Looking up a California business is straightforward once you know where to click. This guide walks you through the Secretary of State’s BizFile portal to do two things fast: check if a name is available and find details on an existing LLC, corporation, or partnership. You’ll also learn how to read status labels, locate the registered agent, and download filings like the Statement of Information or a Certificate of Status.

We keep each task simple with clear definitions and step-by-step instructions. Whether you’re verifying a company before you work with them, reserving a name for your own LLC, or pulling official documents for compliance, you’ll find the exact steps below along with common pitfalls and quick troubleshooting tips.

Key California Business Search Terms

Quick definitions you’ll see throughout this guide.

Statuses, IDs, Filings & Actions

| Term | What it means |

|---|---|

| Active | The entity is in good standing and allowed to operate and file documents. |

| FTB Suspended | Suspended by the Franchise Tax Board for tax/filing issues. Cannot legally transact business until revived. |

| SOS Suspended / Forfeited | Suspended or forfeited by the Secretary of State (often for missed Statement of Information). Requires reinstatement. |

| Entity Number | Unique ID assigned by CA SOS; use it to pull the exact record and filings. |

| FEIN / EIN | Federal tax ID from the IRS. Not shown in the state search; different from the Entity Number. |

| Agent for Service of Process | The registered agent who receives legal and government mail for the entity. |

| Articles of Organization (LLC) | Formation document for LLCs (creates the company at the state level). |

| Articles of Incorporation (Corp) | Formation document for corporations. |

| Statement of Information (SI) | Regular update filing listing addresses, managers/officers, and agent. Missing SI often triggers suspension. |

| Certificate of Status | Official certificate confirming current legal status (often needed by banks or agencies). |

| Name Availability | Check if a proposed name is free under CA rules before filing formation documents. |

| Entity Lookup | Find details on an existing company (status, agent, filings, history). |

What is the California Secretary of State Business Entity Search Tool?

The California Secretary of State’s bizfileonline portal offers a robust business entity search function that allows users to search for detailed information about corporations, LLCs, limited partnerships, and other business entities registered in the state. This searchable database contains records for every entity that has registered to do business in California, including those originally formed in other states but authorized to operate within California.

The search tool is officially called “bizfileonline” and can be accessed directly at https://bizfileonline.sos.ca.gov/search/business. Unlike some states that charge fees for business entity searches, California offers this service completely free of charge, including free PDF copies of most business entity documents.

When to Use the California Business Entity Search

There are several scenarios where conducting a California business entity search is essential:

- Name availability check: Before registering a new business entity, you need to ensure your chosen name isn’t already taken.

- Entity status verification: To confirm whether an existing business is in good standing with the state.

- Registered agent information: To find the agent for service of process for a specific business.

- Business research: To gather information about potential partners, competitors, or acquisition targets.

- Pre-transaction due diligence: Verifying business registration details before entering into contracts.

- Finding entity numbers: Locating the unique identification number assigned to a business.

Step-by-Step Guide to Using the California Business Entity Search Tool

Follow these detailed steps to conduct an effective search through California’s business entity database:

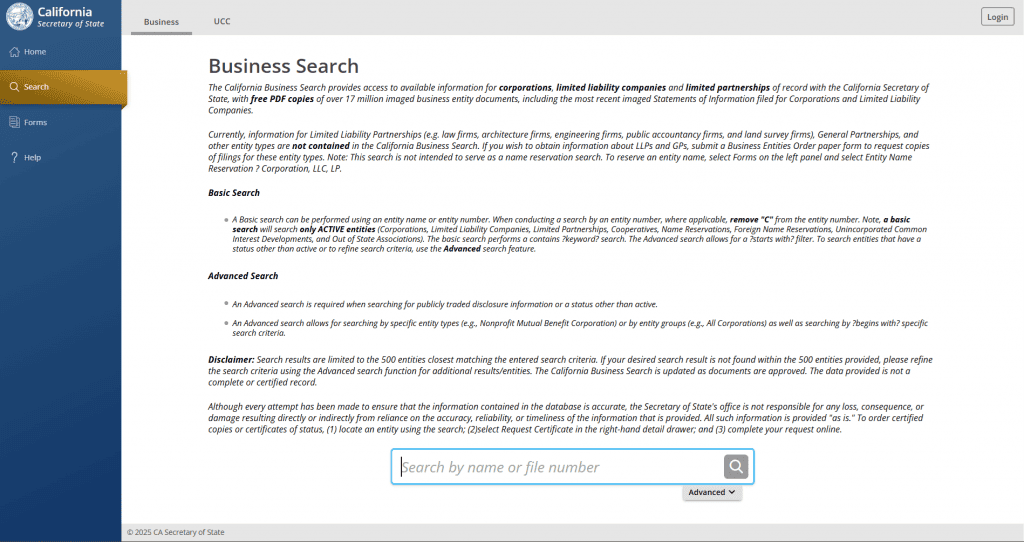

Step 1: Access the Search Portal

- Visit the California Secretary of State’s bizfileonline portal at https://bizfileonline.sos.ca.gov

- Click on the “Business Search” option in the navigation menu

- This will take you to the main search interface

Step 2: Choose Your Search Method

The California bizfileonline system offers multiple search methods:

- Basic Search: Search by entity name or entity number

- Type the full or partial business name or the entity number in the search bar

- Click the magnifying glass icon to initiate the search

- Advanced Search: Click the “Advanced” button to access more search filters, including:

- Entity Status (Active, Canceled, Suspended, etc.)

- Entity Type (Corporation, LLC, LP, etc.)

- Filing Date Range

- Service of Process Agent Name

- Principal Address

Step 3: California-Specific Search Tips

Keep these California-specific tips in mind for more effective searches:

- Entity numbers format: California has recently updated their entity numbering system. Corporation entity numbers typically start with a “C” followed by 7 digits, while LLC and LP entity numbers are now 12-digit numbers. Newly registered entities use a 12-character ID starting with the letter “B”.

- Case insensitivity: The search is not case-sensitive; all letters are treated as uppercase.

- Wildcards not needed: The system automatically searches for partial matches without requiring wildcard characters.

- Business types: The search covers Corporations, LLCs, LPs, LLPs, and certain other business filings.

- Limited results display: Basic searches only display active entities by default. Use the Advanced search to see inactive, suspended, or dissolved entities.

- Search limitations: The system doesn’t search trademark registrations or fictitious business names (DBAs), which are handled at the county level.

Step 4: Understanding Search Results

When your search returns results, you’ll see a list of matching entities with the following information:

- Entity Name: The official registered name of the business

- Entity Number: The unique identifier assigned by the Secretary of State

- Registration Date: When the entity was initially registered in California

- Status: The current standing of the entity (Active, Good Standing, Suspended, etc.)

- Entity Type: The type of business entity (Corporation, LLC, LP, etc.)

- Jurisdiction: The state or country where the entity was formed

Step 5: Accessing Detailed Entity Information and Documents

To view more detailed information about a specific entity:

- Click on the entity name in the search results

- This opens a detailed information page showing:

- Complete registration information

- Agent for Service of Process details

- Entity address

- Filing history

- Available document links

One unique feature of California’s system is the ability to download free PDF copies of many business documents directly from the search results page. These may include:

- Articles of Organization/Incorporation

- Statements of Information

- Certificates of Good Standing

- Amendments and other filings

Simply click on the document link to view or download the PDF. This California-specific feature eliminates the need to purchase copies of most business documents, saving both time and money.

Understanding California Entity Status Definitions

When reviewing search results, you’ll encounter various status designations. Here’s what each California entity status means:

Active/Good Standing

The entity has met all filing requirements and paid all required fees. The business is legally authorized to operate in California.

Suspended

This status indicates the entity has failed to meet certain obligations, such as:

- Not filing required Statements of Information

- Not paying the annual $800 franchise tax

- Not reimbursing the Victims of Corporate Fraud Compensation Fund (for certain corporations)

Suspended entities lose many legal rights, including the ability to sue in California courts.

SOS Suspended/FTB Suspended

- SOS Suspended: The Secretary of State has suspended the entity for failing to file required documents.

- FTB Suspended: The Franchise Tax Board has suspended the entity for tax-related issues.

Dissolved/Canceled/Surrendered

- Dissolved: A domestic entity that has formally ended its existence.

- Canceled: An entity whose formation was canceled because payment for filing fees was not honored.

- Surrendered: A foreign entity that has formally ended its authorization to transact business in California.

Pending

The entity’s registration documents have been received but not yet processed by the Secretary of State.

California-Specific Quirks and Tips

The California business entity search system has several unique characteristics worth noting:

- Newly formed entities: Recently formed entities may not appear in the database immediately. Processing times for new business registrations can range from 5-10 business days, and there may be additional delays before they appear in search results.

- Document availability: While many documents are available for free download, some older records may not be digitized and might require a separate request for copies.

- Statement of Information requirement: California law requires corporations and LLCs to file Statements of Information periodically (annually or biennially). The search results will show if these filings are current.

- No account needed: Unlike some states, California does not require users to create an account to perform basic searches or view documents.

- Enhanced services with login: Creating a free account does provide additional features, such as the ability to save search results and track entities of interest.

- Entity name reservation information: The search won’t show pending name reservations, which last 60 days in California. If you’re planning to form a business, consider reserving your desired name first.

- Separate search for DBAs: The California Secretary of State search doesn’t include fictitious business names (DBAs), which are filed at the county level. You’ll need to check with the appropriate county clerk’s office to search for DBAs.

What to Do After Finding (or Not Finding) a Business Name

When Your Desired Business Name is Available

If your California business entity search indicates that your desired name is available, you have several options:

- Reserve the name: You can reserve your business name for 60 days by filing a Name Reservation Request with the California Secretary of State. The reservation fee is $10, and it can be submitted online through the bizfileonline portal or by mail. This prevents others from registering the same name while you prepare your formation documents.

- Form your business entity: If you’re ready to establish your business, you can file the appropriate formation documents:

- For an LLC: File Articles of Organization (Form LLC-1) – $70 filing fee

- For a Corporation: File Articles of Incorporation – $100 filing fee

- For a Limited Partnership: File Certificate of Limited Partnership (Form LP-1) – $70 filing fee

- Register a foreign entity: If your business is formed in another state but wants to operate in California, file a registration for foreign entity:

- Foreign LLC: Form LLC-5 – $70 filing fee

- Foreign Corporation: Statement and Designation by Foreign Corporation – $100 filing fee

When Your Desired Business Name is Taken

If your search reveals that your preferred name is already in use, you have several alternatives:

- Modify your business name: Add distinctive words or phrases to make your name unique and distinguishable.

- Check entity status: If the existing entity with your desired name is shown as “Suspended” or “Dissolved,” the name might become available eventually, but this can be a lengthy and uncertain process.

- Use a DBA: Form your business with a different legal name, then file a Fictitious Business Name Statement (DBA) with the county clerk in the county where your business is located. This allows you to operate under your preferred name for marketing purposes.

- Consider a different business structure: Sometimes the same name might be available for a different entity type (e.g., if “ABC Company” is taken by a corporation, “ABC Company LLC” might still be available).

- Contact the business owner: In some cases, you might be able to purchase the rights to a business name from the current owner, particularly if the business is inactive.

FAQs About California Business Entity Searches

How long does a name reservation last in California?

A business name reservation in California lasts for 60 days from the date of filing. The reservation fee is $10. After the 60-day period, you can renew the reservation, but not consecutively – there must be at least one day between reservation periods.

What do the different status labels mean in California?

California uses several status labels, including:

- Active/Good Standing: The entity is compliant with state requirements

- Suspended: The entity has failed to meet filing requirements or pay taxes

- Dissolved/Canceled: The entity has terminated its existence

- Pending: The entity’s registration is being processed

What are the filing fees for business entities in California?

- LLC formation (Articles of Organization): $70

- Corporation formation (Articles of Incorporation): $100

- Limited Partnership (Certificate of Limited Partnership): $70

- Name Reservation: $10

- Statement of Information: $20 (LLCs and Corporations)

Is there an annual tax for California business entities?

Yes, California imposes an annual franchise tax of $800 on most business entities, payable to the Franchise Tax Board. This applies even if the business is not actively conducting operations or is operating at a loss. This tax is due by the 15th day of the 4th month after the entity is formed and annually thereafter.

Can I reserve or register a business name online?

Yes, California allows online reservation of business names through the bizfileonline portal. Entity formations can also be completed online for faster processing. Online filings typically process in 5-10 business days, while mail filings can take significantly longer.

What information does the California business entity search provide?

The search provides entity name, number, registration date, status, entity type, jurisdiction, agent for service of process information, and access to filed documents like Articles of Organization and Statements of Information.

Can I see who owns a California LLC in the search results?

Usually no. The public record often shows a manager or the registered agent, not members. Ownership may appear in the Statement of Information, but many LLCs list only a manager or RA for privacy.

My filing isn’t showing yet. How long until records appear?

Indexing can take a few business days after acceptance. Wait 2–5 business days, then search by exact entity name or entity number. If it’s still missing, confirm the acceptance date and try again later.

Where do I find local licenses after the state search?

Licensing is handled by cities and counties. After confirming the entity with the state, check the website of the city or county where you operate for business license or tax registration requirements.

How do I order certified vs plain copies of filings?

Open the entity record, choose the document, then select plain copy or certified copy at checkout. Banks and agencies often require certified copies or a Certificate of Status.

Is a business name search the same as a trademark search?

No. A California entity name reserves your legal name in the state registry. A trademark protects your brand for goods or services. Do both checks before finalizing branding.

Next Steps After Your California Business Entity Search

After completing your business entity search, your next steps will depend on your goals:

For New Business Formation

- Reserve your business name if you’re not immediately forming your entity

- Choose a business structure that best fits your needs (LLC, Corporation, etc.)

- File formation documents with the California Secretary of State

- Obtain necessary business licenses from state and local authorities

- Apply for an EIN (Employer Identification Number) from the IRS

- File initial Statement of Information within 90 days of formation

- Set up business banking accounts to separate personal and business finances

- Register for tax accounts with the California Department of Tax and Fee Administration and the Employment Development Department if necessary

For Existing Business Research

- Verify entity status to ensure the business is in good standing

- Review filed documents to understand the business structure

- Identify the registered agent for service of process

- Check filing history for any recent changes or amendments

- Verify compliance with Statement of Information requirements

Conclusion

The California Secretary of State’s Business Entity Search tool is an invaluable resource for entrepreneurs, business owners, and researchers. By following this comprehensive guide, you can effectively navigate the search process, understand the results, and take appropriate next steps based on your findings.

Remember that business entity information is constantly changing, so it’s advisable to conduct searches close to when you’ll be making business decisions. For the most current information, always use the official California Secretary of State website at https://bizfileonline.sos.ca.gov.

Additional Resources

- How to Start an LLC in California

- How to Start an LLC

- California Secretary of State Business Programs

- California Franchise Tax Board

- California Department of Tax and Fee Administration

- California Employment Development Department

- How to Dissolve an LLC in California