Florida has emerged as America’s entrepreneurial hotspot, with population growth of 3.0% in recent years, making it one of the fastest-growing states in the nation. This unprecedented growth has created a thriving business ecosystem that’s particularly attractive to digital nomads, remote entrepreneurs, and location-independent professionals seeking to establish their business foundations in a tax-friendly, business-welcoming environment. If you’re wondering how to start an LLC in Florida, this environment offers all the resources you need.

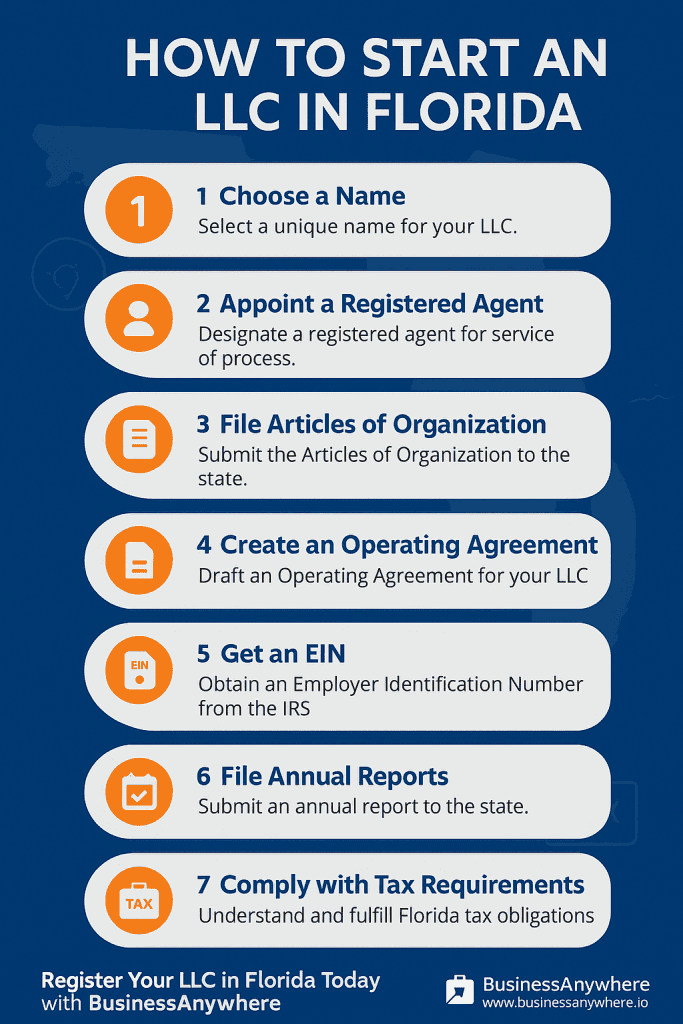

Starting a Limited Liability Company (LLC) in Florida offers entrepreneurs significant advantages, including robust personal asset protection, operational flexibility, and favorable tax treatment. This comprehensive guide will walk you through every step of the Florida LLC formation process, from initial planning to final registration, ensuring you have all the knowledge needed to establish your business successfully.

Why Choose Florida for Your LLC? The Strategic Advantages

Tax Benefits That Make a Difference

Florida stands out among U.S. states for its business-friendly tax structure. The state imposes no personal income tax, which means LLC members can potentially save thousands annually compared to high-tax states like California or New York. Additionally, Florida doesn’t impose a franchise tax on LLCs, unlike many other states that charge annual franchise fees ranging from $50 to $800 or more.

Business Climate and Economic Growth

The Sunshine State has consistently ranked among the top states for business formation, with over 300,000 new businesses registered annually. This robust business environment is supported by:

- Diverse economy: From tech startups in Miami and Orlando to tourism and agriculture

- Strategic location: Gateway to Latin American markets and international trade

- Growing talent pool: Influx of professionals from other states brings diverse skills

- Infrastructure investment: Continuous improvements in transportation and technology

Legal Protections and Business Structure Benefits

Florida LLCs provide comprehensive liability protection, shielding personal assets from business debts and legal claims. The state’s LLC laws are well-established and business-friendly, offering flexibility in management structure and operational procedures that accommodate both single-member and multi-member LLCs.

Step 1: Choose and Reserve Your Florida LLC Name

Legal Requirements for LLC Names in Florida

Your Florida LLC name must comply with specific state requirements to ensure legal compliance and avoid rejection during the filing process:

Mandatory Designation Requirements

- Must include “Limited Liability Company” or acceptable abbreviations (LLC, L.L.C.)

- Cannot be identical or confusingly similar to existing registered entities

- Must be distinguishable from other business names on file with the Florida Secretary of State

Prohibited and Restricted Words

Florida law prohibits certain words in business names without proper authorization:

Completely Prohibited Words:

- Government agency references (Treasury, FBI, State Department)

- Words suggesting government affiliation without authorization

- Profanity or offensive language

Restricted Words Requiring Additional Documentation:

- Financial terms: Bank, Credit Union, Trust Company, Insurance

- Professional designations: Attorney, Lawyer, Doctor, Certified Public Accountant

- Educational terms: University, College (without proper accreditation)

Name Availability Search Process

Before committing to a business name, conduct a thorough availability search:

- Florida Secretary of State Database: Use the official business search portal to check name availability

- Federal Trademark Search: Check the USPTO database to avoid trademark conflicts

- Domain Name Availability: Secure matching web domains for your digital presence

- Social Media Handles: Verify availability across major platforms

Florida’s Unique Name Reservation Policy

Important Note: Florida is the only U.S. state that does not allow name reservations. This means you cannot hold a desired name while preparing your paperwork. If you’ve identified the perfect name, you should proceed with formation quickly to secure it before another entity claims it.

Professional Naming Strategies for Digital Entrepreneurs

When selecting your LLC name, consider these strategic factors:

- SEO Optimization: Include relevant keywords that potential customers might search for

- Brandability: Choose a name that’s memorable and easy to pronounce

- Scalability: Avoid overly specific names that might limit future growth

- International Considerations: Ensure the name works well if you plan to expand globally

- Legal Requirements: Understand whether you need to include LLC in your business name for all business communications

Step 2: Designate Your Registered Agent – A Critical Decision

Understanding the Registered Agent Role

A registered agent serves as your LLC’s official point of contact for legal documents, government correspondence, and important notices. This person or entity must be available during standard business hours (typically 9 AM to 5 PM, Monday through Friday) to receive time-sensitive legal documents.

Legal Requirements for Florida Registered Agents

Your registered agent must meet specific criteria:

- Residency: Must be a Florida resident with a physical street address (not a P.O. Box)

- Business Authorization: If using a company, it must be authorized to conduct business in Florida

- Availability: Must be accessible during regular business hours

- Physical Presence: Must have a physical address where documents can be served

Why You Shouldn’t Serve as Your Own Registered Agent

While legally permissible, serving as your own registered agent presents several significant disadvantages:

Privacy Concerns

- Your personal address becomes part of public records

- Anyone can look up your registered agent information online

- Privacy is compromised for home-based businesses

- Consider anonymous LLC registration options for maximum privacy protection

Operational Challenges

- Must be physically present at the registered address during business hours

- Cannot travel or work remotely without risking missed service

- Professional image may suffer if using a home address

Legal and Compliance Risks

- Missing important legal documents can result in default judgments

- Failure to respond to government notices may trigger penalties

- Annual report deadlines and tax notices require immediate attention

Professional Registered Agent Services: The Smart Choice

Business Anywhere’s registered agent service provides comprehensive support for location-independent entrepreneurs:

Key Benefits:

- Privacy Protection: Your personal address remains confidential

- Reliable Service: Professional staff ensures no documents are missed

- Digital Convenience: Document scanning and digital delivery options

- Compliance Monitoring: Proactive alerts for important deadlines

- Cost-Effective: Annual fees typically cost less than the risk of missed documents

Step 3: File Your Articles of Organization – The Official Formation

Understanding Articles of Organization

The Articles of Organization is the foundational legal document that officially creates your LLC. Florida’s streamlined online filing system makes this process efficient and straightforward.

Required Information for Your Articles

Basic Entity Information

- LLC Name: Your chosen business name (including required designation)

- Principal Address: Primary business location (can be anywhere in the U.S.)

- Mailing Address: Where official correspondence should be sent

Registered Agent Details

- Name: Full legal name of your registered agent

- Address: Complete Florida street address (P.O. Boxes not accepted)

- Acceptance: Registered agent’s consent to serve

Management Structure

Choose between two management options:

Member-Managed LLC

- All members participate in daily operations and decision-making

- More informal structure suitable for small businesses

- Each member can bind the company in business transactions

Manager-Managed LLC

- Designated managers handle operations while members remain passive investors

- Better for businesses with silent partners or investor members

- Managers must be specifically identified in the Articles

Duration and Purpose

- Duration: Most LLCs choose “perpetual” (indefinite existence)

- Purpose: General business purpose statement (can be broad)

Filing Process and Timeline

Online Filing (Recommended)

- Cost: $125 state filing fee

- Processing Time: 3-5 business days for standard processing

- Expedited Options: Same-day processing available for additional fees

Paper Filing

- Cost: $125 state filing fee plus potential delays

- Processing Time: 2-3 weeks

- Not Recommended: Slower processing and higher error rates

Post-Filing: Your Certificate of Formation

Once approved, you’ll receive a Certificate of Formation from the Florida Secretary of State. This document serves as official proof of your LLC’s legal existence and should be kept in your corporate records.

Step 4: Create Your Operating Agreement – The Business Blueprint

Why Every Florida LLC Needs an Operating Agreement

Although Florida law doesn’t require LLCs to have operating agreements, creating one is essential for several critical reasons:

Legal Protection

- Court Reference: Judges reference operating agreements during disputes

- Limited Liability: Helps maintain the corporate veil protecting personal assets

- Credibility: Demonstrates professionalism to banks, investors, and partners

Operational Clarity

- Decision-Making: Establishes clear procedures for business decisions

- Conflict Resolution: Provides mechanisms for resolving member disagreements

- Succession Planning: Addresses what happens when members leave or die

Essential Components of Your Operating Agreement

Understanding what an LLC membership certificate is can help you better structure your ownership documentation alongside your operating agreement.

Member Information and Ownership Structure

- Member Details: Full names, addresses, and contact information

- Ownership Percentages: Each member’s stake in the company

- Capital Contributions: Initial investments and future contribution requirements

- Profit and Loss Allocation: How earnings and losses are distributed

Management and Operations

- Management Structure: Member-managed vs. manager-managed designation

- Voting Rights: How decisions are made and what requires unanimous consent

- Meeting Requirements: Frequency and procedures for member meetings

- Record Keeping: Requirements for maintaining corporate books and records

Financial Provisions

- Banking: Requirements for business bank accounts and financial management

- Accounting Methods: How the LLC will handle bookkeeping and tax reporting

- Distributions: When and how profits are distributed to members

- Additional Capital: Procedures for obtaining additional funding

Transfer and Exit Provisions

- Transfer Restrictions: Limitations on selling or transferring membership interests

- Buy-Sell Agreements: Procedures for member buyouts

- Dissolution: Circumstances that trigger LLC dissolution

- Succession Planning: What happens to membership interests upon death or incapacity

Professional Operating Agreement Development

While template operating agreements are available online, having a customized agreement drafted by an experienced business attorney ensures your specific needs are addressed and potential issues are anticipated.

Step 5: Obtain Your Employer Identification Number (EIN)

Understanding the EIN Requirement

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, serves as your LLC’s “Social Security number” for tax and business purposes.

When You Need an EIN

Mandatory Situations

- Multiple Members: All multi-member LLCs must obtain an EIN

- Employees: Required if you plan to hire employees

- Business Banking: Most banks require an EIN to open business accounts

- Tax Elections: Needed for certain tax classifications

Optional but Recommended Situations

- Single-Member LLCs: Not required but highly recommended

- Professional Image: Shows credibility to vendors and customers

- Future Planning: Easier to obtain now than later when needed urgently

How to Apply for Your EIN (Free Process)

IRS Online Application (Recommended)

- Cost: Completely free through the IRS website

- Processing Time: Immediate (receive EIN instantly)

- Availability: Available Monday-Friday, 7 AM to 10 PM EST

Important Warning About Third-Party Services

Many websites charge $50-$300 for EIN applications, but this service is always free directly through the IRS. Avoid unnecessary fees by using the official IRS website.

Required Information for EIN Application

- LLC Name: Exact name as filed with Florida Secretary of State

- Responsible Party: SSN of the person responsible for the LLC

- Business Address: Physical location where business is conducted

- Formation Date: Date your Articles of Organization were filed

Step 6: State Business License Requirements

Industry-Specific Licensing in Florida

Florida requires specific licenses for certain professions and industries. The licensing requirements vary significantly based on your business activities.

Professional Licenses Through DBPR

The Florida Department of Business and Professional Regulation (DBPR) oversees numerous professional licenses:

Healthcare Professionals:

- Physicians, Nurses, Dentists, Pharmacists

- Mental Health Counselors, Physical Therapists

- Veterinarians, Optometrists

Legal and Financial Professionals:

- Attorneys, Certified Public Accountants

- Real Estate Agents and Brokers

- Insurance Agents, Investment Advisors

Service Professionals:

- Barbers, Cosmetologists, Massage Therapists

- Contractors, Electricians, Plumbers

- Security Guards, Private Investigators

Industry-Specific Requirements

Food Service and Retail:

- Food service licenses through the Department of Health

- Retail sales tax permits through the Department of Revenue

- Alcohol licenses if serving or selling alcoholic beverages

Online and Digital Businesses:

- Generally require fewer licenses

- May need sales tax permits for e-commerce

- Professional licenses if offering regulated services online

License Application Process

Most professional licenses require:

- Education: Completion of approved educational programs

- Examination: Passing state-administered professional exams

- Experience: Documented relevant work experience

- Background Check: Criminal history review

- Continuing Education: Ongoing professional development requirements

Step 7: Open Your Business Bank Account – Financial Separation

Why Business Banking is Essential

Maintaining separate business and personal finances is crucial for LLC owners for several important reasons:

Legal Protection

- Corporate Veil: Helps maintain limited liability protection

- Court Scrutiny: Judges look unfavorably on commingled finances

- Asset Protection: Clearer distinction between personal and business assets

Tax and Accounting Benefits

- Simplified Bookkeeping: Easier to track business income and expenses

- Audit Protection: Reduces IRS scrutiny and audit risk

- Deduction Documentation: Clear records support business tax deductions

Professional Credibility

- Customer Confidence: Professional appearance builds trust

- Vendor Relations: Easier to establish business credit relationships

- Banking Services: Access to business-specific financial products

Required Documents for Business Banking

When opening your business bank account, banks typically require:

Entity Documentation

- Certificate of Formation: Proof of LLC registration with Florida

- EIN Letter: IRS confirmation of your tax identification number

- Operating Agreement: Many banks require this document

Personal Identification

- Government-Issued ID: Driver’s license or passport for all signers

- Personal Information: Social Security numbers for account signers

- Credit Check: Banks may review personal credit for new business accounts

Choosing the Right Business Bank

Traditional Banks vs. Online Banks

Traditional Banks:

- Advantages: In-person service, extensive ATM networks, relationship banking

- Disadvantages: Higher fees, more stringent requirements, limited hours

Online Banks:

- Advantages: Lower fees, better interest rates, 24/7 access

- Disadvantages: No physical branches, limited cash deposit options

Key Features to Consider

Fee Structure:

- Monthly maintenance fees

- Transaction limits and overage charges

- ATM fees and reimbursement policies

- Wire transfer and ACH fees

Digital Banking Features:

- Mobile app functionality and user experience

- Online bill pay and automated payments

- Integration with accounting software

- Real-time transaction notifications

Business Services:

- Business credit cards and lines of credit

- Merchant services for payment processing

- Payroll services and direct deposit

- Business loans and equipment financing

Florida LLC Ongoing Compliance Requirements

Annual Report Filing

Florida LLCs must file an annual report with the Secretary of State:

Filing Requirements

- Due Date: By May 1st each year

- Filing Fee: $138.75 (subject to change)

- Late Penalties: $400 penalty plus potential administrative dissolution

Required Information

- Current business address and registered agent information

- Names and addresses of all members and managers

- Brief description of business activities

Tax Obligations and Elections

Federal Tax Considerations

- Default Classification: Single-member LLCs are disregarded entities; multi-member LLCs are partnerships

- Tax Elections: Can elect corporate taxation (Form 8832) or S-Corporation status (Form 2553)

- Quarterly Payments: May need to make estimated tax payments

Florida State Tax Requirements

- No Income Tax: Florida doesn’t impose state income tax on LLCs

- Sales Tax: Required if selling taxable goods or services

- Employer Taxes: Unemployment and workers’ compensation if you have employees

Maintaining Limited Liability Protection

To preserve your LLC’s liability protection:

Corporate Formalities

- Separate Records: Maintain distinct business records and accounts

- Meeting Documentation: Keep records of important business decisions

- Contract Signing: Always sign contracts in your LLC capacity

Financial Separation

- Business Banking: Never commingle personal and business funds

- Business Credit: Establish credit in the LLC’s name

- Expense Documentation: Keep detailed records of all business expenses

Common Mistakes to Avoid When Starting a Florida LLC

Formation Errors

Name-Related Problems

- Similarity Issues: Choosing names too similar to existing businesses

- Trademark Conflicts: Not researching federal trademark databases

- Domain Unavailability: Failing to secure matching web domains

Documentation Mistakes

- Incomplete Articles: Missing required information or signatures

- Registered Agent Issues: Using unavailable or unreliable agents

- Address Problems: Using P.O. Boxes where street addresses are required

Post-Formation Compliance Failures

Operating Agreement Oversights

- No Agreement: Operating without a written operating agreement

- Generic Templates: Using inappropriate template agreements

- Outdated Terms: Failing to update agreements as business evolves

Tax and Banking Errors

- EIN Delays: Waiting too long to obtain necessary tax identification

- Commingled Funds: Mixing personal and business finances

- License Oversights: Operating without required professional licenses

Advanced Strategies for Digital Entrepreneurs

Multi-State Considerations

If you’re a digital nomad or plan to operate in multiple states:

Foreign Qualification

- Registration Requirements: May need to register in states where you conduct significant business

- Tax Obligations: Understanding nexus rules for state tax purposes

- Compliance Costs: Budgeting for multi-state registration and filing fees

Delaware vs. Florida LLCs

- Delaware Advantages: Established business law, Court of Chancery

- Florida Advantages: No state income tax, lower costs, simpler compliance

- Decision Factors: Consider your specific business needs and growth plans

Asset Protection Strategies

Series LLCs

Florida allows Series LLCs, which can provide additional asset protection:

- Separate Liability: Each series has separate liability protection

- Cost Efficiency: One filing fee covers multiple business units

- Complexity: Requires careful management and documentation

Charging Order Protection

Florida provides strong charging order protection for LLCs:

- Creditor Limitations: Creditors generally cannot force distributions or seize LLC assets

- Single-Member Exception: Some protection may be limited for single-member LLCs

- Professional Advice: Consult with asset protection attorneys for complex situations

International Considerations

For entrepreneurs with global operations:

Tax Treaty Benefits

- Foreign Tax Credits: Potential benefits from U.S. tax treaties

- FATCA Compliance: Reporting requirements for foreign financial accounts

- Professional Guidance: International tax attorneys are essential

Banking and Finance

- Multi-Currency Accounts: Consider banks with international capabilities

- Transfer Costs: Evaluate fees for international wire transfers

- Compliance Requirements: Understanding foreign banking regulations

Note: LLC costs vary significantly by state, so compare Florida’s fees with other business-friendly jurisdictions before making your final decision.

Step-by-Step Action Plan: Your Florida LLC Formation Checklist

Phase 1: Pre-Formation Planning (1-2 weeks)

Week 1: Research and Planning

- Research your industry’s licensing requirements

- Conduct comprehensive name availability searches

- Secure matching domain names and social media handles

- Research registered agent service options

- Determine your LLC’s management structure

Week 2: Professional Consultations

- Consult with a business attorney about your operating agreement

- Meet with an accountant about tax elections and planning

- Interview registered agent service providers

- Research business banking options in your area

Phase 2: Official Formation (1 week)

Day 1-2: Final Preparations

- Finalize your LLC name choice

- Engage your chosen registered agent service

- Gather all required information for Articles of Organization

Day 3-5: Filing and Processing

- File Articles of Organization online with Florida Secretary of State

- Pay the $125 state filing fee

- Monitor filing status and await Certificate of Formation

Day 6-7: Immediate Post-Formation

- Apply for your EIN through the IRS website (free)

- Begin drafting your operating agreement

- Research professional licensing requirements if applicable

Phase 3: Operational Setup (2-3 weeks)

Week 1: Documentation and Agreements

- Finalize and execute your operating agreement

- Apply for required professional or business licenses

- Create your LLC record-keeping system

Week 2: Banking and Financial Setup

- Gather required documents for business banking

- Open your business bank account

- Apply for business credit cards if needed

- Set up accounting software or bookkeeping system

<strong>Week 3: Compliance and Operations

- Register for Florida sales tax if applicable

- Set up payroll systems if hiring employees

- Create calendar reminders for ongoing compliance requirements

- Establish relationships with key professional service providers

Phase 4: Ongoing Maintenance (Ongoing)

Monthly Tasks

- Reconcile business bank accounts

- Review and categorize business expenses

- Update business records and meeting minutes

- Monitor compliance requirements and deadlines

Annual Tasks

- File Florida annual report by May 1st

- Review and update operating agreement as needed

- Conduct annual review of business licenses

- Plan for tax filing and estimated payments

Frequently Asked Questions (FAQ)

How long does it take to start an LLC in Florida?

The Florida LLC formation process typically takes 5-10 business days from start to finish. The state filing processing time is 3-5 business days for standard processing, with expedited same-day options available for additional fees. However, gathering required documents, choosing a registered agent, and completing post-formation requirements like obtaining an EIN and opening a business bank account can extend the total timeline to 2-3 weeks for a fully operational LLC.

How much does it cost to start an LLC in Florida?

The minimum cost to start a Florida LLC is $125 for the state filing fee. However, most entrepreneurs should budget $500-$1,500 for the complete formation process, including registered agent services ($100-$300 annually), operating agreement drafting ($300-$1,000), and initial business banking setup. Professional services like attorney consultations and accounting setup may add additional costs but provide valuable expertise and protection.

Can I start a Florida LLC if I don’t live in Florida?

Yes, you can form a Florida LLC regardless of where you live. Florida law allows non-residents to own and operate LLCs in the state. However, you must maintain a registered agent with a physical Florida address. Many out-of-state entrepreneurs use professional registered agent services like Business Anywhere to meet this requirement while maintaining privacy and ensuring reliable document service.

Do I need an operating agreement for my Florida LLC?

While Florida law doesn’t require LLCs to have operating agreements, creating one is strongly recommended and considered a best practice. An operating agreement provides legal protection, establishes clear operational procedures, and helps maintain limited liability protection. Courts reference operating agreements during disputes, and banks often require them for business account opening. Even single-member LLCs benefit from having formal operating agreements.

What’s the difference between member-managed and manager-managed LLCs in Florida?

Member-managed LLCs allow all members to participate in daily operations and decision-making, making it suitable for small businesses where all owners are actively involved. Manager-managed LLCs designate specific individuals (who may or may not be members) to handle operations while other members remain passive investors. This structure works well for businesses with silent partners or when members prefer not to be involved in day-to-day management.

Can I change my LLC name after formation in Florida?

Yes, you can change your Florida LLC name by filing Articles of Amendment with the Secretary of State. The process costs $25 and requires the new name to meet all standard naming requirements and be available for use. You’ll also need to update your operating agreement, bank accounts, business licenses, and other official documents to reflect the name change. It’s generally easier and less expensive to choose the right name initially.

What licenses do I need for my Florida LLC?

License requirements depend on your specific business activities. Professional services like healthcare, legal, accounting, and cosmetology require state professional licenses through the Florida Department of Business and Professional Regulation (DBPR). Many businesses also need local business tax receipts (often called business licenses) from their city or county. Online and service-based businesses typically have fewer licensing requirements but should verify their specific industry regulations.

How do I maintain my Florida LLC in good standing?

To maintain good standing, your Florida LLC must file an annual report by May 1st each year and pay the $138.75 filing fee. You should also maintain current registered agent information, keep your business address updated with the state, and ensure all required licenses remain current. Additionally, maintaining separate business finances, keeping proper records, and following your operating agreement helps preserve limited liability protection.

Conclusion: Your Florida LLC Success Strategy

Starting an LLC in Florida offers tremendous opportunities for digital entrepreneurs, location-independent professionals, and traditional business owners alike. The state’s business-friendly environment, tax advantages, and robust legal protections make it an ideal jurisdiction for establishing your business foundation.

Success in forming and operating your Florida LLC depends on careful planning, attention to detail, and ongoing compliance with state requirements. By following the comprehensive steps outlined in this guide, you’ll establish a solid legal and operational foundation for your business growth.

Key Takeaways for Success

Immediate Action Items:

- Conduct thorough name availability research before committing to a business name

- Engage a professional registered agent service to ensure reliable document service and privacy protection

- File your Articles of Organization promptly, as Florida doesn’t allow name reservations

- Obtain your EIN immediately after formation to enable business banking and operations

Long-Term Success Factors:

- Invest in a professionally drafted operating agreement tailored to your specific needs

- Maintain strict separation between personal and business finances

- Stay current with all compliance requirements, including annual reports and license renewals

- Build relationships with key professional service providers including attorneys, accountants, and business advisors

Take Action Today

Ready to start your Florida LLC journey? The process begins with a single step, and the sooner you begin, the sooner you can start building your business legacy in the Sunshine State.

Get Professional Support: At Business Anywhere, we specialize in helping digital entrepreneurs and location-independent professionals establish their business foundations efficiently and correctly. Our comprehensive business registration services include Florida LLC formation, registered agent services, and ongoing compliance support designed specifically for modern entrepreneurs.

Register with Business Anywhere today to get expert guidance through every step of your Florida LLC formation process. Our experienced team will ensure your business is properly established, compliant, and positioned for long-term success.

Don’t let another day pass without taking action on your entrepreneurial dreams. Your Florida LLC is the first step toward building the location-independent business you’ve always envisioned. Start today, and let us help make your business formation process seamless and successful.

Related Resources: LLC Formation in Other States

If you’re considering other states for your LLC formation or need to expand your business operations, explore our comprehensive guides for LLC registration across the United States:

Popular Business-Friendly States

- How to Start an LLC in Texas – No state income tax and pro-business environment

- How to Start an LLC in California – Navigate California’s complex requirements

- Wyoming LLC Formation – Premier asset protection and privacy benefits

- Nevada LLC Benefits – Strong privacy laws and tax advantages

Additional State Guides

- How to Start an LLC in Illinois – Midwest business hub with affordable formation costs

- How to Start an LLC in North Carolina – Growing business environment in the Southeast

- How to Start an LLC in Colorado – Ideal for outdoor and tech entrepreneurs

Cost Comparison and Planning

- LLC Cost by State Analysis – Compare formation and ongoing costs across all 50 states

- Complete State-by-State Cost Chart – Detailed 2025 pricing breakdown

Multi-State Business Resources

- LLC Registration in 45 US States – Our comprehensive state coverage

- Best States to Incorporate Your Business – Strategic state selection guide

- General LLC Formation Guide – Universal principles and best practices

Whether you’re expanding your business to multiple states or comparing options for your initial formation, these resources provide the expert guidance you need to make informed decisions about your business structure and location strategy.

This guide provides general information about Florida LLC formation and should not be considered legal or tax advice. Always consult with qualified professionals for guidance specific to your situation.