When starting a business in Nebraska or checking on an existing one, knowing how to navigate the Nebraska Secretary of State’s Business Entity Search tool is essential. This comprehensive guide walks you through the entire process of conducting a business entity search in Nebraska, with state-specific details you won’t find anywhere else.

What is the Nebraska Secretary of State Business Entity Search?

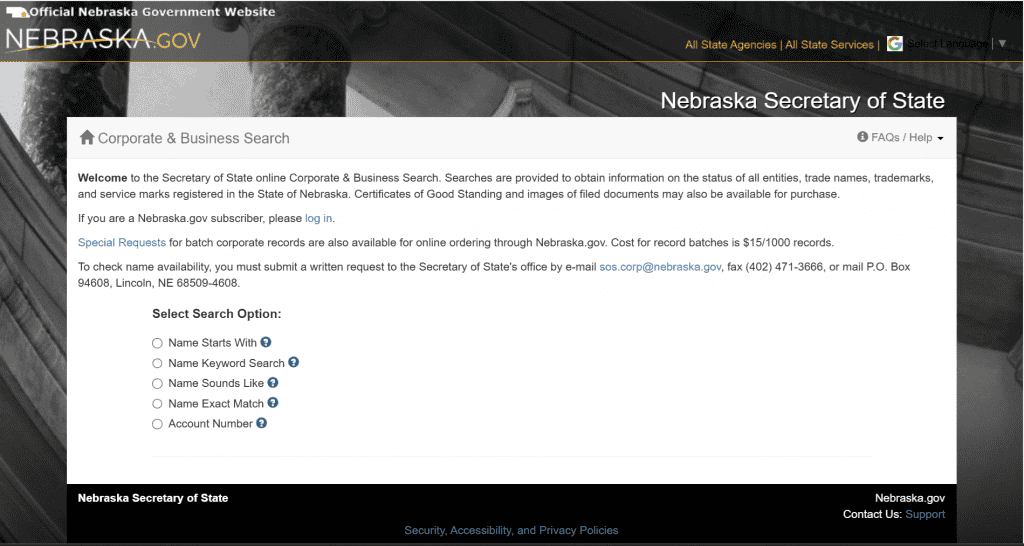

The Nebraska Secretary of State’s Business Entity Search is an official online database maintained by the Nebraska Secretary of State’s office. It allows users to search for information about all business entities registered in Nebraska, including corporations, LLCs, limited partnerships, trade names, and trademarks.

The official name of the search tool is the “Nebraska Secretary of State Corporate & Business Search,” and it’s completely free to use for basic searches. This database provides real-time access to current business information on file with the state.

Why You Might Need to Use the Nebraska Business Entity Search

There are several reasons why you might need to use this search tool:

- Starting a new business: Verify if your desired business name is available

- Checking business status: Confirm if an entity is in good standing with the state

- Due diligence: Research potential business partners or vendors

- Legal proceedings: Find registered agent information for service of process

- Competitor research: Gather public information about other businesses in your industry

- Verification: Confirm a business’s legal existence and registration details

How to Access the Nebraska Business Entity Search Tool

The Nebraska Business Entity Search tool can be accessed directly at: https://www.nebraska.gov/sos/corp/corpsearch.cgi?nav=search

You can also navigate to it by:

- Visiting the Nebraska Secretary of State website at https://sos.nebraska.gov/

- Clicking on “Business Services” in the navigation menu

- Selecting “Corporate and Business”

- Clicking on “Corporation and Business Search”

Unlike some states, Nebraska’s business search portal does not require creating an account or logging in for basic searches, making it easy for anyone to access.

Nebraska Business Entity Search: Step-by-Step Guide

Step 1: Choose Your Search Method

When you arrive at the search page, you’ll notice several search options. Nebraska’s system gives you multiple ways to search for a business entity:

- Name Starts With: Finds entities where the name begins with your search term

- Name Keyword Search: Locates entities where the name contains your search term anywhere

- Name Sounds Like: Uses phonetic matching to find similarly pronounced names

- Name Exact Match: Finds only entities with names matching your search exactly

- Account Number: Searches using the entity’s unique state-assigned account number

For most users conducting name availability searches, the “Name Keyword Search” option is most effective, as it will return any business with your desired name component.

Step 2: Enter Your Search Criteria

After selecting your search method, enter your search criteria in the provided field. Here are some Nebraska-specific tips:

- Nebraska’s search is not case sensitive, so “Cornhusker Enterprises” and “cornhusker enterprises” will return the same results

- When using “Name Keyword Search,” consider whether you want to match “Any Word” or “All Words” (this option appears after selecting Name Keyword Search)

- Avoid using business designators like “LLC” or “Inc.” in your initial search to get broader results

- For more precise results with common names, try the “Name Exact Match” option

- The system will automatically include similar variations (plurals, possessives) in your search results

Step 3: Complete the CAPTCHA

Nebraska’s system requires completing a CAPTCHA verification by checking the “I’m not a robot” box before proceeding. This is a security measure to prevent automated scraping of the database.

Step 4: Click “Perform Search”

After entering your search criteria and completing the CAPTCHA, click the “Perform Search” button to execute your search.

Step 5: Review Search Results

The search results page will display a table with the following information for each matching entity:

- Entity Name: The full legal name of the business

- Account Number: The unique identifier assigned by the Secretary of State

- Type: The business structure (LLC, Corporation, etc.)

- Status: Whether the entity is active, dissolved, or has another status

- Details: A link to view more information about the entity

Nebraska’s search results display up to 500 matches. If your search returns more than 500 results, you’ll need to refine your search criteria to narrow down the list.

Step 6: Access Detailed Entity Information

To view detailed information about a specific entity, click the “Details” button next to the entity name in the search results.

The details page provides comprehensive information about the business entity, including:

- Full legal name

- Account number

- Entity type

- Status (Active, Inactive, Dissolved, etc.)

- Formation date

- State of formation (for foreign entities)

- Duration (if not perpetual)

- Registered agent name and address

- Principal office address

- List of filed documents with dates

A unique feature of Nebraska’s business entity database is that it displays the date of the last biennial report filing, which can help determine if a business is maintaining good standing.

Step 7: Purchase Additional Information (Optional)

Nebraska allows you to purchase additional information directly through the search portal:

- Certificate of Good Standing: $10.00 (shows the entity is in compliance with state requirements)

- Certified Copies of Filed Documents: $10.00 + $0.50 per page

- Plain Copies of Documents: $1.00 per page

Credit card payment is required for these services. These documents can be delivered electronically or by mail.

Nebraska-Specific Search Tips and Quirks

Having conducted numerous Nebraska business entity searches, I’ve discovered several state-specific quirks and helpful tips:

Nebraska’s Search Engine Peculiarities

- Apostrophes and special characters: The search system sometimes has difficulty with apostrophes. If searching for “John’s Bakery” doesn’t return results, try “Johns Bakery”

- Spaces matter: Unlike some state databases, Nebraska’s search treats “Coffee House” and “Coffeehouse” as different names

- Partial word matching: The system doesn’t automatically search for partial words. “Construct” won’t find “Construction” unless you use the “Name Starts With” option

- No wildcard searches: Nebraska’s system doesn’t support wildcard characters like * or ?

- Entity types display: The search results page abbreviates entity types (DOM LLC = Domestic Limited Liability Company, FOR CORP = Foreign Corporation)

Status Meanings in Nebraska

Nebraska uses specific status labels in their search results:

- Active: The entity is in good standing and authorized to conduct business

- Admin Dissolution – Time: The entity was administratively dissolved for failing to file required reports

- Admin Dissolution – Tax: The entity was administratively dissolved for tax-related issues

- Vol Dissolution – Articles: The entity voluntarily dissolved by filing dissolution articles

- Name Reserved: The name is currently reserved but the entity is not yet formed

- Expired: For trade names, indicates the registration has expired

Understanding these status designations is crucial when evaluating search results.

Sample Business Entity Search Simulation

Let’s walk through a simulated search for “Cornhusker Consulting”:

- Go to the Nebraska Secretary of State Business Entity Search page

- Select “Name Keyword Search”

- Choose “Match All Words”

- Enter “Cornhusker Consulting” in the search field

- Complete the CAPTCHA verification

- Click “Perform Search”

Hypothetical results might show:

- Cornhusker Consulting, LLC (Active)

- Cornhusker Consulting Group, Inc. (Active)

- Cornhusker Financial Consulting Services, LLC (Admin Dissolution – Time)

Clicking on “Cornhusker Consulting, LLC” would reveal:

- Formation Date: March 15, 2018

- Registered Agent: John Smith, 1234 O Street, Lincoln, NE 68508

- Last Biennial Report: March 1, 2024

- Principal Office: 5678 P Street, Lincoln, NE 68510

This information tells us the business is active, formed in 2018, current on its filings, and provides contact information through the registered agent.

How to Reserve a Business Name in Nebraska

If your Nebraska business entity search confirms your desired name is available, you may want to reserve it while preparing to form your business. Here’s how:

- Submit a written request to reserve a name via email ([email protected]), fax (402-471-3666), or mail (Secretary of State, P.O. Box 94608, Lincoln, NE 68509-4608)

- Complete the appropriate name reservation application form:

- For corporations: Application for Reservation of Corporate Name

- For LLCs: Application for Reservation of Limited Liability Company Name

- For LPs: Application for Reservation of Limited Partnership Name

- Pay the $30 filing fee (checks made payable to “Nebraska Secretary of State”)

Name reservations in Nebraska are valid for 120 days and can be renewed if needed. This is a longer reservation period than many other states, giving you ample time to prepare your formation documents.

Name Availability Guidelines in Nebraska

Nebraska has specific naming requirements and restrictions:

Limited Liability Companies (LLCs):

- Must contain “Limited Liability Company,” “Limited Company,” or abbreviations like “LLC,” “L.L.C.,” “LC,” or “L.C.”

- Cannot be the same as or deceptively similar to an existing entity name

- Cannot contain words that falsely imply government affiliation

- Professional LLCs must indicate the profession (e.g., “Engineering” or “Legal”)

Corporations:

- Must contain “Corporation,” “Incorporated,” “Company,” “Limited,” or abbreviations like “Corp.,” “Inc.,” “Co.,” or “Ltd.”

- Cannot be the same as or deceptively similar to existing names

- Cannot contain words requiring special licensing without proof of appropriate credentials

- Benefit corporations must include “Benefit Corporation” or “B. Corporation”

Trade Names:

- Cannot be deceptively similar to existing registered names

- Must be distinguishable from other business names

- Registration is valid for 10 years (longer than many states)

What to Do After Your Nebraska Business Entity Search

If Your Desired Name is Available:

- Reserve the name (optional but recommended)

- Form your business entity:

- For LLCs: File a Certificate of Organization ($110 filing fee)

- For Corporations: File Articles of Incorporation ($110 filing fee)

- For Trade Names: File a Trade Name Application ($110 filing fee)

- Obtain necessary licenses and permits:

- Nebraska doesn’t have a general state business license

- Check local requirements with your city/county

- Research industry-specific licenses

- Register for taxes through the Nebraska Department of Revenue

- Set up business compliance processes to maintain good standing

If Your Desired Name is Not Available:

- Consider modifications to make your name distinguishable

- Research the existing business to see if it’s active or may be available for purchase

- Check name availability for a trade name (can be different from your legal entity name)

- Look into consent for similar name (in some cases, a similar name may be allowed with written consent from the existing business)

Nebraska Business Entity Filing Fees (2025)

Unlike many states, Nebraska maintains consistent filing fees across different entity types:

- LLC Formation (Certificate of Organization): $110

- Corporation Formation (Articles of Incorporation): $110

- Name Reservation: $30 (valid for 120 days)

- Trade Name Registration: $110 (valid for 10 years)

- Certificate of Good Standing: $10

- Articles of Amendment: $30

- Biennial Reports: $10-$30 for LLCs, based on assets for corporations

All filings can be submitted online through the Nebraska Secretary of State’s eDelivery service or by mail. Online filings incur an additional $2 processing fee.

Nebraska Secretary of State Contact Information

If you need assistance with your business entity search or have questions about business filings, contact:

Nebraska Secretary of State – Business Services Division

- Physical Address: 1201 N Street, Suite 120, Lincoln, NE 68508

- Mailing Address: P.O. Box 94608, Lincoln, NE 68509-4608

- Phone: (402) 471-4079

- Fax: (402) 471-3666

- Email: [email protected]

- Website: https://sos.nebraska.gov/business-services

Business Hours: Monday through Friday, 8:00 AM to 5:00 PM Central Time (excluding state holidays)

Frequently Asked Questions

How long does a name reservation last in Nebraska?

A business name reservation in Nebraska lasts for 120 days from the date of filing. This is longer than many other states (which often offer only 30-60 days), giving you more time to prepare your formation documents.

What do the different status labels mean in the Nebraska business search?

Nebraska uses several status designations:

- Active: The entity is in good standing

- Admin Dissolution – Time: Administratively dissolved for failing to file reports

- Admin Dissolution – Tax: Dissolved for tax-related issues

- Vol Dissolution – Articles: The entity voluntarily dissolved

- Cancelled: Registration has been canceled

- Expired: Registration period has ended (commonly for trade names)

Can I form a Nebraska LLC online?

Yes, Nebraska allows online formation through their Corporate Document eDelivery service at https://www.nebraska.gov/apps-sos-edocs/. You’ll need to upload a signed PDF of your formation document and pay by credit card. An additional $2 processing fee applies to online filings.

How often do Nebraska LLCs need to file reports?

Nebraska LLCs must file a biennial report (every two years) during even-numbered years. The report is due between January 1 and April 1, and the filing fee is $10. Failure to file can result in administrative dissolution.

What should I do if my desired business name is taken?

If your desired name is taken, you have several options:

- Modify your name to make it distinguishable

- Form under a different name but register a trade name for public use

- Use a different business entity designation

- In some cases, obtain consent from the existing name owner

- Check if the existing business is inactive and may be available for reinstatement

Does Nebraska allow name reservations to be transferred?

Yes, Nebraska allows the transfer of a reserved name to another person by filing a notice of transfer with the Secretary of State, signed by the person who reserved the name.

Conclusion

Conducting a Nebraska business entity search is a crucial first step in the business formation process. The Nebraska Secretary of State provides a user-friendly search tool that offers comprehensive information about registered businesses in the state.

By following this guide, you can effectively navigate the Nebraska business entity database, understand search results, and take the appropriate next steps whether your desired name is available or not.

Remember that while the business entity search is useful for preliminary research, the final determination of name availability is made by the Secretary of State’s office when you submit your formation documents.

Ready to start your Nebraska business journey? Begin with a thorough business entity search to ensure your desired name is available and compliant with state requirements.

This article is provided for informational purposes only and does not constitute legal advice. For specific legal guidance regarding your business, please consult with a qualified attorney.

Related Resources:

- Texas Business Entity Search

- California Business Entity Search

- Florida Business Entity Search

- New York Business Entity Search

- Pennsylvania Business Entity Search

- Washington Business Entity Search

- Indiana Business Entity Search

- Michigan Business Entity Search

- South Carolina Business Entity Search

- North Dakota Business Entity Search