Quick Start: D.C. LLC Formation Summary

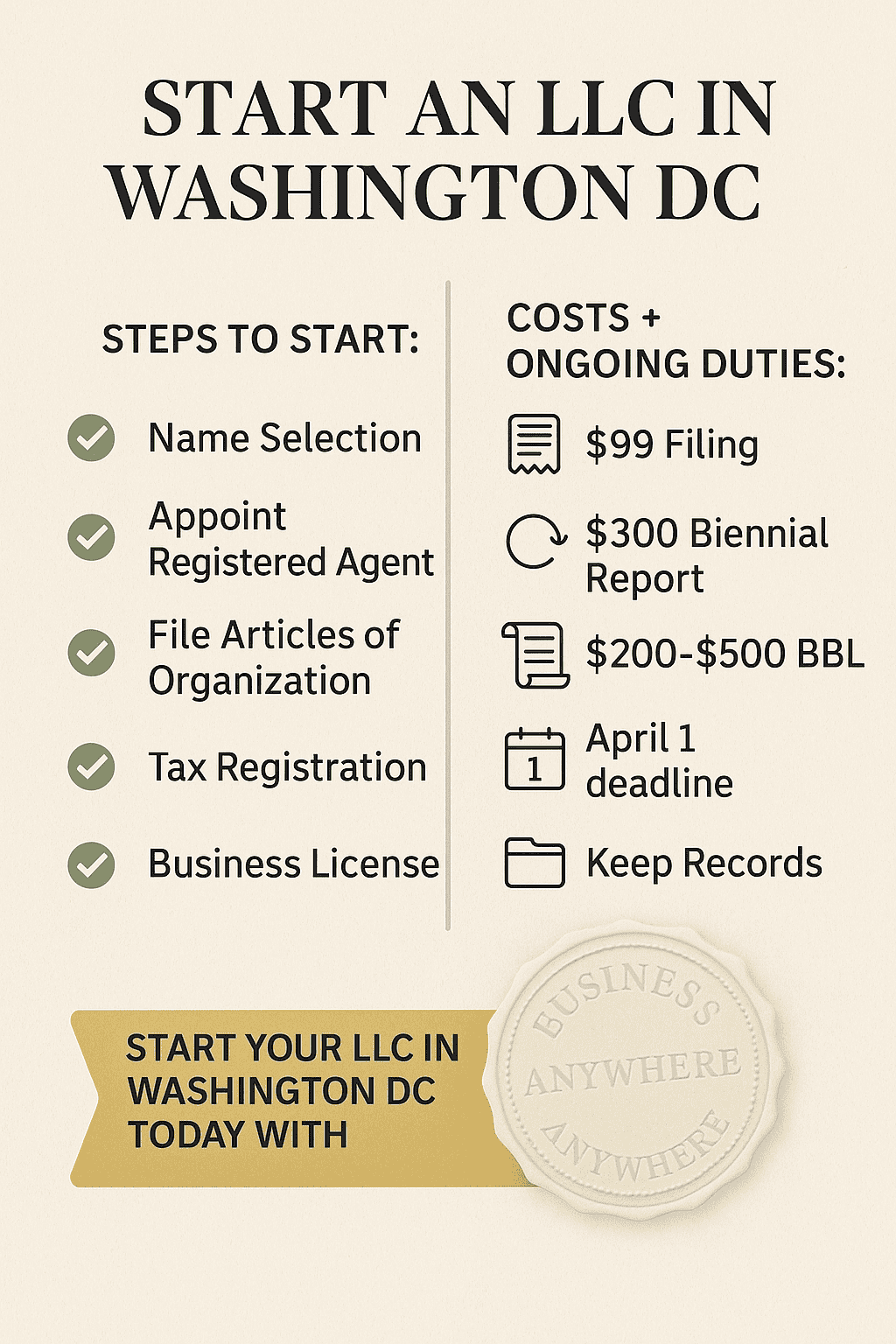

Starting a Washington D.C. LLC offers business owners exceptional advantages including asset protection, tax benefits, and access to federal contracting opportunities. Understanding how to start an LLC in Washington DC is crucial for ensuring a smooth process. The D.C. LLC registration process requires filing Articles of Organization ($99), appointing a registered agent with a D.C. address, and obtaining proper business licenses.

Key Requirements for Washington D.C. LLC Formation:

- Unique business name with “LLC” designation

- Registered agent with physical D.C. address

- Articles of Organization filed with D.C. Department of Licensing and Consumer Protection

- Federal EIN from IRS online application

- Basic Business License through My DC Business Center

- Tax registration with D.C. Office of Tax and Revenue

Washington D.C. LLC costs include $99 filing fee, $300 biennial reports, and $200-$500 business license fees. Processing takes 3-5 business days online or up to 6 weeks by mail. Expedited LLC formation available for additional $50-$100.

Why Form an LLC in Washington D.C.

Washington D.C. provides unique advantages for business owners across all industries:

Business Environment Benefits:

- Access to $26 million in venture capital funding through city programs

- Highly educated workforce (60% hold bachelor’s degrees)

- Strategic proximity to federal agencies and contracting opportunities

- Strong business infrastructure with advanced connectivity

- Professional business climate attracting diverse industries

Legal and Financial Advantages:

- Strong asset protection under modern LLC statutes

- Pass-through taxation avoiding double taxation

- Flexible management structures suitable for various business models

- Access to federal small business programs and certifications

- Professional credibility for government and corporate clients

Federal Contracting Access: D.C. LLCs gain preferential access to federal procurement opportunities through Small Business Administration programs, including set-aside contracts representing 23% of federal contracting dollars.

Washington D.C. LLC Formation Costs and Timeline

Required Filing Fees

| Expense Type | Cost | Frequency | Authority |

|---|---|---|---|

| Articles of Organization | $99 | One-time | DLCP Filing |

| Expedited Processing | +$50-$100 | Optional | DLCP |

| Biennial Report | $300 | Every 2 years | DLCP Biennial Report |

| Basic Business License | $200-$500 | Every 2 years | My DC Business Center |

| Registered Agent (Professional) | $100-$300 | Annual | Third-party service |

Processing Timeline

Online Filing (Recommended):

- Standard processing: 3-5 business days

- Expedited processing: 1-3 business days

- Same-day walk-in: Available with $100 fee

Mail Filing:

- Processing time: 4-6 weeks

- No expedited options available

Step 1: Washington D.C. Business Entity Search

Before filing your LLC, verify name availability using the official D.C. business entity search system.

Conducting Your Name Search: Use our comprehensive guide: How to Do a Washington DC Business Entity Search for detailed instructions on using the D.C. CorpOnline system. This resource explains how to search effectively, interpret results, and avoid common naming conflicts.

Name Requirements:

- Must include “Limited Liability Company,” “LLC,” “L.L.C.,” “Limited Company,” “LC,” or “L.C.”

- Cannot use restricted terms like “bank,” “insurance,” or “credit union” without approval

- Must be distinguishable from existing D.C. entities

- Cannot imply government affiliation

Name Reservation: Reserve your chosen name for 120 days by paying $50 through the DLCP name reservation process.

Step 2: Choose Your Registered Agent

Every D.C. LLC must maintain a registered agent with a physical D.C. address to receive legal documents and official correspondence.

Registered Agent Requirements:

- Physical D.C. address (P.O. boxes prohibited)

- Available during business hours (9 AM – 5 PM, Monday-Friday)

- At least 18 years old

- Written consent to serve

Professional vs. Self-Service:

Professional Registered Agent Services ($100-$300 annually):

- Privacy protection for personal addresses

- Guaranteed availability and document handling

- Compliance monitoring and deadline alerts

- Professional mail handling and forwarding

- Recommended for business owners prioritizing privacy

Consider BusinessAnywhere’s registered agent services for reliable, professional representation with digital document management.

Self-Service Options ($0):

- Personal appointment as your own agent

- Friend or family member with D.C. address

- Requires constant D.C. availability

- No privacy protection

Step 3: File Articles of Organization

File Form DLC-1 (Articles of Organization) with the D.C. Department of Licensing and Consumer Protection to officially create your LLC.

Required Information:

- LLC name with proper designation

- Principal office address (can be outside D.C.)

- Registered agent name and D.C. address

- Management structure (member-managed or manager-managed)

- Member/manager information

- Business purpose description

Filing Methods:

Online Filing (Recommended):

- Access CorpOnline portal with AccessDC account

- Complete Form DLC-1 electronically

- Pay $99 filing fee by credit card or ACH

- Receive immediate confirmation and tracking number

- Download approved documents within 3-5 business days

Alternative Methods:

- Mail: Send completed form with $99 check to DLCP (4-6 weeks processing)

- Walk-in: Visit DLCP office with $199 total fee for same-day service

Step 4: Obtain Federal EIN

Apply for an Employer Identification Number through the IRS EIN application portal immediately after LLC approval.

Why You Need an EIN:

- Required for business tax filings

- Necessary to open business bank accounts

- Needed for employee hiring and payroll

- Protects personal Social Security Number

- Required for most business licenses

Application Process:

- Visit IRS.gov EIN application page

- Select “Limited Liability Company” as entity type

- Provide LLC name exactly as filed with D.C.

- Enter responsible party information

- Receive EIN immediately upon completion

Common Mistakes to Avoid:

- Inconsistent LLC name spelling

- Wrong entity type selection

- Multiple applications for same LLC

- Incorrect formation date information

Step 5: Register for D.C. Taxes

Register with the D.C. Office of Tax and Revenue through the MyTax.DC.gov portal for required business taxes.

Required Tax Registrations:

Unincorporated Business Franchise Tax:

- Rate: 8.25% on net income

- Minimum tax: $250 (≤$1M gross receipts) or $1,000 (>$1M)

- Filing deadline: 15th day of 4th month after tax year

- Registration and information

Sales and Use Tax (if applicable):

- Rate: 6% on taxable sales

- Required for businesses selling goods or taxable services in D.C.

- Economic nexus: $100,000 in sales or 200 transactions

- Sales tax information

Step 6: Apply for Business License

Obtain your Basic Business License through the My DC Business Center portal.

License Requirements:

- Federal EIN

- D.C. tax registration

- Clean Hands Certification (no outstanding D.C. debts over $100)

- Certificate of Occupancy or Home Occupation Permit

- Professional licenses (if applicable)

Application Process:

- Access My DC Business Center

- Complete Basic Business License application

- Upload required documentation

- Pay fees ($200-$500 depending on business type)

- Receive approval within 5-10 business days

Professional Licensing: Certain professions require additional licenses from respective D.C. boards:

- Legal services: D.C. Bar

- Medical services: D.C. Board of Medicine

- Accounting: D.C. Board of Accountancy

Step 7: Create Operating Agreement

While not required by D.C. law, an operating agreement protects your business interests and establishes operational procedures.

Essential Provisions:

- Ownership percentages and capital contributions

- Management structure and decision-making processes

- Profit and loss distribution methods

- Member admission and withdrawal procedures

- Dissolution and liquidation protocols

Important Considerations for All Businesses:

- Meeting protocols and decision-making procedures

- Tax elections and accounting methods

- Banking and financial management requirements

- Member responsibilities and restrictions

Consider professional assistance for complex structures or multi-member LLCs. BusinessAnywhere offers operating agreement guidance tailored for various business needs.

Ongoing Compliance Requirements

Biennial Report Filing

File biennial reports with DLCP every two years to maintain good standing.

Filing Details:

- Due date: April 1 of even-numbered years following formation

- Filing fee: $300

- Late penalty: $100

- Required information: Current business details, registered agent, members/managers

First Report Timeline: If your LLC was formed in 2024, your first biennial report is due April 1, 2026.

Annual Tax Obligations

Federal Requirements:

- Single-member: Report on personal tax return

- Multi-member: File Form 1065 and issue K-1s to members

- Employment taxes if you have employees

D.C. Tax Requirements:

- Unincorporated Business Franchise Tax return

- Sales tax returns (if applicable)

- Quarterly estimated payments if annual tax exceeds $1,000

Business License Renewal

Renew your Basic Business License every two years through the My DC Business Center. Maintain Clean Hands status by keeping all D.C. obligations current.

Advanced Strategies for Business Owners

Federal Contracting Opportunities

D.C. LLCs gain access to federal procurement programs through the System for Award Management (SAM):

- Small business set-aside contracts

- SBA certification programs

- GSA Schedule opportunities

- SEWP (Solutions for Enterprise-Wide Procurement) eligibility

Multi-State Business Considerations

Foreign Qualification: Consider when your D.C. LLC needs to qualify in other states based on business activities and nexus creation.

Banking Solutions: Establish relationships with banks experienced in business banking, offering services like merchant accounts, business credit lines, and cash management solutions.

Common Mistakes to Avoid

Formation Phase Errors:

- Inadequate trademark and domain name research

- Choosing unreliable registered agent services

- Filing without proper name verification

- Missing EIN application deadlines

Operational Mistakes:

- Mixing personal and business finances

- Neglecting operating agreement creation

- Missing compliance deadlines and paying penalties

- Inadequate record-keeping for business transactions

Tax and Compliance Oversights:

- Not registering for required D.C. taxes before operations

- Missing quarterly estimated tax payments

- Failing to maintain Clean Hands status

- Inadequate documentation for business expenses

Professional Formation Services

While D.C. LLC formation is straightforward, professional guidance ensures optimal structure and compliance. BusinessAnywhere has helped thousands of entrepreneurs successfully launch businesses with comprehensive formation and ongoing support services.

Key Services:

- Complete LLC formation packages

- Professional registered agent services

- EIN application assistance

- Ongoing compliance support

For entrepreneurs managing multiple entities or complex international structures, professional services provide valuable expertise and peace of mind.

Frequently Asked Questions

How long does a Washington D.C. LLC formation take?

Online filing through CorpOnline takes 3-5 business days for standard processing, 1-3 days for expedited service. Mail filing requires 4-6 weeks. Complete business setup including EIN, licenses, and banking typically takes 2-4 weeks.

Can non-residents form a Washington D.C. LLC?

Yes, D.C. welcomes out-of-state and international LLC formation. No residency requirements exist for members or managers, but you must maintain a registered agent with a D.C. physical address.

What’s the difference between member-managed and manager-managed LLCs?

Member-managed LLCs allow all members to participate in daily operations and bind the company. Manager-managed structures designate specific managers for operations while members retain voting rights on major decisions. Choose manager-managed for passive investors or complex ownership structures.

Do I need business insurance for my D.C. LLC?

While not legally required, business insurance protects your assets and operations. Consider general liability, professional liability, and cyber liability coverage based on your business activities. Costs typically range from $300-$2,000 annually.

How is a Washington D.C. LLC taxed?

Single-member LLCs are disregarded entities with income reported on personal returns. Multi-member LLCs file partnership returns (Form 1065) and issue K-1s to members. Both pay D.C. Unincorporated Business Franchise Tax. LLCs can elect corporate taxation if beneficial.

What happens if I miss the biennial report deadline?

Late filing incurs a $100 penalty plus the $300 filing fee. Continued non-compliance can result in administrative dissolution, loss of good standing, and inability to conduct business legally. File immediately and pay all fees to restore compliance.

Can I change my registered agent after formation?

Yes, change your registered agent by filing a Statement of Change with DCRA, obtaining written consent from the new agent, and paying applicable fees. Update all business records and notify relevant parties of the address change.

Do I need an operating agreement?

While not required by D.C. law, operating agreements are essential for protecting liability protection, establishing operational procedures, and preventing member disputes. All multi-member LLCs should have comprehensive operating agreements.

What business licenses do I need in D.C.?

All businesses need a Basic Business License. Additional licenses may be required based on your business activities, such as professional licenses for regulated services, health department permits for food service, or special permits for contractors.

How do I maintain my LLC’s good standing?

File biennial reports by April 1 deadline, maintain current registered agent information, keep D.C. tax obligations current, renew business licenses as required, and maintain Clean Hands status with no outstanding D.C. debts over $100.

Ready to Start Your Washington D.C. LLC?

Washington D.C. offers exceptional opportunities for business owners seeking professional credibility, asset protection, and access to federal markets. With proper formation and ongoing compliance, your D.C. LLC provides a strong foundation for business success.

Next Steps:

- Conduct business name search and verify availability

- Choose professional registered agent service

- Gather formation information and file Articles of Organization

- Obtain Federal EIN and register for D.C. taxes

- Apply for required business licenses

- Create comprehensive operating agreement

Get Expert Help: Start your D.C. LLC formation today with BusinessAnywhere’s comprehensive formation services, or schedule a free consultation to discuss your specific business needs.

For additional resources, explore our complete library of business formation guides covering all 50 states and business strategies.

- Related Posts

- How to Start an LLC in Alaska: Filing Requirements, Costs, and Tips

- How to Start an LLC in California (Without Losing Your Mind)

- How to Start an LLC in Delaware in 2025

- How to Start an LLC in Hawaii: Everything You Need to Form a Compliant Business

- How to Start an LLC in Idaho: Quick Guide to Registering Your Business

- How to Start an LLC in Nevada: Privacy, Taxes, and What No One Tells You

- How to Start an LLC in Oregon: A Smart Guide for First-Time Business Owners

- How to Start an LLC in Utah: A Straightforward Guide for Entrepreneurs

- How to Start a Wyoming LLC in 2025