The global entrepreneurship boom has created an unprecedented demand for U.S. business entities among international founders. Whether you’re a digital nomad in Bali, a tech entrepreneur in London, or a startup founder in São Paulo, having a U.S. presence has become almost essential for accessing American markets, payment processors, and business opportunities.

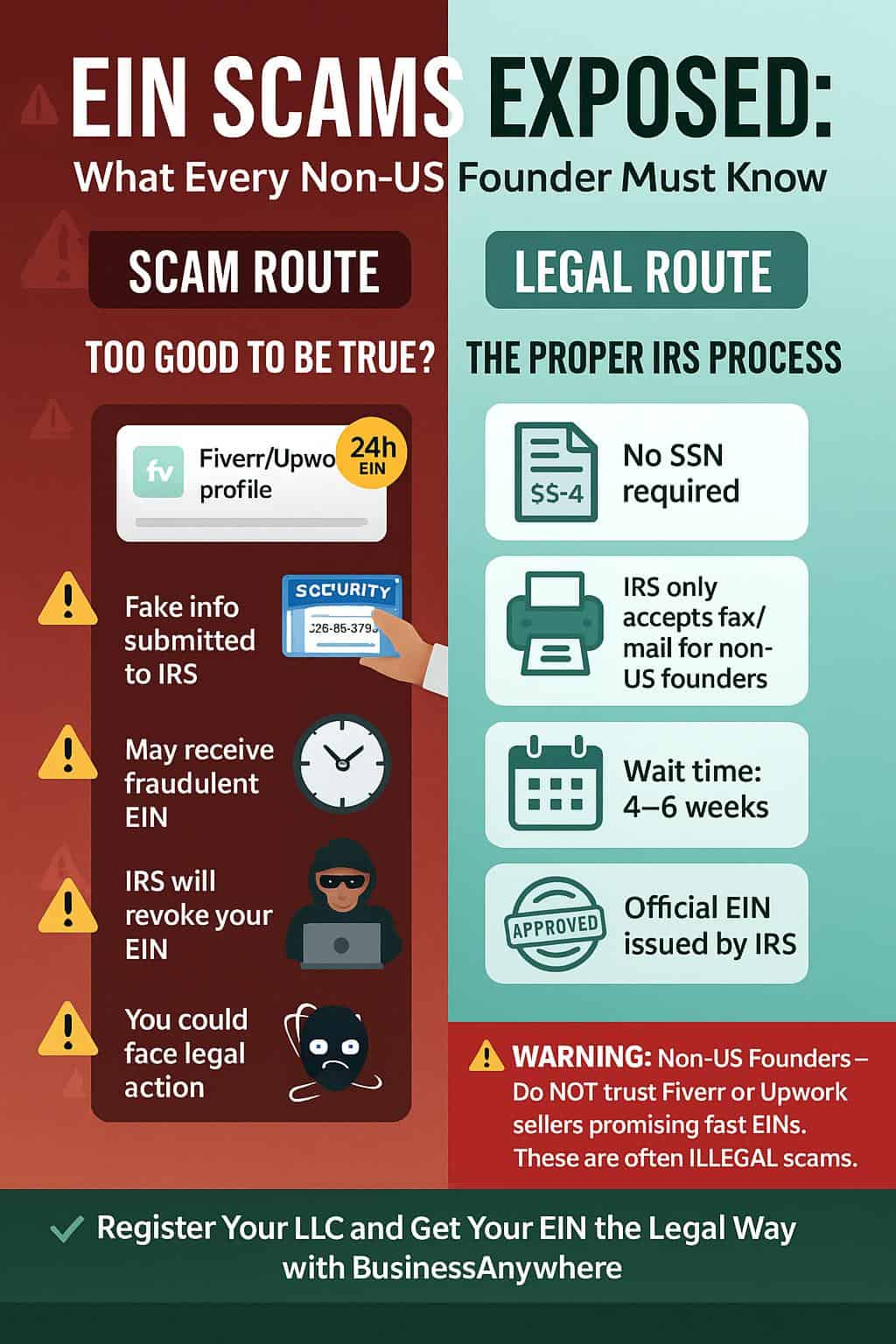

This surge in demand has created a perfect storm on freelance platforms like Fiverr and Upwork, where “EIN services” have exploded in popularity. Thousands of sellers promise to get you an Employer Identification Number (EIN) in 24-48 hours for as little as $25-$50. But beware, as this can sometimes be an EIN scam that sounds too good to be true—and unfortunately, it often is.

What most non-US founders don’t realize is that they’re walking into a legal minefield that could destroy their American business dreams before they even begin. The fake EIN industry isn’t just unethical; it’s putting innocent entrepreneurs at risk of IRS violations, frozen bank accounts, and even potential criminal charges.

What Is an EIN, and Why Do Non-US Founders Need It?

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. Think of it as a Social Security Number for your business.

For non-US residents starting American businesses, an EIN isn’t just helpful—it’s absolutely critical for:

Opening a U.S. Business Bank Account: Nearly every American bank requires an EIN to open a business account. Without one, you’re stuck with personal accounts that limit your business operations and create tax complications.

Using Payment Processors: Stripe, PayPal Business, Square, and other payment platforms require valid EINs for business accounts. This is especially crucial for e-commerce, SaaS, or service-based businesses targeting American customers.

Amazon Seller Accounts: If you want to sell on Amazon as a business entity, you’ll need an EIN for your professional seller account and to access wholesale opportunities.

Hiring in the United States: Planning to hire American freelancers, contractors, or employees? An EIN is mandatory for payroll processing and tax reporting.

Building Business Credit: Establishing a business credit profile separate from your personal credit requires an EIN as the foundation.

The challenge for non-US residents is that obtaining an EIN through traditional channels can be complex, time-consuming, and often requires a U.S. address and phone number. This complexity has created a massive opportunity for scammers and unethical service providers.

For legitimate business setup, many international entrepreneurs use services like virtual mailboxes to establish the required U.S. presence, but the appeal of “instant” solutions on freelance platforms continues to trap unsuspecting founders.

The Fiverr & Upwork EIN Black Market

A quick search on Fiverr for “EIN” returns hundreds of results, with sellers promising everything from “24-hour EIN delivery” to “guaranteed approval for non-residents.” These services typically cost between $25-$100 and are marketed with compelling promises:

- “No SSN required!”

- “100% approval rate for foreigners!”

- “Same-day delivery guaranteed!”

- “No paperwork needed on your end!”

On Upwork, the situation is similar, with freelancers offering EIN services as part of broader “business setup packages.” The reviews often look legitimate, with buyers praising the speed and efficiency of the service.

But here’s what’s really happening behind the scenes:

How the EIN Scam Actually Works

Fake Numbers: Some sellers simply generate fake nine-digit numbers that look like EINs but were never issued by the IRS. These numbers will pass basic formatting checks but fail when validated against IRS databases.

Recycled EINs: More sophisticated scammers use real EIN numbers from defunct businesses or companies that are no longer active. The problem? The IRS doesn’t immediately reassign these numbers, so using them can create legal complications with previous tax filings.

Identity Theft: The most dangerous scams involve sellers who use stolen personal information from U.S. citizens to file EIN applications. This puts both the buyer and the identity theft victim at risk of serious legal consequences.

Bulk Applications: Some sellers file dozens of EIN applications using slight variations of business names and addresses, then sell the numbers to different buyers. This creates conflicts when multiple businesses try to use similar EINs for banking or tax purposes.

Why Fake Reviews Look So Convincing

The reviews and testimonials on these platforms can be misleading because many buyers don’t immediately discover the problems. An invalid EIN might work initially for simple applications, but the issues surface weeks or months later when banks run deeper verification checks or when tax filing season arrives.

Why This Is a Legal and Financial Disaster Waiting to Happen

Using a fraudulent or improperly obtained EIN isn’t just a business inconvenience—it’s a recipe for catastrophic legal and financial problems that can destroy your American business aspirations.

IRS Penalties and Criminal Consequences

IRS Penalties and Interest: The IRS treats EIN fraud seriously. According to the Treasury Inspector General for Tax Administration (TIGTA), the IRS may issue almost $2.3 billion each year in potentially fraudulent tax refunds based on stolen or falsely obtained EINs. If they discover you’re using an invalid number, you could face penalties ranging from $25,000 to $100,000, plus interest and potential criminal charges for tax evasion or fraud. The Federal Trade Commission has also warned that companies violating impersonation rules can face civil penalties of up to $53,088 per violation. Even if you didn’t know the EIN was fake, ignorance isn’t a legal defense.

Criminal Liability: In the worst cases, using a fake EIN—especially one obtained through identity theft—can result in federal criminal charges. The penalties can include substantial prison time and permanent immigration consequences for non-US residents.

Financial Services Complications

Frozen Payment Processor Accounts: Stripe, PayPal, and other payment processors regularly verify EIN numbers against IRS databases. When they discover discrepancies, they don’t just close your account—they often freeze your funds for extended periods while conducting investigations. Some entrepreneurs have lost thousands of dollars this way.

Bank Account Shutdowns: U.S. banks are required to verify the legitimacy of business entities they serve. A fake EIN will eventually trigger their compliance systems, leading to immediate account closure and potential reporting to financial crime authorities. This can make it extremely difficult to open new accounts with other banks.

Long-Term Business Impact

Tax Filing Nightmares: Come tax season, a fake EIN creates impossible situations. You can’t file proper business tax returns, claim legitimate deductions, or maintain proper financial records. This can result in personal liability for business taxes and lost legal protections.

Partnership and Investment Problems: If you’re seeking business partners or investors, a fake EIN will surface during due diligence. This not only kills potential deals but can permanently damage your reputation in the business community.

The financial services industry has become increasingly sophisticated in detecting EIN fraud. What might slip through initially will likely be caught eventually, and the consequences become more severe the longer the fraud continues.

For international entrepreneurs, this creates additional complications with proper business address management, as legitimate services require valid EINs for compliance purposes.

How to Verify if Your EIN Is Legitimate

If you’ve already obtained an EIN through Fiverr, Upwork, or another questionable source, it’s crucial to verify its legitimacy before it creates bigger problems. Here’s how to check:

Official IRS Verification Methods

IRS EIN Verification: The IRS doesn’t provide public EIN lookup tools, but you can verify your number by attempting to use it for official purposes. Try setting up an IRS online account for your business—fake EINs will be rejected immediately.

Bank Account Test: Attempt to open a business bank account using your EIN. Banks have direct access to IRS databases and will quickly identify invalid numbers. If multiple banks reject your application citing “invalid EIN,” that’s a clear red flag.

Payment Processor Verification: Apply for business accounts with major payment processors like Stripe or PayPal. These platforms verify EINs in real-time and will reject applications with fraudulent numbers.

Documentation Red Flags

IRS Letter 147C: When the IRS issues a legitimate EIN, they send a confirmation letter (Letter 147C) to the business address on file. If you never received this letter, or if the seller “lost” it, your EIN is likely fraudulent.

Timeline Red Flags: Legitimate EIN applications take 4-6 weeks when filed by mail or fax for non-US residents, or can be obtained immediately by calling the IRS (though international calls are complicated). If someone delivered your EIN in 24-48 hours without IRS contact, it’s almost certainly fake.

Documentation Gaps: Legitimate EIN applications require specific information and documentation. If your seller never asked for business purpose, structure details, or responsible party information, they likely didn’t file a proper application.

What to Do If Your EIN Is Fake

If you discover your EIN is fraudulent, don’t panic, but act quickly. Stop using the fake number immediately, contact any banks or services where you’ve used it, and begin the process of obtaining a legitimate EIN. The IRS has specific procedures for reporting business identity theft and provides Form 14039-B for businesses that suspect their information has been misused. The sooner you address the problem, the less damage it will cause.

The Correct and Legal Way to Get an EIN as a Non-US Person

Obtaining a legitimate EIN as a non-US resident is more complex than domestic applications, but it’s entirely legal and straightforward when done properly. Here’s the step-by-step process:

Step 1: Establish Your US Business Entity First

Establish a U.S. Business Entity First: You can’t get an EIN without a legitimate U.S. business entity. This means forming an LLC, Corporation, or Partnership in one of the 50 states. Each state has different requirements, but all require a registered agent and business address.

Step 2: Gather Required Information

Gather Required Information: The IRS requires specific details for EIN applications, including the exact legal name of your business entity, the responsible party’s information (this can be you as a non-US person), business structure, and the reason you need the EIN.

Step 3: Complete Form SS-4

Complete Form SS-4: This is the official IRS application for an EIN. Non-US residents must use the paper version and cannot apply online. The IRS states that if “your principal place of business is outside the U.S.,” you must “apply by phone, fax or mail” rather than using the online system. The form requires precise information matching your state business registration exactly.

Step 4: Provide a US Mailing Address

Provide a U.S. Mailing Address: The IRS requires a U.S. address for EIN correspondence. This is where services like virtual mailboxes become essential, as they provide legitimate U.S. addresses that can receive important business mail.

Step 5: Submit Your Application

Submit by Fax or Mail: Non-US residents must submit Form SS-4 by fax (fastest option, usually 4-6 weeks) or mail (6-8 weeks total processing time). For international applicants, the IRS provides a dedicated fax number at 855-215-1627 within the U.S. or 304-707-9471 from outside the U.S., or you can mail applications to Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999. There is also a phone option available at 267-941-1099, but it operates “Monday – Friday, 6 a.m. to 11 p.m. Eastern time” and often involves long hold times.

Step 6: Wait for Official Confirmation

Wait for Letter 147C: The IRS will mail your official EIN confirmation letter to your U.S. business address. This letter is crucial for banking and other business purposes, so ensure your virtual mailbox service can handle important correspondence.

Alternative: Use a Legitimate Service

Alternative: Use a Legitimate Service: Some reputable business formation companies can handle EIN applications as part of comprehensive business setup packages. These services should be transparent about their process, provide proper documentation, and never guarantee impossible timelines.

The key difference between legitimate services and Fiverr scams is transparency and proper process. Legitimate providers will explain the timeline, requirements, and potential complications upfront. They’ll also provide proper documentation and ongoing support.

Many international entrepreneurs also benefit from comprehensive business setup services that include registered agent services, which are often required alongside EIN applications for complete legal compliance.

Why Trust Matters: Choosing a Legitimate Provider

The difference between legitimate EIN assistance and Fiverr scams comes down to several key factors that every non-US founder should understand before choosing a provider.

What to Look for in Legitimate Providers

U.S.-Based Operations and Compliance: Legitimate providers operate from the United States, understand federal and state compliance requirements, and maintain proper business licenses. They don’t operate from overseas using fake U.S. business addresses or hide their true locations.

Transparent Process and Realistic Timelines: Reputable services explain exactly how they’ll obtain your EIN, what information they need from you, and provide realistic timelines. They never promise same-day delivery or guarantee approvals, because the IRS controls the process, not the service provider.

Proper Documentation and Follow-Through: Professional services provide complete documentation, including copies of all filed forms, IRS correspondence, and ongoing support for business compliance. They don’t disappear after delivering a number.

Comprehensive Business Formation Services

Integration with Other Business Services: Legitimate providers often offer comprehensive business formation services, including state entity formation, registered agent services, and virtual mailbox solutions. This integration ensures all aspects of your business setup work together properly.

Customer Support and Accountability: Professional services provide ongoing customer support, maintain proper business insurance, and stand behind their work with guarantees and legal accountability. Fiverr sellers often disappear when problems arise.

Industry Experience with Non-Residents: The best providers specialize in helping international entrepreneurs and understand the unique challenges non-US residents face. They can guide you through the complexities of U.S. business formation, banking, and ongoing compliance.

Companies like BusinessAnywhere have helped thousands of non-US founders establish legitimate American business entities with proper EIN applications, comprehensive business registration services, and ongoing support for international entrepreneurs.

The additional cost of working with legitimate providers pays for itself by avoiding the catastrophic problems that fake EINs create. When you consider potential IRS penalties, frozen accounts, and destroyed business opportunities, professional services are actually the economical choice.

Protecting Your Business: Red Flags to Avoid

Understanding the warning signs of EIN scams can save you from costly mistakes. Here are the biggest red flags to watch for:

Pricing and Promise Red Flags

Promises That Seem Too Good to Be True: Same-day EIN delivery, 100% approval rates for non-residents, or prices significantly below market rates are all signs of potential fraud. The IRS controls EIN processing, and legitimate providers can’t circumvent their procedures.

Lack of Documentation or Process Transparency: Legitimate providers will explain their process in detail, provide sample forms, and give you copies of everything they file. If a provider won’t explain how they’ll get your EIN or provide documentation, walk away.

Provider Credibility Red Flags

No U.S. Business Address or Contact Information: Professional EIN services operate from legitimate U.S. business addresses and provide multiple contact methods. Providers who only communicate through platform messaging or use foreign contact information are high-risk.

Requests for Suspicious Information: Be wary of providers who ask for your personal banking information, Social Security Numbers (you don’t have one as a non-resident), or other sensitive data that isn’t required for EIN applications.

Poor Reviews or Recent Account Creation: Check the provider’s history on the platform. New accounts with limited reviews, or patterns of negative feedback mentioning problems with banks or the IRS, are major warning signs.

By avoiding these red flags and choosing legitimate providers, you protect not just your immediate business needs but your long-term success in the American market.

Frequently Asked Questions

Is it legal to buy an EIN on Fiverr?

The legality depends on how the EIN is obtained. If the provider files a legitimate Form SS-4 with accurate information and follows proper IRS procedures, it can be legal. However, most Fiverr EIN services use fraudulent methods, fake numbers, or stolen identities, making them illegal. The safest approach is to work with established, U.S.-based business formation companies that specialize in helping non-residents.

Can a non-resident get an EIN without a Social Security Number?

Yes, absolutely. Non-US residents can obtain EINs using an Individual Taxpayer Identification Number (ITIN) or by providing foreign identification information on Form SS-4. You do not need a Social Security Number to get an EIN for your U.S. business entity.

What happens if I use a fake EIN?

Using a fake EIN can result in severe consequences including IRS penalties up to $100,000, frozen bank and payment processor accounts, criminal charges for tax fraud, and permanent damage to your ability to do business in the United States. Even if you didn’t know the EIN was fake, you’re still liable for the consequences.

How long does it take to get an EIN the legal way?

For non-US residents, obtaining an EIN through proper channels typically takes 4-6 weeks by fax or mail. Phone applications can be processed immediately if you can get through, but international callers often face long hold times that make this option impractical. There are no legitimate shortcuts to this timeline, as the IRS must process all applications through their official procedures.

Take Action: Protect Your American Business Dreams

The allure of quick, cheap EIN services on Fiverr and Upwork is understandable, especially for international entrepreneurs eager to start their American business journey. But the risks far outweigh any perceived benefits. Fake EINs don’t just create paperwork problems—they can destroy your business before it begins and create legal complications that last for years.

The path to legitimate U.S. business formation might take longer and cost more upfront, but it’s the only way to build a sustainable, legally compliant business that can thrive in the American market. When you consider the potential costs of EIN fraud—frozen accounts, IRS penalties, destroyed business relationships, and criminal liability—the investment in proper business formation pays for itself many times over.

Don’t let a fake EIN scam derail your entrepreneurial dreams. Take the time to do things right from the beginning, work with legitimate providers who understand the complexities of international business formation, and build your American business on a foundation of legal compliance and professional credibility.

Your future success depends on the decisions you make today. Choose the legitimate path, and give your business the best possible chance to succeed in the American market.

Ready to start your U.S. business the right way? Get started with BusinessAnywhere’s comprehensive business formation services and join thousands of international entrepreneurs who’ve built successful American businesses through legitimate, compliant processes.

Additional Resources

State-Specific LLC Formation Guides

- How to Start an LLC in Alabama

- How to Start an LLC in Alaska

- How to Start an LLC in Arizona

- How to Start an LLC in Arkansas

- How to Start an LLC in California

- How to Start an LLC in Colorado

- How to Start an LLC in Connecticut

- How to Start an LLC in Delaware

- How to Start an LLC in Florida

- How to Start an LLC in Georgia

- How to Start an LLC in Hawaii

- How to Start an LLC in Idaho

- How to Start an LLC in Illinois

- How to Start an LLC in Indiana

- How to Start an LLC in Iowa

- How to Start an LLC in Kansas

- How to Start an LLC in Kentucky

- How to Start an LLC in Louisiana

- How to Start an LLC in Maine

- How to Start an LLC in Maryland

- How to Start an LLC in Massachusetts

- How to Start an LLC in Michigan

- How to Start an LLC in Minnesota

- How to Start an LLC in Mississippi

- How to Start an LLC in Missouri

- How to Start an LLC in Montana

- How to Start an LLC in Nebraska

- How to Start an LLC in Nevada

- How to Start an LLC in New Hampshire

- How to Start an LLC in New Jersey

- How to Start an LLC in New Mexico

- How to Start an LLC in New York

- How to Start an LLC in North Carolina

- How to Start an LLC in North Dakota

- How to Start an LLC in Ohio

- How to Start an LLC in Oklahoma

- How to Start an LLC in Oregon

- How to Start an LLC in Pennsylvania

- How to Start an LLC in Rhode Island

- How to Start an LLC in South Carolina

- How to Start an LLC in South Dakota

- How to Start an LLC in Tennessee

- How to Start an LLC in Texas

- How to Start an LLC in Utah

- How to Start an LLC in Vermont

- How to Start an LLC in Virginia

- How to Start an LLC in Washington

- How to Start an LLC in West Virginia

- How to Start an LLC in Wisconsin

- How to Start an LLC in Wyoming

EIN and Business Setup Resources

- How to Get an EIN for Your LLC as a Non-US Resident

- How to Obtain an EIN for Your LLC

- How to Open a US Bank Account for an LLC as a Non-Resident

Virtual Address and Mailbox Services

- Can I Use a Virtual Address for My LLC?

- Can I Use a Virtual Mailbox as My Business Address?

- How to Set Up an LLC With a Virtual Office

- Top Virtual Address Providers for LLCs in 2025

Business Formation Services

Official IRS Resources

- IRS Form SS-4 Application

- How to Get an Employer Identification Number

- Report Business Identity Theft

- Report Tax Scams or Fraud