

- Monthly maintenance fees

- Transaction limits and overage charges

- ATM fee reimbursement programs

- International transaction fees

- Wire transfer costs

Recommended Banks for Digital Entrepreneurs:

- Mercury: Designed for startups and remote businesses

- Novo: Free business banking with excellent digital tools

- Azlo: Simple business banking for freelancers and small businesses

- Chase Business: Comprehensive services with international capabilities

Step 10: Maintain Your Arizona LLC in Good Standing

Ongoing compliance ensures your LLC maintains its legal protections and remains in good standing with Arizona authorities.

Annual Requirements

No Annual Report Required: Unlike many states, Arizona doesn’t require LLCs to file annual reports, reducing ongoing compliance burden.

Tax Filing Obligations:

- Federal tax returns (if applicable)

- Arizona state tax returns

- Transaction Privilege Tax returns (if applicable)

Ongoing Best Practices

Corporate Formalities: While LLCs have fewer formal requirements than corporations, maintaining proper procedures strengthens legal protection:

- Hold annual member meetings

- Document major decisions in writing

- Maintain separate business bank accounts

- Keep detailed financial records

- Update operating agreement as business evolves

Statutory Agent Maintenance:

- Ensure continuous statutory agent service

- Update agent information if changes occur

- Maintain current contact information with the state

Advanced Strategies for Arizona LLCs

Multi-State Operations

Arizona LLCs can operate in multiple states, but may need to register as foreign LLCs in other jurisdictions where they conduct substantial business.

Foreign LLC Registration Triggers:

- Maintaining physical office or employees in another state

- Regularly conducting business meetings in another state

- Owning significant property in another state

- Having substantial ongoing business relationships in another state

Asset Protection Strategies

Single-Purpose LLCs: For maximum asset protection, consider forming separate LLCs for:

- Different business ventures

- Valuable equipment purchases

- Real estate investments (see our guide on how to form a real estate LLC)

- High-liability activities

Professional Liability Considerations: Professional LLCs (PLLCs) provide limited protection for professional malpractice claims, but protect against general business liabilities.

Common Mistakes to Avoid When Forming an Arizona LLC

Formation Errors

Inadequate Name Research:

- Failing to check trademark databases

- Ignoring domain name availability

- Not considering international trademark conflicts

Incomplete Articles of Organization:

- Missing required designators in business name

- Incorrect statutory agent information

- Unclear management structure designation

Operational Mistakes

Mixing Personal and Business Finances:

- Using personal accounts for business transactions

- Failing to obtain proper business banking

- Not maintaining separate financial records

Neglecting Operating Agreement:

- Operating without written agreements

- Failing to update agreements as business evolves

- Not addressing remote work and digital business considerations

Industry-Specific Considerations for Arizona LLCs

Technology and Software Businesses

Intellectual Property Protection:

- Consider Delaware formation for future investment rounds

- Implement strong IP assignment agreements

- Plan for employee stock option pools

Data Privacy Compliance:

- Understand GDPR implications for international customers

- Implement CCPA compliance for California customers

- Consider cybersecurity insurance coverage

E-commerce and Retail

Sales Tax Obligations:

- Register for Transaction Privilege Tax in Arizona

- Understand nexus rules for other states

- Implement proper sales tax collection systems

Consumer Protection Compliance:

- Develop clear terms of service and privacy policies

- Understand FTC advertising guidelines

- Implement proper return and refund procedures

Professional Services

Licensing Requirements:

- Verify if your profession requires PLLC formation

- Maintain required professional licenses

- Understand continuing education requirements

Professional Liability Insurance:

- Obtain appropriate coverage for your profession

- Consider cyber liability insurance for digital practices

- Understand coverage limitations for LLC structures

Frequently Asked Questions (FAQ)

Q: How long does it take to form an LLC in Arizona?

A: Standard processing takes 5-10 business days when filing online, or 15-20 business days when filing by mail. Expedited processing is available for an additional $35 fee, reducing processing time to 1-2 business days. However, complete LLC setup including EIN application, bank account opening, and operating agreement creation typically takes 2-4 weeks.

Q: Can I form an Arizona LLC if I don’t live in Arizona?

A: Yes, you can form an Arizona LLC regardless of where you live. However, you must have a statutory agent with an Arizona address. Many remote entrepreneurs use professional statutory agent services like BusinessAnywhere.io to meet this requirement while maintaining privacy and compliance. For comprehensive guidance on all 50 states, check our LLC registration guide.

Q: What’s the difference between an LLC and a corporation in Arizona?

A: LLCs offer more operational flexibility, pass-through taxation, and fewer formalities compared to corporations. Corporations provide better options for raising capital through stock sales and may offer certain tax advantages in specific situations. LLCs are generally preferred for small businesses and solo entrepreneurs due to their simplicity and protection benefits.

Q: Do I need to publish my LLC formation in all Arizona counties?

A: No, publication requirements vary by county. LLCs formed in Maricopa County (Phoenix) and Pima County (Tucson) are automatically published by the Corporation Commission and don’t require separate newspaper publication. LLCs formed in other counties must publish notice within 60 days of formation approval.

Q: Can my Arizona LLC have foreign owners or members?

A: Yes, Arizona LLCs can have foreign members without restrictions. However, foreign members may face additional tax obligations and should consult with international tax professionals to understand reporting requirements in their home countries.

Q: What happens if I don’t maintain a statutory agent in Arizona?

A: Failing to maintain a statutory agent can result in administrative dissolution of your LLC. The state requires continuous statutory agent service, and any lapse must be corrected immediately. Professional statutory agent services ensure this requirement is never missed.

Q: How much does it cost to start an LLC in Arizona?

A: The minimum cost to form an Arizona LLC is $50 for the Articles of Organization filing fee. Additional costs may include name reservation ($10-45), statutory agent service ($100-300 annually), operating agreement preparation ($200-1,000), and publication fees ($100-800 depending on county). Total costs typically range from $200-1,500 depending on services used.

Q: What should I do if I lose my EIN number?

A: If you lose your EIN, don’t panic. First, check your email records, tax returns, and business documents where it might be recorded. You can also call the IRS Business & Specialty Tax Line at 800-829-4933. For more detailed recovery steps, see our guide on what to do about a lost EIN number.

Q: What are the consequences of missing the publication deadline?

A: If you miss the deadline, your LLC’s powers may be suspended.

Conclusion: Your Path to Arizona LLC Success

Forming an Arizona LLC provides the perfect foundation for location-independent entrepreneurs seeking legal protection, tax flexibility, and operational simplicity. The state’s business-friendly environment, combined with minimal ongoing requirements, makes it an ideal choice for digital nomads, remote consultants, and online businesses.

Key Takeaways:

- Arizona offers one of the most streamlined LLC formation processes in the United States

- Professional statutory agent service is essential for remote entrepreneurs

- Operating agreements protect your interests even when not legally required

- Ongoing compliance is minimal but crucial for maintaining good standing

- Professional guidance can save time and prevent costly mistakes

Ready to Start Your Arizona LLC?

Don’t let administrative complexity delay your entrepreneurial dreams. BusinessAnywhere.io specializes in helping location-independent entrepreneurs establish and maintain their business entities efficiently and affordably.

Get started now with our comprehensive LLC formation services, including:

- Complete Articles of Organization preparation and filing

- Professional statutory agent service with digital document management

- Operating agreement templates customized for remote businesses

- EIN application assistance and tax guidance

- Ongoing compliance support and deadline reminders

Take the first step toward protecting your business and legitimizing your entrepreneurial venture. Your Arizona LLC formation is just a few clicks away.

This guide provides general information about Arizona LLC formation and should not be considered legal or tax advice. Consult with qualified professionals for guidance specific to your situation. BusinessAnywhere.io provides business formation services and registered agent services to help entrepreneurs establish and maintain their business entities efficiently.

Resources

How to Start an LLC in California (Without Losing Your Mind)

How to Start an LLC in Colorado: Step-by-Step Guide for Entrepreneurs

How to Start an LLC in Delaware in 2025

How to Start an LLC in Florida (The Right Way)

How to Start an LLC in Montana: What You Need to File and Maintain Your Business

How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

New Mexico LLC: Step-by-Step Formation Guide

How to Start an LLC in Texas: A No-Nonsense Guide for 2025

How to Start an LLC in Utah: A Straightforward Guide for Entrepreneurs