Starting an LLC in New York offers significant advantages for digital nomads and remote entrepreneurs, but the process involves unique challenges that don’t exist in other states. New York’s publication requirement, varying county costs, and specific compliance rules can cost unprepared founders thousands of dollars and months of delays.

This comprehensive guide covers everything you need to know about forming a New York LLC, from initial planning through ongoing compliance. We’ll explore cost-effective strategies, common pitfalls, and practical solutions based on real-world experience helping location-independent professionals navigate New York’s business formation process.

Why New York Appeals to Remote Entrepreneurs

New York’s business environment offers distinct advantages that make it attractive despite the complexity:

Legal Framework and Protection: New York courts have a long history of upholding LLC protections when proper formalities are maintained. The state’s sophisticated legal system provides stronger asset protection compared to many jurisdictions, particularly valuable for high-revenue service businesses.

Financial Infrastructure: Access to world-class banking, payment processing, and financial services gives New York LLCs advantages in establishing business credit and handling complex financial arrangements. Many international clients prefer working with US entities that have established banking relationships.

Market Credibility: A New York business address carries significant weight in professional services, consulting, and technology sectors. This credibility can be particularly valuable when competing for high-value contracts or establishing partnerships.

Tax Considerations: While New York has state-level taxes, LLCs benefit from pass-through taxation that avoids double taxation. For growing businesses, the option to elect S Corporation status can provide substantial self-employment tax savings.

Understanding New York LLC Formation Costs

The total cost to form a New York LLC varies significantly based on strategic choices, particularly regarding publication requirements:

Mandatory State Fees:

- Articles of Organization filing: $200

- Certificate of Publication: $50

- Total required state fees: $250

Publication Requirement Costs by County (2025 estimates):

- Manhattan (New York County): $1,500-$2,000

- Brooklyn (Kings County): $1,200-$1,600

- Queens: $1,000-$1,400

- Bronx: $800-$1,200

- Nassau County: $500-$800

- Albany County: $300-$400

- Most upstate counties: $300-$500

Strategic Cost Management: Many successful entrepreneurs establish their LLC in Albany County using a virtual address, potentially saving over $1,000 while maintaining full legal compliance.

Complete Step-by-Step Formation Process

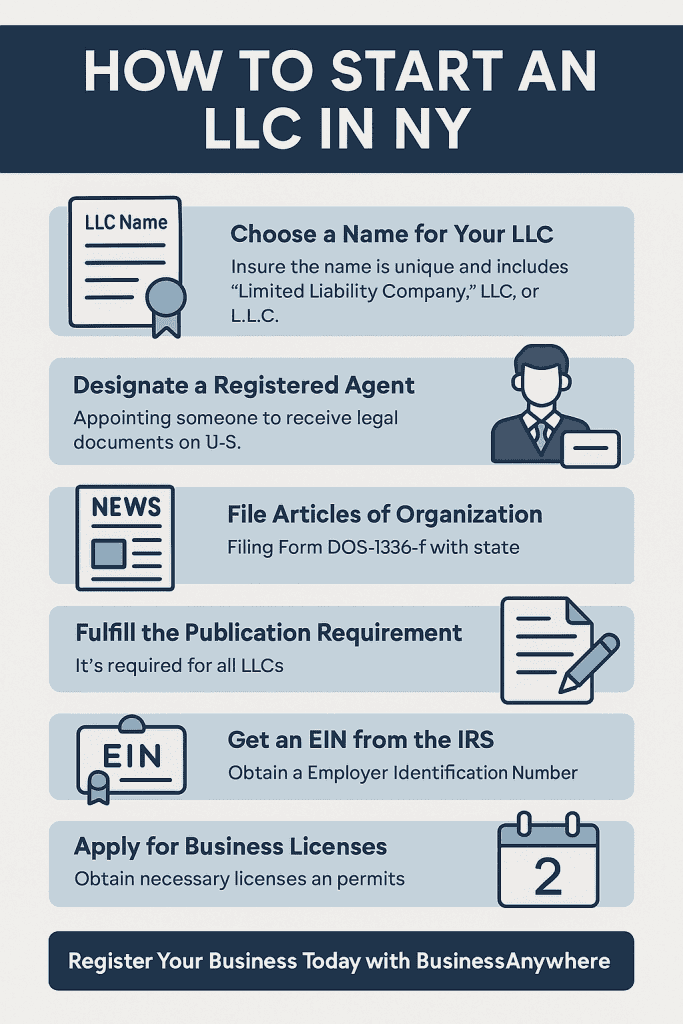

Step 1: Strategic Name Selection and Reservation

Your LLC name must comply with New York requirements while supporting your business goals:

Legal Requirements:

- Must include “Limited Liability Company,” “LLC,” or “L.L.C.”

- Must be distinguishable from existing registered entities in New York

- Cannot include restricted terms without proper licensing

Name Availability Research:

- Search the New York Department of State database

- Check federal trademark databases at USPTO.gov

- Verify domain name availability

- Review social media handle availability

For detailed instructions on conducting thorough name searches, see our guide on how to do a New York business entity search.

Name Reservation Process: If you need time to coordinate other business setup steps, reserve your chosen name by filing Form 1233-f with the Department of State for $20, securing your name for 60 days.

Step 2: Registered Agent Selection

Every New York LLC must have a registered agent with specific qualifications:

Registered Agent Requirements:

- Must be an individual over 18 or a qualified business entity

- Must have a physical street address in New York (P.O. boxes not acceptable)

- Must be available during normal business hours

- Must be able to receive legal documents in person

Options Available:

- Secretary of State (Default): Free but provides no privacy protection

- Professional Service: $100-$300 annually, includes privacy protection and immediate notifications

- Self-Service: Requires maintaining a New York address and compromises privacy

For remote entrepreneurs, professional registered agent services are typically the best choice when combined with virtual mailbox services for complete address privacy.

Step 3: File Articles of Organization

The Articles of Organization officially create your LLC as a legal entity using Form DOS-1336-f. You can file online through the New York Business Express portal or download the form from the New York Department of State.

Required Information:

- Exact LLC name

- County where the LLC will be located (affects publication costs significantly)

- Registered agent name and address

- Mailing address for service of process

- Business purpose

- Management structure designation

Filing Methods:

- Online Filing (Recommended): $200 fee, 1-3 business days processing via New York Business Express

- Mail Filing: $200 fee plus postage, 1-2 weeks processing

- Expedited Processing: Additional $25 fee for 24-hour processing

Critical Consideration: County selection directly affects publication costs. Manhattan publications can cost $1,500+ while Albany typically costs $300-400.

Step 4: Navigate the Publication Requirement

New York’s unique publication requirement must be completed within 120 days of formation:

Publication Process:

- Publish notice in two newspapers (one daily, one weekly) for six consecutive weeks

- Newspapers must be designated by the county clerk

- Obtain affidavits of publication from each newspaper

- File Certificate of Publication with affidavits and $50 fee

Cost-Effective Strategy: Many entrepreneurs legally reduce publication costs by establishing the LLC in Albany County using a virtual mailbox service, maintaining full compliance while saving $1,000+.

Failure to complete publication requirements results in LLC suspension and loss of good standing, affecting banking relationships and legal protections.

Step 5: Draft Your Operating Agreement

New York legally requires all LLCs to have a written operating agreement within 90 days of formation:

Essential Components:

- Member identification and ownership percentages

- Management structure and decision-making procedures

- Capital contributions and profit distribution

- Member withdrawal and dissolution procedures

- Banking and financial management procedures

For comprehensive guidance on creating effective operating agreements, see our complete guide to LLC operating agreements and how to draft an LLC operating agreement.

Step 6: Obtain Your Federal EIN

Your Employer Identification Number (EIN) serves as your business’s federal tax identification. Apply directly through the IRS website for free.

Application Process:

- Visit the official IRS EIN application portal

- Complete the online form with your LLC information

- Receive EIN immediately upon completion

- Download and save your EIN confirmation letter

Important: The IRS provides EINs completely free. Avoid third-party services that charge fees for this service.

Step 7: Research Required Licenses and Permits

Most businesses require additional authorizations beyond basic LLC formation:

Federal Licenses: Industry-specific requirements from agencies like the FDA, FCC, or SEC State Licenses: Professional licenses for doctors, lawyers, CPAs, and other regulated professions Local Permits: Business operating permits, zoning compliance, and industry-specific requirements

Use New York Business Express to research specific licensing requirements for your industry and location.

Step 8: Establish Banking and Maintain Compliance

Business Banking Setup: Open a business bank account using your Articles of Organization, operating agreement, EIN confirmation letter, and government-issued ID. This separation is crucial for maintaining liability protection.

Ongoing Compliance Requirements:

- Biennial Statements: File every two years for $9 to maintain good standing

- Tax Obligations: Annual federal and state tax filings

- License Renewals: Track and renew all business licenses and permits

Advanced Strategies and Considerations

Tax Optimization for Growing Businesses

S Corporation Election: LLCs earning over $60,000-$80,000 annually may benefit from electing S Corporation tax treatment to reduce self-employment taxes. Consult with a CPA to analyze your specific situation.

Multi-State Operations: When expanding beyond New York, register as a foreign LLC in new operating states and understand nexus and tax implications.

Asset Protection Best Practices

Maintain Corporate Formalities:

- Keep business and personal finances completely separate

- Document all major business decisions

- Maintain proper business insurance coverage

- Use professional contracts and agreements

Record Keeping: Maintain detailed financial records, meeting minutes, contracts, and tax documents to support business legitimacy and protect liability shields.

Common Mistakes to Avoid

Formation Errors

Inadequate Name Research: Conduct comprehensive searches including state databases, federal trademarks, and domain availability before finalizing your name choice.

Poor County Selection: Evaluate county selection based on actual business needs and cost implications rather than perceived prestige.

Using Personal Addresses: Protect privacy by using virtual mailbox services instead of personal home addresses for business registration.

Operational Mistakes

Ignoring Publication Requirements: Complete publication requirements immediately to avoid LLC suspension and compliance issues.

Financial Commingling: Maintain separate business bank accounts and credit profiles from day one to preserve liability protection.

Missing Compliance Deadlines: Implement systematic calendar management for biennial statements, tax filings, and license renewals.

Industry-Specific Considerations

Professional Services

Professional LLC (PLLC) Requirements: Certain licensed professions must form PLLCs with additional licensing and insurance requirements.

Technology and Digital Services

Intellectual Property Protection: Implement trademark registration, copyright management, and trade secret protection procedures.

Data Privacy Compliance: Develop privacy policies and security measures for websites and digital services.

E-commerce and Online Retail

Multi-State Sales Tax: Understand economic nexus rules and implement proper sales tax collection and remittance systems.

Product Liability: Maintain appropriate insurance coverage and quality control procedures.

Frequently Asked Questions

Formation and Costs

How much does it cost to start a New York LLC? Total costs range from $600 to $2,000, with the publication requirement being the primary variable cost depending on county selection.

Can non-US residents form a New York LLC? Yes, there are no residency requirements. Non-residents need an ITIN or Social Security Number, New York registered agent, and typically a US bank account.

How long does formation take? Articles of Organization: 1-3 business days (online filing) Publication requirement: 6-8 weeks Total timeline: 2-3 months for complete compliance

Operations and Compliance

What’s the publication requirement? New York requires publishing formation notice in two newspapers for six consecutive weeks within 120 days of formation. Costs vary dramatically by county.

How often do I file reports? New York requires biennial statements every two years for $9, plus annual tax filings.

Can I operate from outside New York? Yes, but you must maintain a New York registered agent and may need licenses in states where you actively conduct business.

Banking and Growth

What do I need for a business bank account? Articles of Organization, operating agreement, EIN confirmation, government ID, and initial deposit.

When should I consider S Corp election? Generally beneficial when LLC profits exceed $60,000-$80,000 annually for self-employment tax savings.

Resources for Success

Government Resources

- New York Department of State – Division of Corporations: Official LLC filing and information

- New York Department of Taxation and Finance: State tax registration and compliance

- IRS Small Business Resources: Federal tax guidance and EIN applications

- SBA Business Guide: Comprehensive business planning resources

Professional Development

- SCORE Mentorship: Free business mentoring and education

- Small Business Development Centers: Consulting and educational programs

- Industry associations: Profession-specific guidance and networking

Additional BusinessAnywhere Resources

- Business Registration Service: Complete formation assistance

- Virtual Mailbox Services: Professional business addresses

- Operating Agreement Templates: Professionally drafted agreements

Conclusion

Forming a New York LLC requires careful navigation of unique requirements, but the benefits for digital nomads and remote entrepreneurs are substantial. The state’s robust legal framework, sophisticated financial infrastructure, and global business recognition provide advantages that justify the additional complexity and costs.

Key Success Factors:

- Strategic planning for county selection and registered agent services

- Professional guidance for complex requirements like publication

- Systematic compliance management for ongoing requirements

- Proper business infrastructure from formation

With proper preparation and understanding, your New York LLC will provide the legal foundation for long-term business success in one of the world’s most dynamic business environments.

This guide provides educational information about New York LLC formation and should not be construed as legal or tax advice. Specific situations may require professional consultation with qualified attorneys, accountants, or business advisors. Laws and regulations change regularly, so verify current requirements with official sources before making business decisions.

About the Author: This guide reflects extensive experience in business formation and compliance, with particular expertise in helping location-independent professionals navigate complex state requirements. The information presented is based on current New York State laws and regulations as of 2025.

- Related Posts

- How to Start an LLC in Delaware in 2025

- How to Start an LLC in Florida (The Right Way)

- How to Start an LLC in Maryland: Step-by-Step Guide to Launching Your Business

- How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

- How to Start an LLC in New Hampshire: Filing, Costs, and Tax Basics

- How to Start an LLC in New Jersey: Avoid Common Filing Mistakes

- How to Start an LLC in Pennsylvania: Legal, Tax, and Filing Essentials

- How to Start an LLC in Rhode Island: Registration, Fees, and Formation Guide

- How to Start an LLC in Texas: A No-Nonsense Guide for 2025

- How to Start an LLC in Virginia: Steps, Costs, and Compliance Tips

- How to Start an LLC in Washington D.C.: What You Need to Know to Register

- How to Start a Wyoming LLC in 2025