If you’re planning to start a business in Nevada or need to verify the status of an existing entity, conducting a thorough business entity search is a crucial first step. Nevada’s Secretary of State offers the SilverFlume Business Portal, a comprehensive online platform that allows users to search for registered businesses throughout the state. This detailed guide walks you through the entire process of conducting a business entity search in Nevada, from navigating the search portal to understanding search results and taking next steps.

What is the Nevada SilverFlume Business Portal?

The Nevada Secretary of State’s SilverFlume Business Portal is the official state-managed system for business entity searches and registrations. This centralized platform allows users to search for all registered businesses in Nevada, including corporations, LLCs, partnerships, and nonprofits.

The portal provides access to vital public information such as:

- Business name availability

- Entity status (active, expired, revoked, etc.)

- Registration dates

- Registered agent information

- Officer/manager details

- Filing history

Step-by-Step Guide to Nevada Business Entity Search

Step 1: Access the Nevada SilverFlume Business Portal

Navigate to the Nevada SilverFlume Business Portal in your web browser. The portal serves as the state’s primary business registration and search platform.

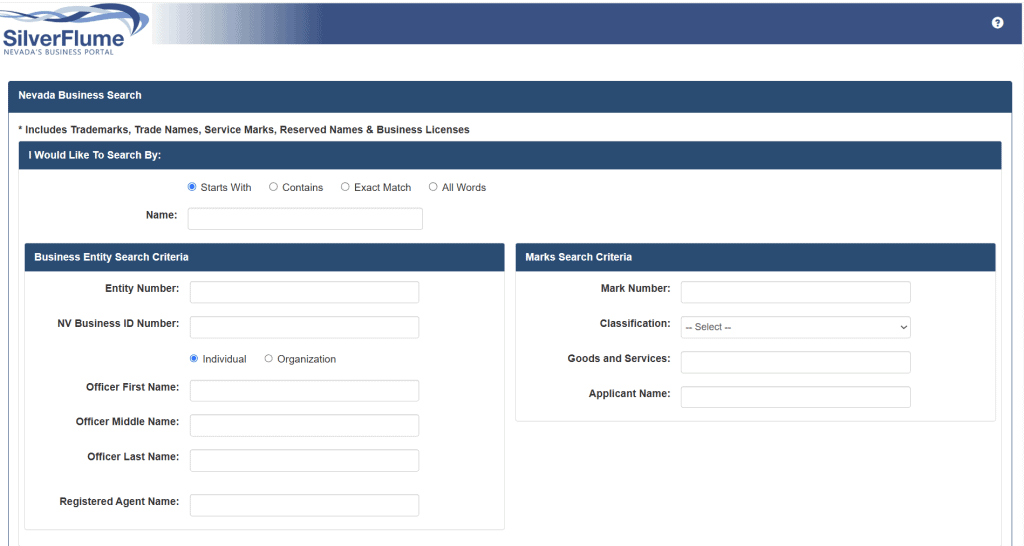

Step 2: Locate the Business Entity Search Function

On the SilverFlume homepage, look for the “Business Entity Search” option. This can typically be found in the main navigation menu or prominently displayed on the home page.

Step 3: Select Your Search Criteria

The Nevada business entity search tool offers several search methods:

- Entity Name Search: The most common search method. Select the radio button for “Contains” if you know only part of the name, or “Exact Match” if you know the complete name.

- Entity Number Search: Search using a specific Nevada entity number.

- NV Business ID Search: Use the Nevada Business ID if you have it.

- Officer Name Search: Find businesses associated with a particular individual.

- Registered Agent Search: Look up entities using their registered agent’s name.

Step 4: Enter Your Search Parameters

After selecting your search criteria:

- Type your search term in the provided field.

- For name searches, you can refine your search by selecting where the term should appear (beginning, anywhere in the name, or exact match).

- The search is not case-sensitive, but special characters and punctuation marks will affect results.

- To narrow your results, you can use additional filters such as entity type (LLC, corporation, etc.) or entity status (active, default, etc.).

Step 5: Execute Your Search

Click the “Search” button to run your query. The system will process your request and return matching results.

Step 6: Review Your Search Results

The results page displays a table of matching entities with the following information:

- Entity Name

- Entity Type (LLC, Corporation, etc.)

- Entity Status (Active, Default, Revoked, etc.)

- Entity Number

- NV Business ID

- Initial Filing Date

Results are typically arranged alphabetically by entity name.

Step 7: Access Detailed Entity Information

To view comprehensive information about a specific entity:

- Click on the entity name in the results list.

- This will open a detailed information page containing:

- Entity Information: Legal name, formation date, status, and next filing deadline

- Registered Agent Information: Name and address of the entity’s registered agent

- Officer/Manager Information: Names and addresses of current officers or managers

- Filing History: Record of documents filed with the Secretary of State

Note: Some entities may display a “View Historical Data” option, allowing you to see previous officers and name changes.

Understanding Nevada Business Entity Statuses

When reviewing search results, you’ll encounter various entity statuses. Here’s what each status means:

- Active: The business is in good standing with all filings and fees current.

- Default: The business has failed to file its annual list or pay required fees but can still be reinstated.

- Revoked: The entity’s right to do business in Nevada has been revoked due to non-compliance, typically for failing to file annual reports or pay fees for over a year.

- Dissolved/Permanently Revoked: The business has been officially terminated and is no longer operating.

- Expired: Typically applies to reserved names or business licenses that have lapsed.

- Merged Out: The entity has merged into another business entity.

- Converted Out: The entity has converted to a different business type or moved to another state.

Reserving a Business Name in Nevada

If your business entity search shows that your desired name is available, you may want to reserve it while preparing to form your business. Here’s how to reserve a business name in Nevada:

Option 1: Online Reservation

- Create an account on the SilverFlume portal if you don’t already have one.

- Select “Reserve Your Entity Name” from the portal options.

- Follow the on-screen instructions to complete the reservation process.

- Pay the $25 name reservation fee.

Option 2: Mail-In Reservation

- Download the Name Reservation Request form from the Nevada Secretary of State website.

- Complete the form with your contact information and desired business name.

- Mail the form along with the $25 filing fee to: Secretary of State 202 North Carson Street Carson City, NV 89701-4201

Important Name Reservation Details:

- A name reservation lasts for 90 days.

- You can renew the reservation before it expires by submitting another reservation request and fee.

- If you no longer need the reserved name, you can transfer or release it by filing a “Name Consent or Release” form.

- Expedited processing options are available for an additional fee:

- 24-hour service: Additional $50

- 2-hour service: Additional $500

- 1-hour service: Additional $1,000

What to Do After Your Business Entity Search

If You Find Your Desired Name is Available:

- Reserve the Name: Consider reserving the name while you prepare your business formation documents.

- Check Domain Availability: Verify if the corresponding domain name is available for your website.

- Form Your Business Entity: Proceed with filing the necessary formation documents with the Nevada Secretary of State.

If You Find Your Desired Name is Already Taken:

- Modify Your Name: Consider slight variations of your desired name that still capture your brand.

- Check Status: If the existing entity is revoked or dissolved, you might be able to use the name (consult with a business attorney).

- Consider a DBA: You can form your entity under a different name and then file for a “Doing Business As” (DBA) name.

Understanding How to Start a Business in Nevada

After completing your business entity search and confirming your desired name is available, you’ll need to understand the complete process for starting a business in Nevada. The formation process varies slightly depending on your chosen business structure, but generally follows these steps:

For Nevada LLCs:

- File Articles of Organization: Submit this document along with the $75 filing fee.

- File Initial List of Managers/Members: Submit with a $150 filing fee.

- Apply for a State Business License: Required for all Nevada businesses with a $200 fee.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS.

- Create an Operating Agreement: Though not required to file, this internal document is highly recommended.

For Nevada Corporations:

- File Articles of Incorporation: Submit with the applicable filing fee ($75).

- File Initial List of Officers and Directors: Submit with a $150 filing fee.

- Apply for a State Business License: $200 fee.

- Hold Organizational Meeting: Adopt bylaws and appoint officers. If you’re planning to register a Nevada LLC instead of a corporation, the process is similar but with different formation documents. LLC owners should carefully consider the advantages of the Nevada LLC structure before proceeding with formation.

Nevada Business Entity Search FAQs

How often is the Nevada business entity database updated?

The database is updated in real-time as new filings are processed by the Secretary of State’s office. When you conduct a search, you’re seeing the most current information available.

What does a “Default” status mean for a Nevada business entity?

A status of “Default” indicates that the business has failed to file its annual list or pay the required annual fees. Businesses in default can be reinstated by filing the missing documents and paying all outstanding fees plus penalties. Understanding Nevada’s business compliance requirements is essential for maintaining good standing.

How long does a name reservation last in Nevada?

A business name reservation in Nevada lasts for 90 days from the filing date. You can renew the reservation before it expires by submitting another reservation request and paying the $25 fee again. For businesses looking to establish a permanent presence in Nevada, it’s advisable to move quickly from reservation to formation.

What are the filing fees for forming a business in Nevada?

- Articles of Organization (LLC): $75

- Initial List of Managers/Members: $150

- State Business License: $200

- Name Reservation: $25

- Expedited Processing: Additional fees ranging from $50 to $1,000 depending on speed

Can I register or reserve a business name online in Nevada?

Yes, Nevada allows for both online name reservation and business registration through the SilverFlume Business Portal. Online filing is typically processed faster than mail-in submissions.

What if my desired business name is taken?

If your desired name is already in use, you’ll need to choose a different name or consider using a “Doing Business As” (DBA) name. You might also check if the existing entity with your desired name is active—if it’s been permanently revoked or dissolved, the name might be available.

SilverFlume Portal: Sample Search Process

To help illustrate how the search process works, here’s a simulated business name search for “Silver State Consulting”:

- Navigate to the SilverFlume Business Portal

- Select “Business Entity Search”

- Choose the “Entity Name” search option

- Select “Contains” from the radio button options

- Type “Silver State Consulting” in the search field

- Click “Search”

Sample Results Page:

- The search returns three results:

- “Silver State Consulting LLC” (Active)

- “Silver State Consulting Services Inc.” (Default)

- “Northern Silver State Consulting Group LLC” (Active)

Clicking on “Silver State Consulting LLC” reveals:

- Entity Information showing an active status, formation date of 03/15/2019

- Registered Agent: Nevada Agents & Services, Inc. with a Carson City address

- Manager Information showing two managers with their business addresses

- Filing History showing Articles of Organization, Annual Lists, and Business License renewals

This simulation illustrates the type of information you’ll encounter when performing your own search.

Resources for Nevada Business Searches

- Nevada Secretary of State – Business Portal

- Nevada Secretary of State – Forms & Fees

- Nevada Business License Requirements

- Nevada Registered Agent Requirements

Additional Business Entity Search Guides

Looking to conduct a business entity search in other states? Check out our comprehensive guides:

- How to Do a Business Entity Search in California

- How to Do a Business Entity Search in Delaware

- How to Do a Business Entity Search in Florida

- How to Do a Business Entity Search in Texas

- How to Do a Business Entity Search in New York

- How to Do a Business Entity Search in Ohio

- How to Do a Business Entity Search in Illinois

- How to Do a Business Entity Search in Indiana

- How to Do a Business Entity Search in Michigan

- How to Do a Business Entity Search in Idaho

- How to Do a Business Entity Search in Oregon

- How to Do a Business Entity Search in Louisiana

- How to Do a Business Entity Search in Iowa

Resources for Nevada Business Formation

- Nevada Secretary of State – Business Portal

- Nevada Secretary of State – Forms & Fees

- Nevada Registered Agent Requirements

- Nevada Business Forms

Conclusion

Conducting a thorough business entity search is a critical first step in the business formation process in Nevada. The SilverFlume portal provides a user-friendly interface for searching and reserving business names, checking entity statuses, and accessing important business information. By following this comprehensive guide, you’ll be well-equipped to navigate Nevada’s business search system and take the appropriate next steps in establishing your business.

Remember that business name availability can change quickly, so it’s advisable to conduct your search shortly before filing your formation documents. If you have specific questions about business entity searches or formation requirements, consider consulting with a business attorney familiar with Nevada regulations.