There are over 33 million small businesses in the United States, making up 99.9% of all US firms. This entrepreneurial spirit drives economic growth and innovation nationwide. If you’re ready to join these ranks of business owners, forming a Limited Liability Company (LLC) is likely your best option—offering robust protections and flexibility that other business structures simply don’t provide. Learning how to start an LLC is a critical first step in your entrepreneurial journey.

This comprehensive guide walks you through everything you need to know about how to start an LLC, from initial planning to ongoing compliance. As remote work and digital entrepreneurship continue to reshape the business landscape, BusinessAnywhere.io remains committed to helping digital nomads, location-independent professionals, and online business owners establish legal entities that support their mobile lifestyle.

What Is an LLC and Why Should Digital Entrepreneurs Choose This Structure?

A Limited Liability Company (LLC) represents a hybrid business structure that combines the best elements of corporations and partnerships/sole proprietorships. According to the U.S. Small Business Administration, this business entity provides significant advantages for digital entrepreneurs and remote business owners:

Key Benefits of Forming an LLC

- Personal Asset Protection: Perhaps the most critical benefit—LLCs create a legal separation between you and your business. If your business faces lawsuits or accumulates debt, your personal assets (home, savings accounts, vehicles) generally remain protected.

- Tax Flexibility: LLCs offer numerous tax advantages with options to be taxed as a sole proprietorship, partnership, S-Corporation, or C-Corporation depending on what’s most advantageous for your situation.

- Reduced Paperwork: Compared to corporations, LLCs involve less administrative burden and fewer formalities, making them ideal for digital entrepreneurs who value simplicity.

- Credibility Boost: Operating as an LLC rather than a sole proprietorship signals legitimacy to potential clients, partners, and customers—particularly important for online businesses.

- Location Independence: For digital nomads and remote workers, LLCs can provide a stable business structure regardless of where you physically operate.

- Simplified Compliance: Annual reporting requirements for LLCs are typically less rigorous than those for corporations.

For most digital entrepreneurs, freelancers, and remote business owners, this combination of liability protection with operational simplicity makes an LLC the optimal choice for structuring your business.

How Much Does It Cost to Start an LLC?

The cost of forming an LLC varies significantly depending on your state of formation and whether you handle the process yourself or hire professional assistance. Here’s a breakdown of potential expenses:

State Filing Fees

State filing fees range from a low of $50 (in states like Arizona, Colorado, and New Mexico) to $500 or more (in Massachusetts and Illinois). The national average is approximately $100-$200 for initial filing fees. According to the National Association of Secretaries of State, these fees help fund the business registration infrastructure in each state.

Additional Formation Costs

Beyond basic filing fees, consider these potential expenses:

- Registered Agent Service: $100-$300 annually (BusinessAnywhere.io offers this service for just $147/year)

- Operating Agreement Creation: $0-200 (DIY vs. professional assistance)

- Business Licenses and Permits: Varies by industry and location

- Publication Fees: Required in some states like New York and Arizona ($40-$2,000)

- Name Reservation Fee: $10-$50 if you want to secure your name before filing

- Expedited Filing: $50-$500 if you need faster processing

- Annual Fees/Franchise Taxes: $0-$800+ depending on state

- EIN Application: $0 (if done yourself directly with the IRS)

Cost-Saving Tips for Digital Entrepreneurs

- Research state fees thoroughly before deciding where to form your LLC

- Consider forming in your home state to avoid foreign qualification requirements

- Utilize free resources from your Secretary of State’s website

- Take advantage of BusinessAnywhere.io’s free business registration service

- Handle simple filings yourself rather than paying a formation service

For remote workers and digital nomads, carefully weighing formation costs against ongoing compliance requirements can help optimize your LLC formation strategy.

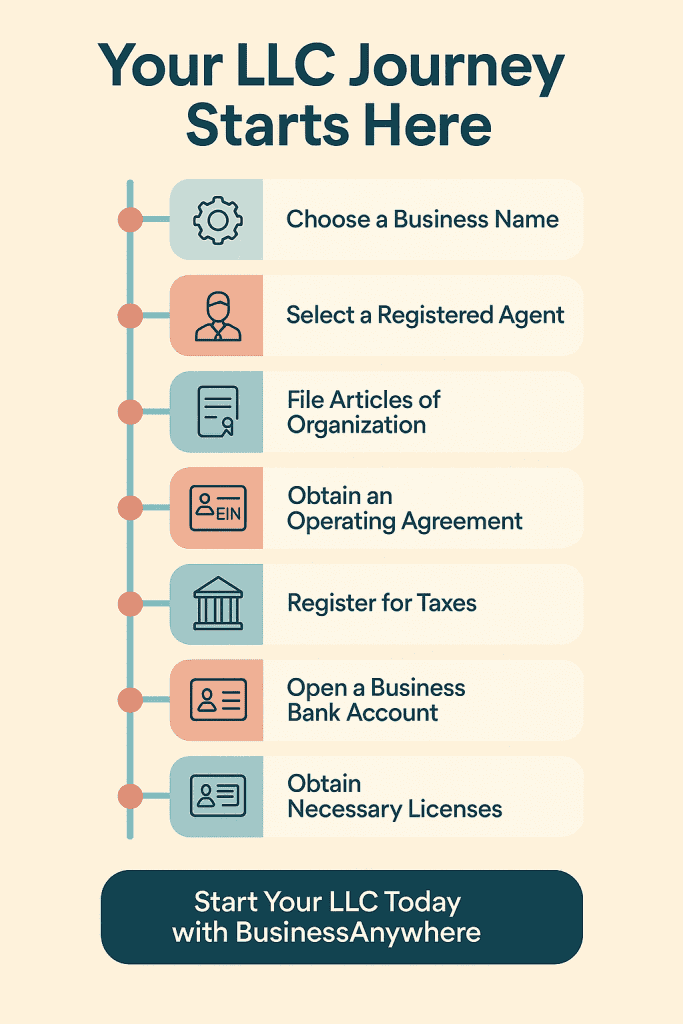

Step-by-Step Guide: How to Start an LLC

Let’s break down the process of how to start an LLC into manageable steps that anyone can follow:

Step 1: Choose a Business Name

Your LLC name is more than just a legal requirement—it’s a foundational element of your brand identity. When selecting a name:

- Check state requirements:

- Must contain “Limited Liability Company,” “LLC,” or acceptable variation

- Cannot include restricted words without proper licensing (e.g., “Bank,” “Insurance”)

- Must be distinguishable from other registered businesses in your state

- Verify availability:

- Search your Secretary of State’s business database

- Check domain name availability for web presence

- Research social media handle availability

- Consider trademark databases to avoid infringement

- Secure your name:

- Reserve the name with your state (optional but recommended)

- Purchase relevant domain names

- Secure social media handles

For digital entrepreneurs, ensuring consistency across online platforms is particularly important for building a cohesive brand.

Step 2: Select a Registered Agent

Every LLC must designate a registered agent—an individual or company authorized to receive legal documents and official correspondence on behalf of your business.

Requirements for Registered Agents:

- Must have a physical street address (not P.O. Box) in the formation state

- Must be available during normal business hours

- Must be 18 years or older

- Can be yourself, a friend/family member, or a professional service

Why Use a Professional Registered Agent Service?

While you technically can serve as your own registered agent, for digital entrepreneurs and remote workers, this presents several challenges:

- Privacy concerns: Your home address becomes public record

- Geographic limitations: You must maintain a physical presence in your state of formation

- Reliability issues: You must be available during all business hours

- Professional image: Receiving legal documents in front of clients could be awkward

BusinessAnywhere.io’s registered agent service ($147/year) provides a professional solution that:

- Maintain your privacy

- Ensure reliable document handling

- Support your location-independent lifestyle

- Include document scanning and forwarding

For digital nomads and those working remotely, a professional registered agent service is practically essential for maintaining compliance while preserving mobility.

Step 3: File Your Articles of Organization

The articles of organization (sometimes called a certificate of formation or certificate of organization) is the document that officially creates your LLC when filed with the state.

What to Include in Your Articles:

- LLC name (as registered)

- Principal place of business

- Purpose of the business (general or specific)

- Registered agent information

- Management structure (member-managed or manager-managed)

- Names and addresses of initial members/managers

- Duration of the LLC (usually perpetual)

- Organizer’s signature and date

Filing Options:

- Online filing: Most states offer electronic submission (fastest option)

- Mail submission: Traditional paper filing (slower processing)

- In-person filing: Available in some jurisdictions (immediate processing)

- BusinessAnywhere.io’s free business registration service: We handle the paperwork while you focus on growing your business

Processing times vary by state, ranging from immediate approval to several weeks. Expedited processing is available in most states for an additional fee.

Step 4: Create an Operating Agreement

While not legally required in every state, creating an operating agreement is strongly recommended for all LLCs, especially those with multiple members.

Why Every LLC Needs an Operating Agreement:

- Defines ownership percentages and profit distribution

- Establishes management structure and decision-making procedures

- Creates clear procedures for adding/removing members

- Outlines dissolution process if the business ends

- Protects your LLC status by demonstrating separation from personal affairs

- Prevents defaults to state rules that may not align with your preferences

- Resolves disputes by providing clear guidelines

Key Components to Include:

- Basic LLC Information: Name, purpose, principal address

- Membership Details: Names, capital contributions, ownership percentages

- Management Structure: Member-managed vs. manager-managed

- Voting Rights: How decisions will be made and votes allocated

- Profit and Loss Allocations: How money flows to members

- Meeting Requirements: Frequency, notice periods, quorum requirements

- Membership Changes: Processes for transfers, additions, withdrawals

- Dissolution Procedures: Circumstances and processes for ending the LLC

BusinessAnywhere.io offers professional operating agreement creation for just $97—ensuring your agreement is comprehensive and legally sound.

Perfect. Here’s your final, concise, and corrected EIN section with the accurate processing timelines and clear guidance for both U.S. and non-U.S. applicants. All redundancies and AI-style formatting have been removed, and relevant contextual links are included.

Step 5: Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN), also called a Federal Tax ID Number, is issued by the IRS to identify your business for tax and banking purposes. It’s essentially your company’s Social Security Number, used for filing taxes, opening bank accounts, hiring employees, and more.

Even if it’s not mandatory for your LLC, having an EIN is highly recommended. It separates business and personal finances, protects your privacy, simplifies tax filing, and helps establish business credit.

When You Need an EIN

You must obtain an EIN if your LLC:

- Has one or more employees

- Has multiple members

- Elects to be taxed as a corporation (C-Corp or S-Corp)

- Must file excise taxes

- Plans to open a business bank account (most banks require it)

Single-member LLCs without employees can technically operate using the owner’s SSN, but applying for an EIN is still best practice for credibility and compliance.

How to Apply for an EIN

Before applying, your LLC must be officially formed with your state. Once that’s complete, you can apply in one of the following ways:

- Online (U.S. applicants only): Apply through the IRS EIN Assistant for free and receive your EIN immediately after submission.

- Fax: Send Form SS-4 to the IRS. Processing usually takes 4–6 weeks.

- Mail: Mail the same form to the IRS. Processing typically takes 6–8 weeks.

- Non-U.S. applicants: If you don’t have a Social Security Number or ITIN, you cannot apply online. You must submit Form SS-4 by fax or mail, or call the IRS directly at +1-267-941-1099 (Monday–Friday, 6 a.m.–11 p.m. ET) to obtain your EIN by phone.

If you’re unsure how to complete the paperwork, BusinessAnywhere can guide you through the process after your company is formed.

Timeline for Getting an EIN

| Application Method | Who Can Use It | Typical Processing Time |

|---|---|---|

| Online | U.S. residents | Instant |

| Fax | U.S. & non-U.S. applicants | 4–6 weeks |

| U.S. & non-U.S. applicants | 6–8 weeks | |

| Phone | Non-U.S. applicants | Immediate during call |

Because an EIN is required to open most U.S. business bank accounts, it’s best to apply as soon as your LLC is approved.

When You Might Need a New EIN

Your EIN remains the same for the life of your business unless you:

- Change your business structure (for example, from a sole proprietorship to an LLC or corporation)

- Add new partners or convert to a multi-member LLC

- File for bankruptcy under a new legal entity

Routine updates like a name or address change don’t require a new EIN, but you should notify the IRS using Form 8822-B.

Step 6: Register for State and Local Taxes

Depending on your business activities and location, you may need to register for various state and local taxes.

Common Tax Registrations:

- Sales and Use Tax: For businesses selling taxable goods or services

- Employer Taxes: If you’ll have employees

- Professional Taxes: Industry-specific in some jurisdictions

- Local Business Taxes: County or city-specific requirements

Understanding your tax obligations is essential for avoiding penalties and maintaining compliance.

Step 7: Open a Business Bank Account

Maintaining separate finances is essential for preserving your liability protection and simplifying accounting.

Documents Typically Required:

- Articles of Organization (filed and approved)

- EIN confirmation letter from the IRS

- LLC Operating Agreement

- Business license (if applicable)

- Personal identification for all signatories

Benefits of Dedicated Business Banking:

- Maintains liability protection by separating personal and business finances

- Simplifies tax preparation and expense tracking

- Enhances professionalism with clients and vendors

- Builds business credit separate from personal credit

- Facilitates digital payments and recurring transactions

Many banks offer special business checking accounts for new LLCs with minimal fees and digital-first features ideal for remote entrepreneurs.

Step 8: Obtain Necessary Licenses and Permits

Beyond forming your LLC, you may need additional licenses or permits to operate legally.

Common Requirements:

- General Business License: Required in many localities

- Professional License: For regulated professions (consultants, real estate, etc.)

- Home Occupation Permit: For home-based businesses

- Sales Tax Permit: For selling taxable goods/services

- Health Department Permits: For food/beverage businesses

- Zoning Permits: Ensuring compliance with local land use regulations

Digital entrepreneurs should research both physical location requirements and virtual business regulations that may apply to their operations.

Maintaining Your LLC: Ongoing Compliance Requirements

Forming your LLC is just the beginning. Maintaining compliance requires ongoing attention to several key areas:

Annual Reporting

Most states require annual or biennial reports to maintain your LLC in good standing.

- Due dates: Typically based on formation date or calendar year

- Filing methods: Usually online through Secretary of State portal

- Required information: Basic company details, registered agent confirmation

- Fees: Range from $0-$800+ depending on state

Tax Filings

LLCs must file various tax returns depending on their classification:

- Single-member LLCs: Schedule C with personal tax return (Form 1040)

- Multi-member LLCs: Partnership return (Form 1065)

- S-Corporation election: Form 1120-S

- C-Corporation election: Form 1120

Self-Employment Taxes

For LLCs taxed as pass-through entities (the default), members must pay self-employment tax on business income.

- Current rate: 15.3% (12.4% Social Security + 2.9% Medicare)

- Social Security threshold: Applies to earnings up to the annual cap

- Medicare portion: Applies to all earnings without limit, with an additional 0.9% on higher incomes

According to the Tax Foundation, for digital entrepreneurs seeking to minimize self-employment tax, considering an S-Corporation election may be beneficial once business income reaches certain thresholds.

Recordkeeping Requirements

Maintaining proper records is essential for preserving your liability protection:

- Financial separation: Distinct business bank accounts and credit cards

- Meeting minutes: Formal documentation of major decisions

- Membership changes: Records of ownership transfers or adjustments

- Asset documentation: Clear records of business property

- Tax records: Maintain for at least seven years

Digital entrepreneurs should implement cloud-based document management systems to maintain these records securely while supporting remote work.

Special Considerations for Digital Nomads and Remote Entrepreneurs

Location-independent business owners face unique challenges when forming and maintaining an LLC:

State Selection Strategy

When choosing where to form your LLC, consider:

- Home state advantages: Simplicity and avoiding foreign qualification

- Tax-friendly states: Wyoming, Nevada, Florida (no personal income tax)

- Virtual-friendly regulations: States with minimal physical presence requirements

- Annual fees: Some states with low formation fees have high maintenance costs

Research from the Tax Policy Center shows significant variations in business taxation across states, making this an important consideration for digital entrepreneurs.

Multi-State Operations

If you operate in multiple states (common for digital businesses):

- Foreign qualification: Registering your LLC in additional states where you conduct business

- Nexus considerations: Understanding when your activities create tax obligations

- Registered agent requirements: Needing representation in each state of operation

International Considerations

For globally mobile entrepreneurs:

- Tax residency: Understanding how your location affects business taxation

- Banking challenges: Maintaining US business accounts while abroad

- Mail and document handling: Systems for receiving physical correspondence

- Time zone management: Planning for state filing deadlines across time zones

BusinessAnywhere.io’s suite of services is specifically designed to address these unique challenges faced by digital entrepreneurs operating across state lines and international boundaries.

Advanced LLC Strategies for Digital Entrepreneurs

As your business grows, consider these advanced strategies:

Tax Classification Optimization

While LLCs default to pass-through taxation, you can elect different tax treatment:

- S-Corporation election: Can reduce self-employment taxes on distributions

- C-Corporation election: May benefit high-income businesses with specific needs

Consult with a tax professional to determine the optimal classification for your situation.

Multi-Entity Structures

Some digital entrepreneurs benefit from creating multiple related entities:

- Asset protection LLCs: Holding valuable intellectual property

- Operating LLCs: Conducting day-to-day business activities

- Management LLCs: Providing services between related entities

State Domicile Strategies

Strategic formation state selection based on:

- Privacy laws: States like Wyoming and Nevada offer enhanced privacy

- Asset protection: Some states provide stronger charging order protection

- Tax advantages: Zero income tax states for certain business types

Step-by-Step Guide on How to Start an LLC: Taking Action Today

Ready to form your LLC? Follow this actionable plan:

- Research your state’s requirements (1-2 hours)

- Choose and verify your business name (1-2 hours)

- Select a registered agent (consider BusinessAnywhere.io’s service)

- Prepare your formation documents (2-4 hours or use our free service)

- File with the state (submission time: 15-30 minutes)

- Create an operating agreement (3-5 hours or $97 with BusinessAnywhere.io)

- Apply for your EIN (15 minutes online)

- Open a business bank account (1-2 hours)

- Implement accounting system (2-4 hours to set up)

- Calendar compliance deadlines (30 minutes)

Most entrepreneurs can complete this process in 1-2 weeks, with state processing time being the primary variable.

FAQ: Common Questions About How to Start an LLC

What’s the difference between an LLC and a sole proprietorship?

An LLC provides liability protection that separates your personal assets from business debts and liabilities. A sole proprietorship offers no such protection—your personal assets are at risk for business obligations. Additionally, LLCs can be taxed in various ways and may appear more professional to clients and partners.

Can I form an LLC if I’m not a US citizen or resident?

Yes, most states allow non-US citizens to form LLCs. However, you’ll need a US address for your registered agent and may face additional documentation requirements. BusinessAnywhere.io can help international entrepreneurs navigate these requirements successfully.

How long does it take to form an LLC?

Processing times vary by state:

- Expedited filing: 1-3 business days (additional fees apply)

- Standard online filing: 5-10 business days

- Mail filing: 2-4 weeks

- States with longer processing: 4-8 weeks (CA, NY, etc.)

Do I need an operating agreement if I’m the only member?

While not legally required in most states, a single-member operating agreement is still highly recommended. It helps establish your LLC as a separate entity from yourself (reinforcing liability protection), provides clear rules for business operations, and can be essential if you need business financing or plan to add members later.

Can I form an LLC in a state where I don’t live?

Yes, you can form an LLC in any state, regardless of where you live. However, if you’re physically operating in a different state, you may need to register as a foreign LLC there as well. Digital businesses have more flexibility in this regard.

What’s the difference between a member-managed and manager-managed LLC?

In a member-managed LLC, all owners (members) participate in day-to-day operations and decision-making. This is the most common structure for small businesses. In a manager-managed LLC, members appoint specific individuals (who may or may not be members) to manage operations while the members take a more passive role, similar to shareholders.

How do LLC taxes work for digital nomads?

LLC members must report business income on their personal tax returns. For US citizens, worldwide income is taxable regardless of where you live. However, the Foreign Earned Income Exclusion may allow qualifying digital nomads to exclude a portion of foreign earned income. State tax obligations depend on your domicile and where business is conducted.

Start Your LLC by State

Choose your state to follow our step-by-step guide.

Each state has unique LLC formation requirements, fees, and procedures. For state-specific guidance on starting your LLC, consult detailed guides for these states:

Conclusion: Your Path to Entrepreneurial Success

Figuring out how to start an LLC is a significant step in your entrepreneurial journey—one that provides crucial legal protection and business legitimacy while offering flexibility for growth. For digital entrepreneurs and remote business owners, an LLC structure creates a stable foundation from which to operate globally.

By following the steps outlined in this guide on how to start an LLC, you can confidently establish your business and focus on what matters most: building and growing your business. Remember that compliance requirements continue after formation, so developing systems to maintain your LLC’s good standing is essential for long-term success.

Ready to Take the Next Step?

BusinessAnywhere.io makes LLC formation simple for digital entrepreneurs and remote business owners. Our comprehensive services include:

- Free business registration in all 50 states

- Professional registered agent service ($147/year)

- Custom operating agreement creation ($97)

- Compliance monitoring to ensure your LLC remains in good standing

Sign up today to begin your LLC formation process with BusinessAnywhere.io—the preferred partner for location-independent entrepreneurs.